Some sobering COVID-19 infection numbers out of Sydney and an accompanying lockdown were not enough to push the Australian market lower, with the ASX 200 adding 0.5% on Friday to close at 7308 points.

While that still heralded a weekly loss of 0.8%, it was much better than might have been expected, with a very cheery record close on Wall Street the main positive influence.

Wall Street once again set some fresh records as strong employment numbers and a breakthrough in bipartisan trillion-dollar infrastructure talks in Washington once again left investors in a buoyant mood.

Miners and banks push market up

The big barbells of the Australian market – the big banks and the miners – both lifted to put an end to the two-day losing streak, although the positive influence of Wall Street was the most obvious contributor.

It might have been an even more positive performance but for the sobering news that four large eastern suburbs of Sydney would be locked down for at least a week after 22 new cases of COVID-19 were announced on Friday morning.

In other areas of the market, health stocks lagged, led by blood products and vaccine giant CSL (ASX: CSL), which fell 6.7% or $20.39 for the week to $285.13.

Brokers have turned bearish on the company with the news that the CSL manufactured Astra-Zeneca vaccine was being scaled down in Australia adding to the gloom.

It was a different story for many technology stocks which were charging, with Afterpay (ASX: APT) falling 1.2% on Friday bit still rising an impressive 12.7% for the week to close at $129.

News of the buy now, pay later company’s digital card strategy led to predictions that it would be used by more US retailers.

Kerry Stokes opens his chequebook

A rare show of generosity by Seven Group (ASX: SEV) boss Kerry Stokes helped building products Boral (ASX: BLD) enjoy a 6.4% jump to $7.34 after the Seven Group improved its all-cash offer from $6.50 to $7.40 per share, if it can snare a 34.5% stake in Boral by 7 July.

And it seems booze and gambling is winning out against groceries after Woolworths (ASX: WOW) and its just spun off Endeavour (ASX: EDV) parted ways on the market.

Woolworths shares slid for a second day, falling 2.6% for a weekly fall of 13.8% while shares in Endeavour – which is Australia’s biggest owner of pokies and owns liquor chains BWS and Dan Murphy’s – firmed by 1.3% to $6.10 on its second day as a separately listed company.

Small cap stock action

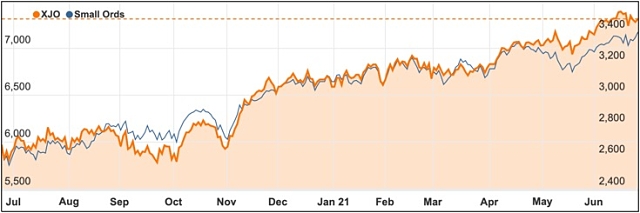

The Small Ords index creeped higher 0.51% to close on 3403.4 points.

Small cap companies making headlines this week were:

Red Mountain Mining (ASX: RMX)

The first diamond hole at Red Mountain Mining’s Mt Maitland project has returned “encouraging” gold and base metal indications.

In this first hole, Red Mountain targeted the Jacia prospect and drilled to a 370m depth. A second hole is underway at the Maitland South prospect pursuing gold.

Over at the company’s Mt Mansbridge project, soil sampling is underway and is expected to take 10 days to complete.

The program will initially focus on heavy rare earth element targets: Killi-Killi, Vader and Kylo.

Little Green Pharma (ASX: LGP)

Medicinal cannabis producer Little Green Pharma has secured a cultivation facility in Denmark to accelerate its European expansion plans.

With the acquisition valued at $21.48 million, the facility includes a 21,500sq m cultivation site and 4,000sq m post-harvest GMP site.

This new Denmark-based facility boosts Little Green Pharma’s cultivation capacity from 3tpa to 23tpa – positioning the company with one of Europe’s largest cannabis manufacturing assets.

Incannex Healthcare (ASX: IHL)

Incannex Healthcare has engaged Vectura to assist with developing a formulation of its drug IHL-216A for evaluation in treating traumatic brain injury (TBI) during clinical trials.

IHL-216A is a combination of cannabidiol and an anaesthetic agent such as isoflurane, which have previously been noted to act synergistically to reduce effects of TBI such as neuronal damage, neuroinflammation and behavioural deficits.

Vectura has worked on the formulation and development of 13 inhaled products with partners including majors such as Novartis, Sandoz, Bayer and GlaxoSmithKline.

Under the agreement, Vectura will perform formulation screening, manufacturing process optimisation, stability assessment and manufacture a lab-scale batch of IHL-216A.

TNG Limited (ASX: TNG)

Malaysia-based AGV Energy & Technology will work with TNG Limited to develop vanadium redox flow batteries (VRFB) and hydrogen technology.

The companies will collaborate on integrating VRFB with AGV’s green hydrogen generation technology known as HySustain.

AGV is developing a pilot project based on HySustain technology in Malaysia and plans to us VRFB as its energy storage system.

TNG and AGV will also explore opportunities for commercialising HySustain in Australia and applications of VRFB in Malaysia.

Blue Energy (ASX: BLU)

Another entrant in the hydrogen space is Blue Energy, which revealed this week it plans to convert pilot gas from the Bowen Basin to hydrogen and sell it to Stanmore Resources.

This pre-development gas would otherwise be flared, with Blue noting converting it to hydrogen would reduce greenhouse gas emissions.

Additionally, with Stanmore planning to use the hydrogen to power its mining fleet, the conversion would also reduce Stanmore’s diesel consumption and own emissions.

Ragnar Metals (ASX: RAG)

Nickel explorer Ragnar Metals has uncovered “significant magmatic sulphide mineralisation” within the second hole of a maiden drilling program at its wholly-owned Tullsta nickel project in Sweden.

Visual inspections and evaluation of a 70.9m-wide intersection have led Ragnar to believe the mineralisation contains primary nickel-copper bearing sulphides of magmatic origin.

Ragnar consulting geologist Neil Hutchison said that it was obvious the sulphides contain copper even without the confirmation of assay or pXRF data.

Meanwhile, Ragnar chairman Steve Formica said he was “extremely pleased” with the broad mineralised zones in the second hole of the company’s maiden program at Tullsta.

Lotus Resources (ASX: LOT)

Uranium hopeful Lotus Resources has begun the first drilling program seen at the Kayelekera uranium mine in more than 15 years.

A reverse circulation program will test anomalies identified from an airborne survey with a focus on those close to the existing processing plant and pit to boost the current 14-year mine life estimate.

Lotus managing director Keith Bowes noted that while exploration success will be beneficial, it is not critical for the mine to be re-started.

The project’s current resource totals 27.1Mt at 630ppm uranium for 37.5Mlb.

The week ahead

While the coming week is likely to be dominated by the success or otherwise in combatting Australian COVID-19 outbreaks, there are also some releases that might reinforce the very positive trends in the Australian economy.

While consumer sentiment numbers on Tuesday are likely to be constrained by the cautious approach to the pandemic by households, numbers such as the CoreLogic home value index on Thursday are likely to tell a much more optimistic story – at least for home owners.

So far in June home prices have been galloping along, up by around 1.5% overall, with Sydney prices flying along at 2%.

It is no surprise that several measures of Australian wealth have been so robust with house prices providing a substantial backdrop.

Figures on job vacancies and international trade are also likely to be bullish with job vacancies up by 13.7% in the February quarter to record highs and the 40th consecutive trade surplus rising from $5.8 billion to $8 billion in April.

The ABS is releasing its lending indicators publication on Friday and it is likely to continue to paint a picture of extraordinary growth in new loan commitments for housing for both owner occupiers and investors but other loan growth may not be as strong.

There will also be 13 new ASX listings this week as the impressive rate of fund raising continues to bear fruit. It will be interesting to see if a rash of big multi-billion-dollar dividend payments from Westpac (ASX: WBC), ANZ (ASX: ANZ), National Australia Bank (ASX: NAB) and Macquarie (ASX: MQG) are ploughed back into buying more shares.

Looking offshore, the biggest news will be the US jobs figures for June, which so far have illustrated a strong comeback by the world’s biggest economy as it recovers from a devastating COVID-19 death toll.

Other US numbers to look out for include manufacturing, house prices, retail sales, mortgage figures and international trade.

Chinese purchasing manager numbers for manufacturing and services are likely to show continuing strong growth for the country as it continues to power on.