Tando Resources makes foray into thriving vanadium arena with high-grade SPD project acquisition

Drill core from Tando Resources’ newly acquired SPD Vanadium Project.

Tando Resources (ASX: TNO) has made a foray into the growing vanadium market after scooping up the high-grade SPD Vanadium Project in South Africa.

Previous reverse circulation and diamond drilling at the project has unearthed thick and high-grade vanadium pentoxide and titanium dioxide intersections. One intersection returned 14m grading 1.08% vanadium pentoxide and 7.07% titanium dioxide from near surface.

Other notable drill intersections included 17m grading 0.92% vanadium and 7.29% titanium, 20m grading 0.96% vanadium and 8.35% titanium, 13m grading 1.13% vanadium and 7.43% titanium, plus a 9m intersection grading 1.34% vanadium and 10.5% titanium.

Previous operators delineated a resource under the SAMREC Code (2007) for SPD of 513.3 million tonnes grading 0.78% vanadium.

“We have been interested in getting shareholders exposure to the energy storage market and see vanadium as a key commodity in the future,” Tando managing director Bill Oliver said of the acquisition.

“To have the opportunity to acquire a project of this scale and this grade profile is very appealing and we look forward to completing the due diligence and actively drilling the SPD Project,” Mr Oliver added.

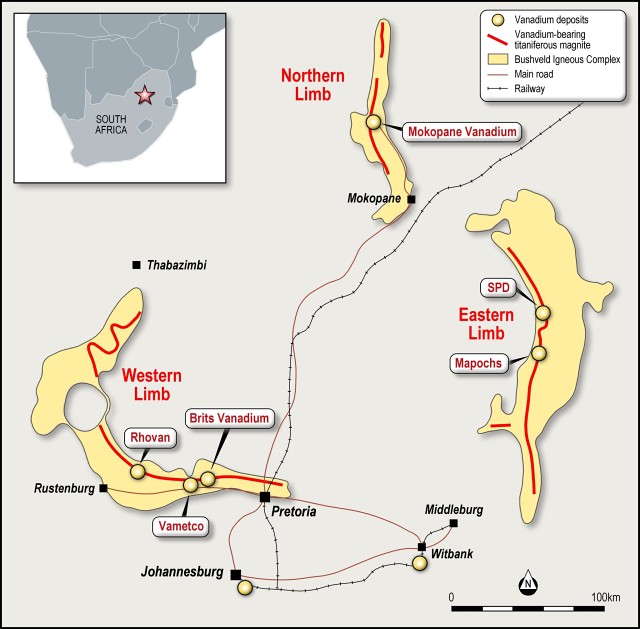

Location of the SPD Vanadium Project in South Africa.

Preliminary metallurgical test work was carried out on several ore samples and produced magnetic concentrates with grades averaging 2% vanadium and 13% titanium.

Under the acquisition, Tando is securing a 74% interest in the project, with the other 26% retained by BEE entities including the Steelpoort Development Trust.

Tando has 45 days to undertake due diligence and will lock-in a 12.5% stake via the issue of 4.25 million shares, after electing to proceed with the project.

Further share issues amounting to 35 million at A$0.30 each will be made to the vendor on reaching specific exploration and development milestones.

Tando claims the SPD project could potentially be “globally significant” based on its grade in concentrate and tonnage.

The company has also appointed key international geological expert Martin Pawlitschek to its board as a non-executive director. According to Tando, Mr Pawlitschek has extensive experience in Australia and abroad including numerous African nations and has worked previously for BHP Billiton and its established junior entities.

Vanadium market dynamics

Demand for vanadium has picked up recently – driven by the increasing use of vanadium flow redox batteries in renewable energies.

This demand is predicted to continue growing due to the vanadium flow redox batteries’ longer life-span and ability to retain charge for up to 12 months. The batteries can also discharge without damage and are scalable so that larger battery storage facilities can be developed.

The Metal Bulletin puts the 98% pure vanadium pentoxide free-on-board out of China price at between US$13.5 per pound to US$14/lb, while the ferro-vanadium price for 78% purity out of China is estimated between US$61/kg and US$62/kg.

To fund a resource drilling campaign and detailed metallurgical testing at SPD, Tando will undertake a A$2 million capital raising as part of its strategy to fast-track the project to development.