Sovereign Metals (ASX: SVM) is positioned to become one of the world’s largest rutile and natural graphite producers after receiving exceptional results from a pre-feasibility study (PFS) of the Kasiya project in Malawi.

Kasiya, located in central Malawi, is the largest natural rutile deposit and second largest flake graphite deposit in the world.

The proposed mine is estimated to have the capacity to become a world-class producer of rutile at 222,000 tonnes per annum over an initial 25 year life-of-mine and the potential to become one of the world’s largest natural graphite producers outside of China at 244,000 tonnes per annum.

Robust financial numbers

Along with identifying high-quality production upside, the pre-feasibility study also confirmed the significant financial benefits associated with a Kasiya development.

This includes total revenue over a 25 year life of mine of around $25.2 billion, an after tax internal rate of return of 28% and an initial capital expenditure forecast of approximately $940 million.

Managing director, Dr Julian Stephens, said the new study has confirmed Kasiya as potentially a major critical minerals project with an extremely low CO2-footprint delivering major volumes of natural rutile and graphite while generating significant economic returns.

Important step forward

“The release of the Kasiya PFS marks another important step towards unlocking a major source of two critical minerals required to decarbonise global supply chains and to achieve net-zero,” Dr Stephens said.

“The project benefits from existing high-quality infrastructure and inherent ESG advantages. Natural rutile has a far lower carbon footprint compared to other titanium feedstocks used in the pigment industry, and natural graphite is a key component in lithium-ion batteries – crucial to de-carbonising the global economy.”

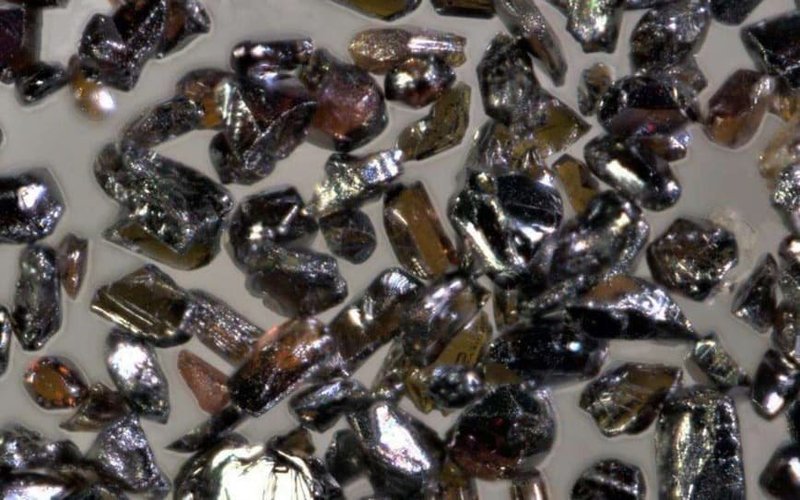

Dr Stephens added that with Kasiya’s natural graphite and rutile resources hosted at surface in soft, friable saprolite material, Sovereign is well positioned to move quickly to supply the highly sought-after critical metals to global markets.

Rio Tinto backing

The project has recently received the backing of one of the world’s largest miners in Rio Tinto and the local government is clearly on-board.

In July Rio Tinto made a significant investment in Sovereign resulting in an initial 15% shareholding and options expiring within 12 months of initial investment to increase their position to 19.99%. Under the investment agreement, Rio Tinto will provide assistance and advice on technical and marketing aspects of Kasiya including with respect to Sovereign’s graphite co-product, with a primary focus on spherical purified graphite for the lithium-ion battery anode market.

Significant local benefits

The Malawian government has identified mining as one of the sectors that could potentially generate economic growth for the country.

It has also recognised that Kasiya has the potential to deliver significant social and economic benefits for Malawi including fiscal returns, job creation, skills transfer and sustainable community development initiatives.

Malawi’s Minister of Mines and Minerals, Monica Chang’anamuno, recently publicly applauded the timely investment by Rio Tinto and marked it as a milestone towards realising the country’s aspirations of growing the mining industry as promoted in the Malawi Vision 2063, which identifies mining as a priority industry.

Critical mineral attention

Both rutile and graphite have been identified as critical to the world economy and demand for high quality flake graphite and natural rutile is growing due to global decarbonisation requirements and current and future predicted supply deficits.

Benchmark Mineral Intelligence recently reported that the demand for anodes grew by 46% in 2022 compared to only 14% growth in natural flake graphite supply.

The natural graphite market is forecast to move into deficit as demand rapidly grows in the lithium-ion battery and electric vehicle sectors.

Natural rutile is facing a significant global supply deficit which is forecast to widen further considerably in the next 5 years.