Formerly Botswana Metals, Six Sigma Metals (ASX: SI6) has emerged from a trading halt with news of highly prospective lithium and vanadium-titanium acquisitions in Zimbabwe, as part of its strategy to strengthen its foothold in the battery minerals sector.

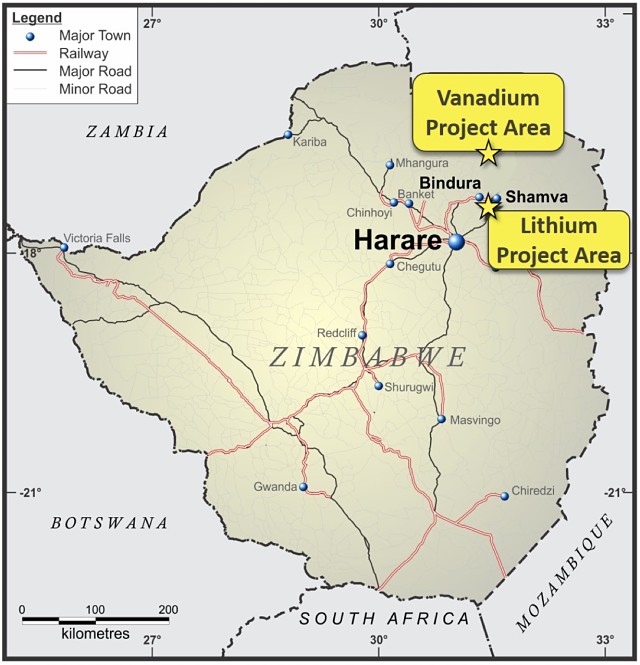

The company has taken advantage of the new mining-friendly establishment in Zimbabwe to lock-in a “first mover advantage” and earn an 80% stake in the lithium-rich Shamva project north of Zimbabwe’s capital Harare and the Chuatsa vanadium-titanium project in Zimbabwe’s far north.

Shamva lithium project

Shamva comprises three main deposits, which Six Sigma Metals non-executive director Josh Letcher describes as “walk up ready drill targets”.

Mr Letcher said the Shamva project totals 20 square kilometres with “significant” lithium outcrops throughout.

The project hosts three main lithium deposits with one prospective for spodumene and the other two containing lepidolite.

Mr Letcher told Small Caps 73 rock chip samples had recently been collected, with analysis revealing lithium grading up to 3.40% and numerous other samples grading above 1% lithium.

The assays confirm historic reports which have noted spodumene and lepidolite mineralisation at several prospects across the project including old workings.

Mr Letcher said that once diligence has been finished, the company plans to fast-track exploration across the project.

Initial drilling at Shamva will test mineralisation at depth to determine the thickness and strike-length of the pegmatites where lithium mineralisation was identified at surface.

Mr Letcher said a second infill drilling campaign will then be carried out to calculate a JORC-compliant resource.

Chuatsa and the growing vanadium market

The other project Six Sigma is picking up is the Chuatsa vanadium asset, which encompasses 12sq km and has applications pending for a further 8sq km.

Similar to Shamva, Chuatsa has been subjected to historical exploration during 1962 and 1964. The owner at the time Anglo America Prospecting submitted samples for analysis which revealed up to 7.8% titanium dioxide, 0.8% vanadium pentoxide and 0.38% copper.

Six Sigma executive director Steve Groves likened Chuatsa’s mineralisation to Australian Vanadium’s (ASX: AVL) Gabanintha project, which has a resource estimate of 179.6 million tonnes grading 0.75% vanadium, 9% titanium and 33.8% iron, as well as King River Copper’s (ASX: KRC) Speewah project, which has a 2004 JORC estimate of 4.7 billion tonnes grading 0.30% vanadium and 2% titanium.

Mr Letcher said Six Sigma plans to fast-track Chuatsa with initial exploration to involve confirming historical grades, followed by proving up a resource.

With the Chuatsa acquisition, Six Sigma is targeting the vanadium market which is enjoying a revival in interest due to the advent of vanadium flow redox batteries, which are for energy storage in sustainable energy applications.

Originally developed in Australia, the vanadium batteries are scalable and are suitable to large-scale storage required in solar farms and even small towns.

In the past two years, the price for vanadium pentoxide has risen sharply from languishing at US$3.50 per pound in 2016 to tipping US$16/lb earlier this year.

Traditionally used in the steel making sector, demand for the mineral is also tightening in this field, with analysts projecting the commodity’s price will continue to grow on mounting consumption from battery and steel industries.

Why Zimbabwe?

According to Mr Groves, Zimbabwe is renowned for its richness in natural resources and with the advent of a new mining-friendly the government, Six Sigma is keen to lock-in some of these assets.

Mr Groves said Zimbabwe is currently the world’s fifth largest lithium producing region with Bikita Mine accounting for the majority of that output.

Bikita Mine is purported to host resources of around 11Mt grading 1.4% lithium and has been operating for 60 years.

Many explorers which steered clear of Zimbabwe and the former President Robert Mugabe’s regime are now circling the area for prospective resource projects.

Mugabe was ousted in a military coup late last year and the new President Emmerson Mnangagwa has proposed an overhaul to the mining sector, with the goal of making it appealing to foreign investment.

One of the changes includes repealing Mugabe’s majority government ownership laws for most mines, retaining its majority government rights only in diamond and platinum mines.

Acquisition terms

As part of the agreement, Six Sigma must pay the vendors a non-refundable A$100,000 option fee to undertake the 60-days due diligence.

If Six Sigma elects to proceed with the acquisition after due diligence, it has the option to secure an initial 30% holding by issuing the vendors 50 million shares and 10 million options. Under the second earn-in phase, Six Sigma can lock-in a 60% interest by issuing the vendors A$1.3 million worth of its ordinary shares.

A final earn-in stage is incumbent on Six Sigma proving up a JORC-compliant resource of 10 million tonnes at an economically mineable lithium grade at Shamva. Once Six Sigma has defined this resource, it can grow its stake in the project to 80% by paying the vendors 20% of the project’s market value in shares.

The acquisition remains subject to shareholder and regulatory approvals.