The Australian share market enjoyed a move higher this week with the ASX 200 up 2.1% on the back of a strong performance by energy and mining shares.

Despite the positive week there was a lack of uniformity about the rally with falls recorded by the major banks.

Still, traders will take a win when they can get one and the tale of the tape showed that the ASX 200 index gained 0.5% on Friday to 6678 points – taking the weekly rise to 2.1%.

Wall Street leads us higher

As usual, the inspiration for the rise came from Wall Street with the Dow Jones Industrial Average up 1.1%, the S&P 500 up 1.5% and the tech heavy Nasdaq Composite Index up by 2.3%.

That trend among the different indices supports a theory that growth shares such as technology had been oversold in the US market correction and are worth revisiting.

Rising oil and iron ore prices help out

Helping energy stocks in the market was a firming of the oil price after recession fears drove falls earlier in the week, with global benchmark Brent crude up 3.9% to US$104.65 a barrel, and US Nymex (WTI) gaining 4.3% to US$102.73/bbl.

That marked the biggest one-day rise since May and coincided with firmer iron ore prices, with futures contracts up 1.6% to US$114.18 a tonne.

As a result of the firming mining and energy stocks, the Australian dollar also rose to US68.40c.

Illustrating the strength of the rise in oil prices, Woodside Petroleum (ASX: WPL) closed up 1.7% to $30.80, Santos (ASX: STO) added 2.3% to $7.06 and Beach Energy (ASX: BPT) jumped 4.3% to $1.71.

That sort of strong and generalised rise was echoed by coal stocks with Whitehaven Coal (ASX: WHC) up 6.3% to $5.03 and New Hope Corporation (ASX: NHC) shares up 4.7% to $3.60.

The big mining companies started very strongly after reports of further stimulus spending by the Chinese Government but weakened a little as the day went on with BHP (ASX: BHP) up 0.7% to $39.22 – the pick of them, followed by Fortescue Metals (ASX: FMG) with a 0.6% increase to $17.30 and Rio Tinto (ASX: RIO) shares up 0.3% to $97.43.

Financials keep falling amid switch to growth stocks

Notably swimming against the tide were financial stocks, which were down 0.21% as a sector, with Commonwealth Bank’s (ASX: CBA) posting a 0.5% fall to $92.59.

Communications stocks and consumer staples were also weaker, demonstrating the market switch back to growth and away from defensive sectors.

Magellan continues to lose clients

In individual share news, international fund manager Magellan Financial (ASX: MFG) fell 3% to $11.90 on news that investors had pulled a further $5.2 billion from its funds.

Magellan’s shares have now shed an astonishing 74% over the past year with its assets under management halving from a peak of $116 billion as mainly institutional clients withdrew investment mandates amid the departure of some senior staff – notably founder Hamish Douglass who was seen as a key stock picker when he worked as a fund manager.

Small cap stock action

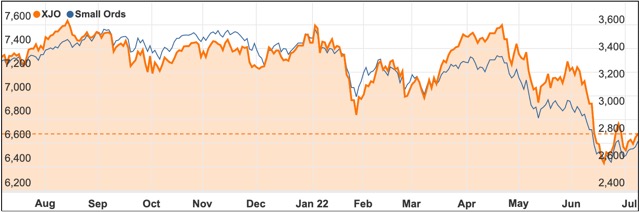

The Small Ords index rallied 3.86% this week to close on 2767.6 points.

Small cap companies making headlines this week were:

Genmin (ASX: GEN)

West Africa iron ore explorer Genmin announced it had linked up with global giant Anglo American to cover financing, development and marketing of production from its flagship Baniaka project.

The company granted Anglo American a 1% royalty and exclusive right to negotiate and agree on terms to cover up to $110.7 million in financing.

The deal will cover 100% of Baniaka’s output, with the royalty payable on the first 75 million tonnes of iron ore sold.

The exclusivity rights commence when Genmin delivers the project’s preliminary feasibility study before the end of the September quarter.

The Hydration Pharmaceuticals Company (ASX: HPC)

After posting its largest ever quarterly sales period for the three months to June, The Hydration Pharmaceuticals Company also disclosed record net sales of $1.18 million in the same month.

The results capped off a quarter of major growth, during which the company hit $2.95 million in net sales for the first time in its 21-year history.

Summer trading in the northern hemisphere markets of the US and Canada is expected to further increase sales as the regions hit peak demand season.

The material sales build on the company’s quarter-on-quarter and yearly financial performance despite ongoing global supply chain issues and manufacturing concerns.

RooLife Group (ASX: RLG) and AFT Pharmaceuticals (ASX: AFP)

The two companies announced this week they had teamed up to launch a range of over the counter products through online platform Tmall Global.

Under the terms of the deal, RooLife will market and sell AFT’s pharmaceuticals including Ferro-Sachet dietary tablets, Crystawash Extend hand sanitiser, Loraclear hay fever relief and Histaclear non-drowsy allergy relief.

RooLife will also be responsible for ensuring AFT gains approval to sell its products in China.

China is the world’s second largest market for OTC medicines (behind the US) and is growing rapidly.

Statistics show that more than 58% of all current sales of OTC products to Chinese consumers occur online.

Kalamazoo Resources (ASX: KZR)

Junior explorer Kalamazoo Resources has had a busy week at its Victorian and West Australian assets.

The company confirmed it would expand its Victoria-based gold portfolio with acquisition of the Mt Piper project from current owner Coda Minerals (ASX: COD).

The move will consolidate its ground in the Central Victorian goldfields region which also hosts the large Fosterville and Costerfield mines.

In WA, Kalamazoo kicked off a maiden drilling campaign at the Marble Bar and DOM’s Hill lithium projects, considered highly-prospective for lithium-caesium-tantalum (LCT) mineralisation.

Both projects are part of a joint venture with Chile’s Sociedad Química y Minera de Chile SA (SQM).

BBX Minerals (ASX: BBX)

BBX Minerals confirmed it had received investor support to raise $2.1 million to assist with ongoing assaying and the delivery of a JORC resource at the Três Estados project in Brazil.

Assays released this week uncovered widespread intervals of platinum and iridium mineralisation in three drill holes at the project.

The company said the continuity of grades and metal content from hole to hole was “extremely encouraging”, placing it in a strong position to deliver on its ultimate goal of becoming a producer.

The week ahead

Once again central bank decisions will be of global importance, even though in this coming week decisions will be announced from relatively smaller countries in the form of the Reserve Bank of New Zealand and the Bank of Canada.

Both countries are expected to get interest rate rises with Canada largely following in the wake of the United States with a 0.75% rise forecast, while in New Zealand, which started hiking rates much earlier than most, expectations are for the sixth straight rise of around 0.5% to 2.5% – given the bank’s prediction that the cash rate will double to 4% over this year.

Here in Australia, the jobs figures out on Thursday and consumer and business confidence figures are the main attraction.

Offshore, there is a really big week in prospect with Chinese growth numbers out on Friday set to show the impact of continuing lockdowns due to the country’s strict COVID- zero policies.

Annual growth is expected to slow to just 1.4% with the struggling property sector also dragging down growth.

Of particular interest will be any sign that government stimulus measures are gaining traction while unemployment numbers are expected to be up.

In the United States the big figure to watch out for is the inflation number out on Wednesday, with economists expecting the headline CPI number to rise by another 1% in June.

That follows on from an 8.6% rise over the year to May which was the highest level in 41 years.