Junior explorer Sovereign Metals (ASX: SVM) has generated a “high-quality” rutile product during metallurgical test work on mineralisation from its large ground holding in Malawi.

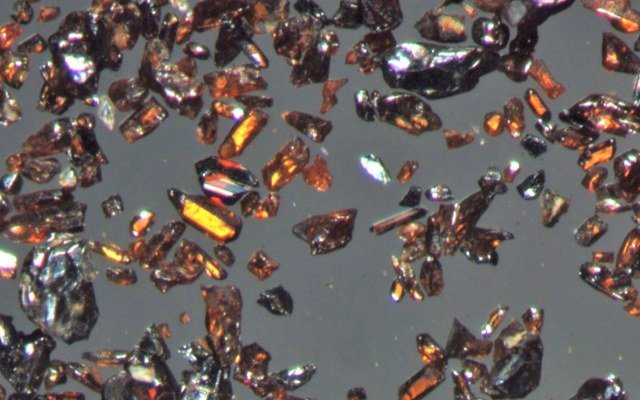

Test work produced a 96% titanium dioxide rutile product that meets or exceeds market specifications.

The rutile was generated using conventional mineral sands processing methods and also had “exceptionally low levels” of chromium, zirconium, uranium and thorium gangue elements.

“The ability to produce a natural rutile product to commercial specifications comparable to leading market products from our saprolite-hosted prospects in Malawi is a significant milestone,” Sovereign managing director Dr Julian Stephens said.

“These initial metallurgical results are an important step in validating the commercial importance of rutile mineralisation we have discovered and give us confidence to move forward with expanded exploration and metallurgical test work programs.”

Earlier this year, Sovereign reported reconnaissance exploration across the Malawi tenements had unearthed high-grades of insitu titanium dioxide mineralisation.

The 96% rutile was made from insitu rutile grading 1.16%.

According to Sovereign, its rutile product is comparable to Iluka Resources’ (ASX: ILU) subsidiary Sierra Rutile’s product which averages 96.29% rutile.

Malawi tenements

Sovereign’s wholly-owned Malawi tenements cover more than 4,000 square kilometres.

The rutile is found in soft, free-dig saprolite, which extends to a depth of about 25m.

The company is carrying out an accelerated work program over the coming months to firm up new areas of mineralisation and publish a resource.

Metallurgical test work is ongoing to optimise the flowsheet and develop samples for potential offtake customers.

Rutile market

Natural rutile is the highest-grade feedstock for manufacturing titanium dioxide pigment and metal, which are the mineral’s primary end-markets.

Dr Stephens noted the market for natural rutile had favourable fundamentals with the product in a structural deficit and demand expected to grow during 2019.

By midday, shares in Sovereign had risen 12.5% to $0.135.