Sweet Earth sets up shop in the Napa Valley of cannabis to enter the CBD beverage market

Sweet Earth will have an enterprise value of around CAD$15 million upon successful listing.

Licensed hemp cultivator and processor, Sweet Earth Holdings, is about to launch a cornerstone $2.5M pre-IPO round and then list on the Canadian Securities Exchange (CSE), in order to develop a multifaceted business that produces seeds for the wider cannabis industry and a range of CBD-based non-alcoholic beverages aimed at health-conscious consumers.

The company is already in the process of manufacturing a Maqui berry drink, CBD Tea and CBD-infused water, that will be sold via online sales and distribution to 300+ dispensaries in Oregon and California.

Via the listing, expected to be completed later this year, Sweet Earth aims to raise C$5-6 million (~A$5.8 million) at a minimum C$0.35 per share.

The cash raised will be deployed towards expanding Sweet Earth’s production and distribution into Europe.

Looking deeper into Sweet Earth

As it stands, the company is already in the process of developing a CBD-derived line of beverages that appeal to both health-conscious consumers, but also the mass-market.

It has three existing greenhouses constructed and “currently in production” according to the company.

Sweet Earth believes it can ensure its greenhouses are fully equipped to handle growing all-year round and has already secured 22.5 acres of growing space, expected to be expanded up to 75 acres courtesy of a letter of intent already signed.

Furthermore, Sweet Earth says it will use “technologically advanced greenhouses” courtesy of a partnership with Forcefield Greenhouse, a company founded by one of Sweet Earth’s management team, Farinaz Wadia, with cutting-edge technology on-hand to ensure high-quality and high harvest yields to maximise its growing footprint.

Sweet Earth’s products.

To further demonstrate its intention to get into production and product sales, company intends to avoid all legislative stumbling blocks by retaining two powerhouse legal firms, McMillan LLP in Vancouver and Loney Law Group in Oregon.

McMilan currently represents some of Canada’s largest cannabis developers including Aurora, The Green Organic Dutchman, iAnthus and OrganiGram. Senior partner at McMilan Desmond Balakrishnan is on the board of advisors for Sweet Earth.

Future catalysts

If Sweet Earth formalises its public listing, it intends to harvest seeds from 16,200 hemp plants, which works out to around 9.5 million seeds being generated, a harvest the aspiring CBD-drinks maker thinks could net between $0.40-0.80 per seed.

At the low-end of this forecast, that works out to around $3.5 million from this venture alone.

In the following month, Sweet Earth says it intends to plant 16,200 hemp plants in its greenhouses for harvest later in the year.

In January of next year, the company says it will expand its overall acreage in Applegate by a further 175 acres as part of its expansive production drive.

The company is presently procuring an automated “beverage production line” that makes around 500 bottles per hour (around 12,000 per day).

Can California repeat the feat with cannabis and industrial hemp?

Sweet Earth is setting up shop in the Applegate Valley, colloquially referred to as the “Napa Valley of Cannabis” – a reference to the Napa Valley’s bountiful wine production which rakes in millions for the state of California through various tax channels, and generates an established industry made up of dozens of winemakers.

Sweet Earth’s farm in Applegate Valley.

The overarching aim is to incrementally build-up its business by growing more with each harvest and implementing some of the most advanced growing techniques, including cutting-edge greenhouses that can operate at full capacity 24 hours a day, 7 days a week to ensure crops are of the highest quality and with maximal commercial value.

Elsewhere in the cannabis market

Molson-Coors Brewing Co. announced a joint venture with Quebec-based The Hydrotherapy Corp. to develop non-alcoholic, cannabis-infused beverages.

In addition, Global liquor giant Constellation Brands increased its ownership in marijuana titan Canopy Growth by investing an industry-record C$5 billion (A$5.31 billion).

The market for CBD-infused beverages is currently bustling to create a wide range of products, and even giant soft drink maker want to get in on the act.

The dawn of cannabis as a market

To highlight how far cannabis has come, Coca-Cola recently announced that it plans to develop its very own range of CBD “wellness” drinks, expected to be available for all ages. However, the company said that “it’s unlikely any CBD producers currently could handle the kind of volume the global beverage giant would require.”

Such talk must be music to the ears of aspiring cannabis-growers and developers and indicates that CBD-based products are en-route to store shelves, first off in North America.

In April this year, Canada passed the Hemp Farming Act of 2018 which seeks to remove hemp with less than 0.3% THC from the controlled substances list.

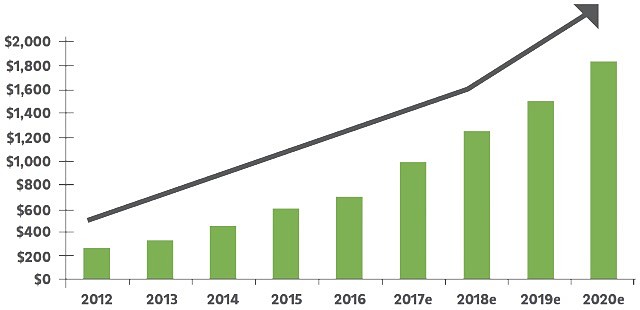

US hemp-based product sales in the millions $ according to the Hemp Business Journal and Vote Hemp.

According to market analysts, this would include the de-scheduling of all derivatives, extracts and seeds of hemp as long as those portions of the plant remain below the THC requirement.

Just like with medicinal cannabis, Canada and the US have led the way in decriminalising industrial hemp and putting it back into the commercial crosshairs for millions of aspiring growers.

Market action imminent

Hemp CBD is now being offered in every segment of consumer products, all the way from cosmetics to animal products, and now, beverages.

Sweet Earth is offering investors exposure to this emerging market and says it intends to “ultimately control the entire vertical of its hemp production,” in order to maximise the commercial viability this market offers.

The company says it will also sell “high-quality feminized seeds” to help supply the nationally expanding hemp market with processed products being offered nationally via internet sales channels.

In addition, Sweat Earth plans to insert its products into the US via Oregon’s dispensary system and will carbon-copy the same wholesale distribution model in California.

Lead manager in the listing is Australia’s Peak Asset Management, who will help list the company on the CSE, further information is available on the Sweet Earth website.