After smashing the record for the fastest initial public offering (IPO) raising on the Automic investor portal, Sun Silver (ASX: SS1) is set to list with a significant bank balance and a high-quality silver project at a time when interest in the precious metal is flying.

Sun Silver is scheduled to make its ASX debut today after completing a $13 million IPO in just a week and almost a month earlier than expected.

The IPO received an overwhelming response, with exceptional demand from both institutional and retail investors.

Silver-rich Nevada asset

The company is forecast to list with an estimated market cap of $25m as it prepares to develop the rich Maverick Springs silver-gold project in Nevada.

Located in one of the USA’s most historic mineral jurisdictions, the Maverick Springs project already hosts a large, high-grade JORC-compliant mineral resource of 292 million ounces silver equivalent at 72.4 grams per tonne silver.

Previous exploration has uncovered an inferred resource of 125.4Mt at 43.5g/t silver and 0.34g/t gold for for 175.7Moz of silver and 1.37Moz of gold.

The company is now looking to take advantage of that significant resource amid booming silver and gold prices to undertake early-stage studies to assess the feasibility of silver paste and solar energy opportunities.

Sun Silver will also accelerate mine and processing studies for Maverick Springs and progress USA Department of Energy, Department of Defense and Inflation Reduction Act grant applications.

Silver interest growing

The company is listing at a time of growing investor interest in the silver industry, driven by increasing demand for the metal from industrial and high-tech applications—the solar industry in particular.

Solar energy capacity in the USA alone is forecast to increase by 125 gigawatts per year to 2030 and the USA has set a target for solar energy to provide 30% of all electricity in the United States by 2030 and 45% by 2050.

The estimated amount of silver required to achieve this target by 2050 represents as much as 98% of the current known global silver reserves.

A recent survey by the Silver Institute forecast that global silver supply is facing the second-largest market deficit in more than 20 years.

The newly published World Silver Survey 2024 found that, while there will be a modest 1% decrease in supply of the precious metal, there will still be another large deficit for silver this year of around 215.3Moz.

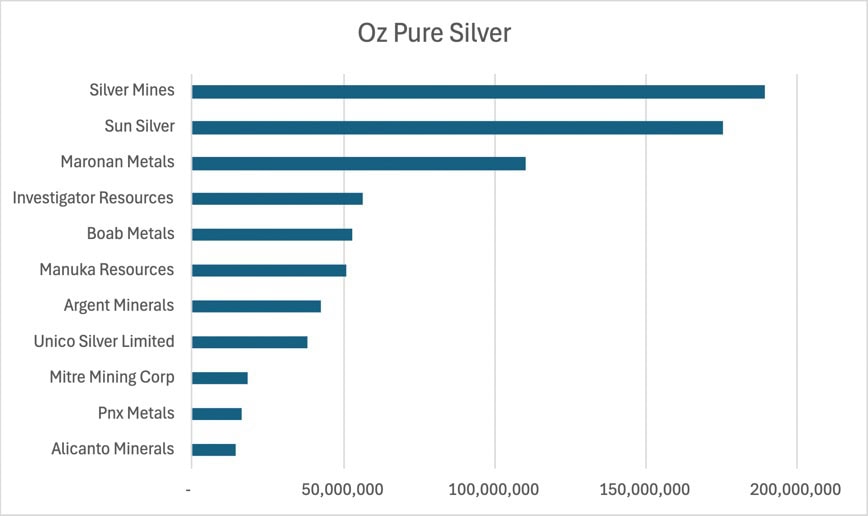

Local stocks to watch

That demand growth and the jump in silver prices has led to a surge in activity amongst ASX silver stocks.

Silver Mines (ASX: SVL) recently conducted its first drill and blast work at the Bowdens silver project to collect bulk samples for ongoing optimisation work and ore-sorting trials.

Bowdens is considered to be the largest undeveloped silver deposit in Australia.

The proposed development comprises an open cut mine feeding a new processing plant with a conventional milling circuit and differential flotation to produce two concentrates that will be sold for smelting off site.

Plant capacity is designed for 2Mtpa with a mine life of 16.5 years.

Life of mine production is planned to be approximately 66Moz silver, 130,000t zinc and 95,000t lead.

Investigator Resources (ASX: IVR) entered into a strategic alliance with Golding Contractors in late April to develop the design, schedules and cost inputs for the mining of the Paris silver project in South Australia.

The alliance is focused on achieving the lowest possible mining cost to support the project’s definitive feasibility study.

The company is confident the initial 70% of the orebody can be mined without the need for drilling and blasting, significantly reducing costs.

Paris has a JORC-compliant mineral resource estimate of 24Mt at 73g/t silver and 0.41% lead for 57Moz of silver and 99,000t of lead.

Mitre Mining (ASX: MMC) completed a highly successful raising in early May to fast-track resource growth at the Cerro Bayo silver-gold project in Chile.

The $10.5m in proceeds will be used to accelerate drilling and rapid resource growth at Cerro Bayo.

Mitre wrapped up the acquisition of Cerro Bayo earlier this year and has already doubled its resource and commenced its maiden drilling program.

The company plans to move quickly to follow-up wide-spread high-grade mineralisation it has identified outside the known resource, including the promising Cristal veins.

Mitre is also integrating over 30 years of geological data and actively working on future drilling targets that have not seen modern exploration methods.

Unico Silver (ASX: USL) has unveiled a significant exploration target for the Cerro Leon project in Argentina.

The estimated exploration target of 10 to 15Mt grading between 175 and 266g/t silver equivalent is additional to an existing mineral resource estimate of 16.47Mt at 172g/t for 92Moz silver equivalent.

A staged 10,000m drill program is planned for 2024-2025 to test prospects included within the exploration target.

Iltani Resources (ASX: ILT) commenced the next phase of drilling at its exciting Orient silver-indium project in Northern Queensland earlier this month.

Orient is an extensive precious metal-rich epithermal system with a likely intrusion (porphyry) at depth and hosts multiple high-grade zinc-lead-silver-indium veins and stockworks outcropping over at least 4km2 area.

The company plans to drill 11 reverse circulation (RC) holes over 2,300m at Orient West, with the aim of covering 1,800m of strike extent – extending mineralisation to the north-east and south-west.

The results will enable the generation of an exploration target for Orient West, forming the basis for subsequent mineral resource estimate drilling.

Iltani will also drill a 750m deep diamond hole at Orient West. The hole is designed to test the down dip extensions of the shallow epithermal mineralisation and then target a deeper geophysical anomaly which could represent a potentially mineralised porphyry style intrusion.

The hole is supported by funding from the Queensland government’s Collaborative Exploration Initiative program and will commence in June after the completion of current RC drilling program.

Argent Minerals (ASX: ARD) recently reported it had intersected shallow, broad high-grade zones of silver-lead-zinc in all 12 RC drill holes completed over the Kempfield deposit in NSW.

The intersections of up to 88m thick from surface came from the Western Lode area and 29m thick high-grade silver-base metal mineralisation located northeast of the Lode 200 resource area.

The 12 RC drill holes of 1,036m in total were aimed at extending and defining new zones from the Lode 200 mineralised block and to drill test its western zone.

The zones of mineralisation have identified that the lateral and vertical depth of the overall mineralised lode system is trending in a north-east direction towards the 16.2Moz silver equivalent Lode 300 block.

Adriatic Metals (ASX: ADT) recently reported on a significant quarter which saw the company produce first concentrates and the official opening of the Vares silver operation in Bosnia and Herzegovina.

Following an exploration and development investment of around $380m, Adriatic produced the first silver/lead and zinc concentrates from Vares in late February 2024.

The Rupice mine, from which the ore is sourced, commenced mining in July 2023.

The company is now focused on plant optimisation and ramp up to consistent production and is scheduled to reach nameplate capacity of 800,000tpa in Q4 2024.

Manuka Resources (ASX: MKR) recently received $1.07m under the Australian government’s research and development tax incentive scheme for a successful process improvement program undertaken by the company to enhance production at the Wonawinta silver mine in NSW.

Between October 2022 and February 2023, the company undertook a limited trial campaign of silver production at Wonawinta, with metallurgical test work identifying an uplift in silver feed grades to the leach circuit by up to 100%.

Manuka is looking to release of an updated reserve statement in May 2024 and to restart the mine as a dedicated silver operation in 2025.