Mid-tier lithium producer Tawana Resources (ASX: TAW) has underlined its mining intentions by kicking off haulage from its jointly-owned Bald Hill Lithium and Tantalum Mine in the Eastern Goldfields region of Western Australia.

Earlier this month, Tawana announced a potentially money-spinning merger with Singapore-based Alliance Mineral Assets (AMAL) aiming to create single entity with a market cap of around A$446 million.

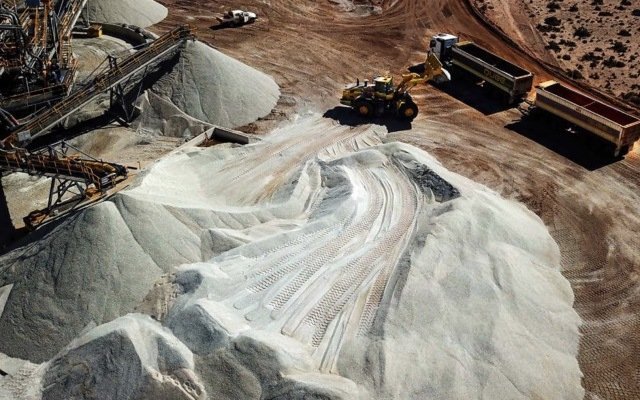

Less than a few weeks later, Tawana and AMAL will be delivering over 4,000 tonnes of high-grade spodumene (lithium) into world markets.

Tawana said that it had engaged Australian company Qube Bulk to provide product loading, haulage, storage and ship loading with an initial shipment of 3,250 tonnes expected to leave Esperance, an industrial port in Western Australia, on vessel Astra N in early May.

Additionally, the spodumene producer said that a “second larger shipment” would be sent from Esperance later in the month.

“Completion of the logistics around the initial shipment of lithium concentrate represents another key milestone for the mine. We currently have about 4,000t of the high-grade concentrate on site,” according to Mark Calderwood, managing director of Tawana Resources.

Growing national ambitions

Given Tawana’s development and production estimates, Bald Hill therefore becomes the first Australian mine to commence spodumene production since 2016 from the Greenbushes deposit in Western Australia, around 250km south of Perth.

News of Tawana’s spodumene shipments means Australia further entrenches its growing lithium supply dominance when compared to other producing nations, despite having comparatively lower mine reserves compared to Argentina, China and current global leader, Chile.

The two largest sources of spodumene in Australia are the Greenbushes and Pilgangoora deposit, now regarded as the world’s second largest deposit. Greenbushes alone now accounts of 30% of global lithium production.

Both Tawana and AMAL executed offtake agreements last year to supply lithium concentrate from Bald Hill over a five-year term with pricing for 2018 and 2019 set at US$880 per tonne for 6% Li20.

According to Tawana, the prepayments received from the offtake agreements are being used to supplement capital expenditure and project progress at Bald Hill.

At the current time, Bald Hill has an indicated and inferred lithium mineral resource of 18.9 million tonnes at 1.18% lithium, and 149ppm tantalum.