Weekly review: Sydney COVID woes push share market down for the week

WEEKLY MARKET REPORT

It took a while to sink in but Sydney’s significant COVID-19 woes finally bore down on the Australian share market, leading it to a weekly decline of 0.4%.

Despite an afternoon rally, the ASX 200 still fell 0.9% on Friday to close at 7273.3 points, with offshore worries also contributing to losses in European and US markets as investors fretted about the durability of the global economic rebound.

At one stage the market was down a really solid 1.6% as an increase in locally transmitted cases and the global spread of the Delta variant forced NSW Premier Gladys Berejiklian to tighten Sydney’s restrictions and warn that the lockdown could keep being extended unless infection numbers started to come down quickly.

Sydney could be locked down for longer

That changed the equation for investors who until that stage had been prepared to factor in the Sydney lockdown as a transitory stage with the latest numbers making it lineball as to whether Sydney would be locked down for a month or even longer.

Firming oil prices were one of the few lines of resistance with energy stocks one of the few to stop the offered a little resistance thanks to improved oil prices but there was little else to cheer about at the top of the market.

Tech names hit the skids

Some of the worst performances came from technology and payment firms along with the major banks, retailers and travel stocks.

Zip Co (ASX: Z1P) shed 5.5% to $8.30 while Afterpay (ASX: APT) fell 5% to $117.51, as the outlook for the global economy grew cloudier as bond yields fell on expectations that the global economy might not bounce back as strongly as expected.

Travel stocks copped some more punishment with Qantas (ASX: QAN) down 2.7%, Flight Centre (ASX: FLT) off by 3.8% and Webjet (ASX: WEB) losing 5.7%.

Surprisingly, the best performing stock of the week was a travel related one with takeover interest pumping up the price of Sydney Airport (ASX: SYD) shares by 33%.

The $22 billion consortium bid of $8.25 a share is 40% above what the shares were trading at.

Another improver for the week was A2 Milk (ASX: A2M) which rose 10% on an improving outlook for the infant formula company.

Small cap stock action

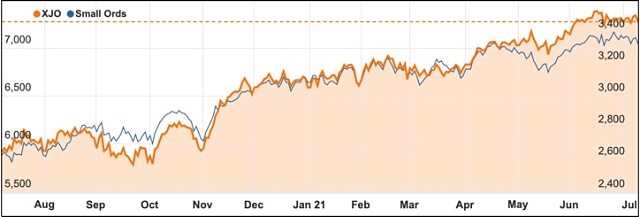

The Small Ords index closed the week down 1.36% on 3330.5 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Venus Metals (ASX: VMC)

Venus Metals kickstarted the week with the commencement of aircore drilling at its Henderson gold-nickel project in WA’s goldfields region.

The program will test structurally-controlled gold targets identified in a review of historical exploration data, including the regionally-significant Ida and Ballard fault zones.

Venus also reported intersections of gold mineralisation at the promising Link prospect within the Youanmi joint venture, which it shares with exploration partner Rox Resources (ASX: RXL).

Drilling defined a zone of high-grade mineralisation within close proximity to historic open pits and existing underground developments.

Link is situated within the northern mineralised envelope which hosted the high-grade United North, Kathleen and Rebel-Kurrajong open pits and Hill End underground mine.

CFoam (ASX: CFO)

Australian manufacturing company CFoam is moving towards commissioning of equipment for a US-funded project focused on the development of coal-derived carbon foam technology.

First up will be a continuous kiln with a 68-foot-long conveyor belt, with commissioning taking place at CFoam’s facilities in West Virginia.

The carbon foam project hopes to ultimately reduce the cost of producing construction panels for the building industry.

Continuing its US presence, CFoam announced it had entered into research and development partnerships with Ohio University and Massachusetts Institute of Technology which seek to enhance the development of carbon products for a cleaner economy.

Envirosuite (ASX: EVS)

Global environmental intelligence firm Envirosuite this week posted record sales revenue of $2.3 million for the June quarter as it continues to scale for growth.

The company is ramping up its resources to expand its business in the US, where the Biden administration’s investment in climate change and infrastructure has created a serviceable addressable market.

Tesoro Resources (ASX: TSO)

Tesoro Resources has continued its winning streak at the El Zorro project in Chile, hitting gold in two zones at the Ternera East deposit.

The first drill hole intercepted mineralisation originating from two zones of the El Zorro Tonalite which is the favourable gold host rock.

The discovery highlights the potential for the Ternera gold system to continue expanding with additional exploration and drilling.

AuKing Mining (ASX: AKN)

Re-listed explorer AuKing will embark on its first drilling program at the Koongie Park copper-gold project in WA at the end of this month.

A 7,000m drilling program has been planned to test the project’s mineralisation at depths of up to 900m over 30 target holes at the highly-prospective Sandiego and Onedin deposits.

Koongie Park is owned by Anglo Australian Resources (ASX: AAR) and AuKing is earning a 75% interest in the project by agreeing to spend $3 million on base metals exploration over three years.

Resource Base (ASX: RBX)

Melbourne-based junior Resources Base is set to re-listed on the ASX on Monday following an oversubscribed $5.5 million initial public offering.

Funds raised will be used to acquire the 124sq km Black Range copper-gold project in Victoria from current owner Navarre Minerals (ASX: NML).

The project hosts multiple untested targets across the Stavely Arc volcanics, which has been recognised as a series of volcanic rocks deposited within a continental margin arc setting and is host to some of the world’s largest known porphyry copper deposits.

Resource Base has planned an aggressive exploration program at Black Range, starting at the high-priority Eclipse prospect, deemed prospective for volcanic-hosted massive sulphides.

The week ahead

One of the big things to watch for this week is the June jobs data, even though they may seem a bit dated as Sydney jobs are hammered by the latest lockdown extension.

In May, jobs lifted by an impressive 115,200 so it will be interesting to see if the trend can be continued.

Other things to watch for locally include measures of consumer and producer sentiment which will give some clues about how those that matter are reacting to the highly uncertain economic situation.

While business conditions have been trending higher, consumer sentiment is being weighed down by further lockdowns, although it often springs back strongly when restrictions are lifted.

Other local releases to watch for include building starts, overseas travel statistics and consumer inflation expectations.

Offshore, the big things coming out include the Chinese economic growth numbers, with GDP tipped to lift by 1.2% in the quarter and US inflation figures, which could see annual core inflation to lift to 4%.

Other things to keep an eye out for include Chinese exports which should continue to show a healthy trade surplus and a swag of US data including a speech by US Federal Reserve Chair Jerome Powell, retail sales, consumer confidence, industrial production and the monthly Budget figures which are expected to show a deficit of US$132 billion for May.

The quarterly earnings season begins in the US with several of the big banks reporting, along with PepsiCo, Delta Airlines, Alcoa and UnitedHealth.