Strategic Energy Resources rides BHP’s copper discovery wave

Strategic Energy Resources is the latest IOCG explorer in South Australia to ride BHP’s massive copper discovery wave.

Strategic Energy Resources (ASX: SER) is the latest small cap to ride BHP’s (ASX: BHP) copper discovery wave, with the company’s share price rocketing more than 100% since last week.

Earlier this week, BHP announced it had pulled out of the ground what some call the thickest high-grade copper intersection seen in many years.

The intersection was 425.7m wide and graded 3.04% copper, 0.59 grams per tonne gold, 346 parts per million uranium and 6.03g/t silver.

Within that was a higher-grade interval of 180m at 6.07% copper, 0.92g/t gold and 401ppm and 12.77g/t silver.

Nearology boosts share prices

Argonaut Resources (ASX: ARE) has a stake in the nearby Torrens project and the company’s chief executive officer Lindsay Owler described the discovery as “spectacular”.

He also pointed out the intersection ended in mineralisation so could potentially be much thicker.

Because of the Torrens project’s proximity to the discovery, shareholders flocked to the stock triggering a please explain from the ASX after the share price rocketed more than 30% during intraday trade.

By late afternoon trade on Thursday, Argonaut’s stock price was 36.84% higher on the previous week.

Aeris Resources (ASX: AIS), which owns a 70% interest in Torrens, also experienced a rush of investor interest this week, with its share price similarly soaring on BHP’s discovery news and up 36.67% on the previous week.

Cohiba Minerals’s (ASX: CHK) share price is up a massive 320% in a week and announced it will expedite plans for its exploration program at its Olympic Domain project. BHP’s discovery being a mere 2km to the east of Cohiba’s tenement.

Strategic Energy has surged on the BHP discovery news as well, with its stock price at the time of writing up 100% on last week due to the proximity of its wholly-owned Myall Creek copper project to the massive find.

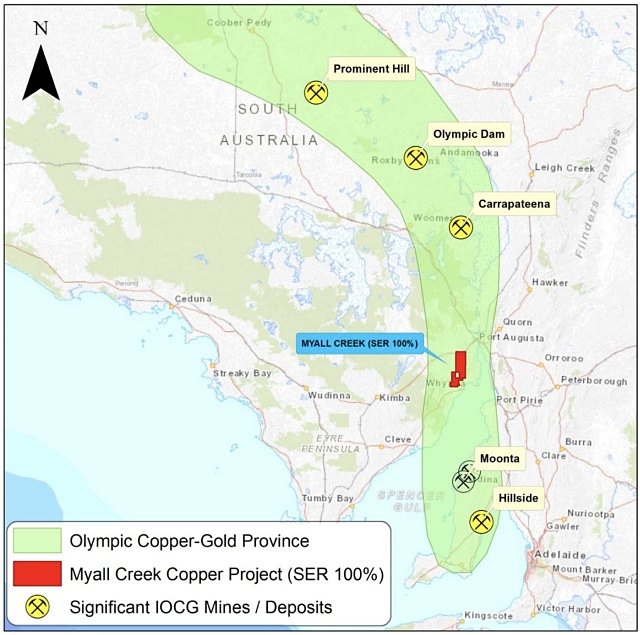

Location of Myall Creek within the Olympic copper-gold province.

Similar to other projects in the region, Myall Creek is believed prospective for iron-oxide, copper, gold-type (IOCG) deposits and Strategic Energy secured access rights from the Department of Defence to begin exploring the project in September.

According to Strategic Energy, historic drilling at the project unearthed a 15km zone of anomalous copper.

Additionally, the Geological Survey of South Australia published findings in August on recent work it had undertaken within the region including information on Olympic Dam and OZ Minerals’ (ASX: OZL) Prominent Hill which have similar geology.

The report revealed Myall Creek is in a similar geological setting, with Strategic Energy claiming this “increases the likelihood of IOCG mineralisation” being present at the project.

Strategic Energy plans to carry out a detailed ground gravity survey to firm up drill targets.

Twiggy climbs on copper bandwagon

During the last 12 months, mining majors BHP and Rio Tinto (ASX: RIO) have been actively exploring copper tenements in South Australia and the Pilbara, with Rio taking its most of its bets on the Pilbara and BHP focusing on South Australia near is Olympic Dam mine.

Meanwhile, Andrew “Twiggy” Forrest has been doing the same with his Fortescue Metals Group (ASX: FMG) vehicle hedging its bets by grabbing up land in both areas.

Many of Fortescue’s recently acquired copper tenements in South Australia surround Strategic Energy’s Myall Creek project and the miner has planned a major exploration campaign in the area.

Director scoops up Strategic Energy shares

In what is viewed as a positive move, Strategic Energy on-executive director David DeTata scooped up 5 million fully paid ordinary shares in the company earlier this month.

Mr DeTata paid $17,500 for the stock at $0.0035 per share, which is a far cry from the company’s share price in late afternoon trade today, which was $0.008 after reaching an intraday high of $0.013.