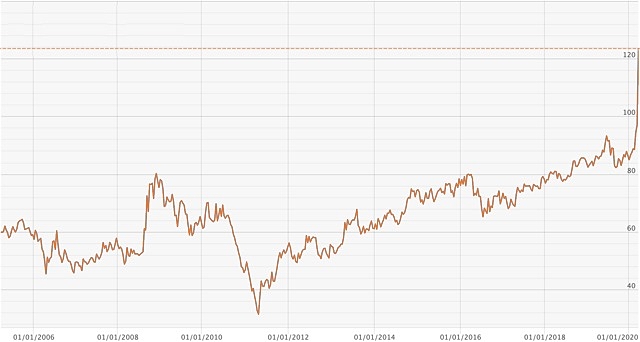

A really astonishing thing has been happening in the precious metal market — the gold-to-silver ratio has gone where it has never gone before.

As the futures market closed in New York on Thursday (Friday morning in Australia) the ratio reached 1:124.

That is, it required 124 ounces of silver to buy 1oz of gold. The highest previous reading was on 25 February 1991 when the ratio hit 1:100.8; the silver number also touched 100 briefly in 1942. Apart from that, silver has never been in three digits — until now.

As one US commentator pointed out this week, never in 5,000 years has silver been this far undervalued relative to gold.

For much of its history, the gold-to-silver ratio was 1:16, but the last time it was at that level occurred in 1884. In more modern times, the silver end of the ratio has blown out as high as 90oz to 1oz of gold.

It’s an easy ratio to figure: the higher the silver number, the higher the fear factor among investors because it indicates that gold is viewed as the safer haven.

Wheaton Precious Metals, listed on both the New York and Toronto stock exchanges, has a portfolio of gold and silver companies.

It asked in a recent investor paper whether the gold-to-silver ratio still applies. Was it a “financial knickknack” from a bygone era, or does it still serve as a reliable indicator of the condition of the global monetary system? The latter is the right answer, it concluded.

The Americans fought a presidential election over silver

First, though, some silver background.

From 1687 until about 1870, the ratio stirred little from 1:16. By 1912, it had reached over 1:30, fell sharply in World War I, then bounced well over 1:60 in the Great Depression (perhaps significant to those wondering where were are headed right now). It collapsed in the late 1960s, then bounced again after the 1987 crash.

People of two countries have silver deeply embedded in their psyches.

One is China, where the metal was the standard for currency from the time of the Ming dynasty until November 4 1935. It was abandoned then, only because China could not control silver use and large amounts of the metal flowed out of the country, causing financial dislocation internally.

The other is the United States. When there’s trouble, investors head for silver.

Earlier this month, the US Mint announced it had sold out of Silver Eagle one-dollar coins, the most popular silver product they offer. The Americans are back in silver frenzy, it would seem.

The US Mint in February sold 650,000 one-dollar Silver Eagles — but in the first 12 days of March, it moved 1.57 million of them before the shelves were bare.

At the same time, it was reported that precious metals dealers across America had sold all their silver products.

One presidential election was fought largely over silver. In 1896, the Democrats wanted both gold and silver as legal tender, whereas the Republicans (who won) wanted a gold standard only.

Anyone interested in silver is familiar with the attempt in 1979 by the oil-rich Hunt Brothers of Texas to corner the silver market, accumulating 55 million ounces by September 1979, or 8% of global supply. That forced the silver price up from US$11/oz to US$50/oz.

But while they bought physical silver, they also took out huge futures contracts. Then, the silver price collapsed as more supply flooded the market, and their fortune disappeared with that collapse.

In 1997 it was reported that Warren Buffett was accumulating silver. The metal’s price was depressed. He cashed in his profit in 2006, by which time silver had recovered.

Ratio soared in 2019

During 2019, the gold-to-silver ratio averaged 86. In June, for example, gold had risen to US$1,300/oz but silver could not break out through US$15/oz. Investors, it seems, were not buying the silver story.

The Wheaton paper’s warning should be of interest to all investors. It argues that for at least 150 years, the ratio has served as an indicator of the global monetary condition. During periods of inflation, the ratio falls; when there is deflationary monetary destruction, the ratio rises.

“These highs are alerting us to a pervasive capital shortage,” the paper noted.

And, it should be pointed out, this document was written just before the COVID-19 story burst.

The historic spikes in the Great Depression and the 1987 crash might be seen as backing up this view.

But Peter Hug, global trading director at Montreal-based precious metals dealer Kitco Metals, said it is at the moment impossible to get one’s hands on physical silver.

“Both the US Mint and the Canadian Mint are on allocation with some products anywhere from four to six weeks out … There is no physical product left to buy,” he said.

Mr Hug added a note of caution to those looking at silver as a safe haven.

In an interview on Kitco’s website this week, Mr Hug said it had to be remembered that silver is an industrial metal as well as a precious one (with about 55% going to industrial uses).

“Ignoring the economics of a significant recession … silver [is] an industrial metal and there would be virtually no demand for it,” he said.

Silver should be behaving more like a precious metal

Here’s something else to keep in mind about the gold-to-silver ratio, courtesy the New Mexico-based Mercenary geologist Micky Fulp.

In a commentary last October, Mr Fulp wrote that “in times of financial distress and economic calamity, silver tends to behave more like a precious metal with widespread hoarding and speculation trickling down from the gold market”.

He also noted that the ratio in the mid-80s five months ago was highly anomalous and he would expect it to drop.

But, it has not. We have never seen 1:124 ever before. And silver yet has to put on a spurt.

Like with most other financial events at present, it seems, we could be in uncharted waters with silver.