Perth-based explorer Strandline Resources (ASX: STA) has strengthened the development outlook of its Coburn mineral sands project in Western Australia’s mid-west region by securing $615 million in long-term binding offtake agreements with customers in Europe, China and the US.

The agreements represent approximately 66% of Coburn’s forecast revenue for the first five years of production, including 100% of ilmenite, 100% of zircon concentrate and a substantial portion of premium finished zircon product.

The remaining 34% of project revenue is expected to be generated from offtake agreements yet to be locked in for the balance of premium finished zircon and rutile product.

Strandline managing director Luke Graham said the offtake agreements mark a pivotal point in the strategy to bring Coburn into production.

“These contracts, with three leading global consumers, are huge endorsements of Coburn and underpin our plan to secure project funding,” he said.

“With two-thirds of the project’s revenue now underwritten by offtake agreements and the remaining agreements well advanced, Strandline is advancing strongly towards development of this world-class project,” Mr Graham added.

Ilmenite offtake

US-based The Chemours Company – currently the world’s largest producer of high-quality titanium dioxide – has signed up to buy all of Strandline’s forecast annual ilmenite production of around 110,000 tonnes.

The ilmenite is of a chloride-grade specification – meaning it contains more than 62% titanium dioxide – and will be used by Chemours for the production of high-quality titanium dioxide primarily used in pigments for paint, paper, ink and plastic applications.

Sales of the product are expected to generate up to 24% of Coburn’s total forecast revenue.

Mr Graham said the agreement provides a strong basis for project financing and certainty in project cashflows.

“A key attribute of the Coburn project is its rich mineral assemblage and ability to produce chloride-grade titanium feedstocks, as well as ceramic-grade zircon products, which are currently scarce in the world and forecast to have strong long-term market demand,” he said.

Zircon sales

Total zircon concentrate production for the first seven years of Coburn has been contracted to a partnership between Chinese companies Sanxiang Advanced Materials Co and Nanjing Rzisources International Trading Co.

The sales are expected to generate approximately US$200 million (A$314 million) in revenue over the term of the agreement, accounting for up to 26% of Coburn’s revenue, based on pricing formulae contained in the agreement and commodity price assumptions contained in the project’s definitive feasibility study.

Coburn’s forecast average annual production of zircon concentrate is 54,000t, containing payable zircon, titanium and rare earth monazite minerals.

The zircon mineral is suitable for a range of applications including ceramics, zirconium chemicals and foundry uses; titanium is used in the production titanium dioxide pigment; and monazite is suitable for the extraction of rare earths.

The Sanxiang-Nanjing agreement also provides for the purchase of heavy mineral concentrate produced from Coburn’s wet concentration plant during the project’s ramp-up phase and while the mineral separation plant is being constructed.

Mr Graham said the agreement is a strong endorsement of Coburn and the high quality of its zircon concentrate product.

Finished zircon

European zircon consumer Industrie Bitossi has signed an agreement with Strandline to purchase the bulk of Coburn’s estimated annual production of premium finished zircon, accounting for approximately 18% of the project’s forecast revenue.

Strandline expects to produce 34,000t of finished zircon, confirmed as a ceramic-grade specification containing more than 66% zirconium dioxide and good whiteness properties with low impurities.

It will be used in the production of micronised zirconium silicate and downstream products primarily in ceramic applications.

Mr Graham said the three offtake agreements leave Strandline in a strong position as the project moves towards a development decision.

Capital raising

Last month, Strandline completed a $6.5 million capital raising to accelerate preparations for Coburn’s development.

Funds will be used primarily to advance project financing and pre-execution activities such as procurement of major construction and operations contracts, offtake agreements, debt financing and partner arrangements.

The capital raising was achieved via a $2 million share placement and a $4.5 million fully underwritten, pro rata, non-renounceable rights issue.

Mr Graham said the raising will ensure the company can pursue an accelerated development strategy for Coburn at the required pace.

“It is increasingly clear that [we are] very well positioned to capitalise on the emerging supply deficit for high-grade zircon and titanium feedstocks, reflected in the favourable feedback from potential lenders, customers, contractors and stakeholders,” he said.

“This raising will ensure we can press ahead with work on all these fronts with the aim of bringing [this] project into production as quickly as possible.”

Strong product suite

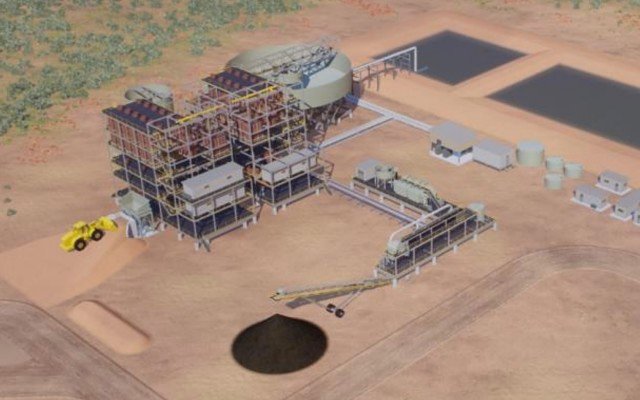

Located 240km north of Geraldton over an area of 1,200sq km, the Coburn project contains a major heavy mineral sand deposit more than 35km long, 3km wide and up to 50m thick.

The project has ore reserves of 523 million tonnes at 1.11% total heavy minerals, underpinning an initial mine life of 22.5 years at a planned average mining rate of 23.4Mt per annum.

Coburn is believed to be one of the world’s largest and most capital-efficient mineral sands projects, with a strong zircon-titanium product suite, low costs and the ability to generate healthy financial returns.

At mid-afternoon, shares in Strandline Resources were trading 19.79% higher at $0.115.