Tando Resources delivers first assay results from South African vanadium project

Drilling at the surrounding shallow vanadium pipes is scheduled start next week for Tando.

Junior metals explorer Tando Resources (ASX: TNO) has received high-grade assay results from its SPD Vanadium Project in South Africa, barely a month since putting pen to paper to acquire the vanadium project which it describes to be as potentially “globally significant”.

Earlier today, the company announced “pre-concentrate grade” assay results of 7m at 0.84% vanadium oxide & 5.60% titanium oxide and 35m at 0.66% vanadium oxide & 4.59% titanium oxide.

The first results, combined with earlier grades of up to 2.2% vanadium oxide at a neighbouring drill site announced last month, indicate that Tando is exploring in the right area to declare a potentially declare a sizeable resource over the coming months.

The SPD project has a similar geological settings to Rhovan, operated by Glencore, Vametco operated by Bushveld Minerals) and Mapochs operated by International Resources – all located within close proximity of Tando in the Gauteng and Limpopo provinces of South Africa.

As of last month, Tando acquired a 74% stake in what it calls a “globally significant vanadium project” that has the potential to push the company into mid-tier status over the coming years – assuming exploration results deliver the company’s maiden resource that can rival those of its peers, in both grade and tonnage.

Its first drill-hole, VRC001, is part of Tando’s phase one drilling program targeting the well-established SPD deposit – a substantial vanadium deposit thought to contain an existing resource of 513 million tonnes at a grade of 0.78% vanadium oxide defined under the SAMREC code.

One of the key objectives from the current drilling program is to translate the resource estimate into accordance with the JORC code, and therefore, to deliver Tando’s maiden resource from SPD.

“Drilling of Phase 1 is well advanced and is anticipated to be completed early next week with the resource to be published next month following receipt of assays from all drill holes,” according to Tando Resources.

Drilling will then move to provide the first test of the potential of the surrounding high-grade vanadium pipes at SPD to support a Direct Shipping Ore (DSO) operation.

In phase two, Tando plans to upgrade its maiden JORC Resource to an Indicated category and will deploy a supplemental drilling program comprised of 58 holes for 5,550 metres.

The cost to complete both phase 1 and 2 and to finalise its resource estimation will cost Tando around $1.4 million, and Tando says it is “fully funded” to conduct both the drilling and the subsequent metallurgical and mining studies that will be required to formalise its exploration results.

Global vanadium opportunity

As it stands, around 85% of the world’s vanadium is produced in China, Russia and South Africa.

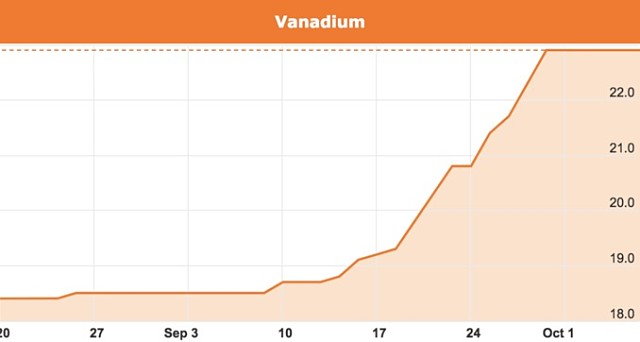

As a junior explorer, Tando is hopeful that it can harness its flagship project to become a significant supplier of vanadium to world markets, at a time of strongly up-trending vanadium prices.

Since early 2017, vanadium prices have risen from $US4/lb to over US$25/lb, with the rapid appreciation attributed to a strong recovery in industrial production, steelmaking, and possibly most pertinently – the surge in battery production that is underpinning the ongoing shift into more efficient energy storage.

Vanadium has been identified as a good basis to manufacture a new generation of battery technology in the form of vanadium redox batteries that have the potential to store electricity from solar and wind generation.

Other potential uses include electric vehicles and electronic devices which further increases the scope for heightened consumer demand.

Market analysts anticipate that the forecast increase in battery usage for large-scale energy storage will lead to a significant increase in the demand for vanadium – an eventuality that’s gradually being proven on global metals markets.

According to research conducted by US financial advisory firm Lazard, vanadium-redox batteries already have a “[levelised] cost of storage that exceeds Li-ion battery storage by 26% to 32% on a comparative basis.”

The US advisory has also stated that the current pace of vanadium battery adoption is being constrained by an absence of supply of battery-grade vanadium oxide – a state of affairs Tando is keen to resolve with its vanadium endowment.