Technology firm Silex Systems (ASX: SLX) and Canadian uranium miner Cameco Corporation have signed a term sheet for the joint purchase of GE Hitachi Nuclear Energy’s stake in Global Laser Enrichment (GLE).

Under the term sheet, the parties will purchase GE Hitachi’s (GEH’s) 76% interest in GLE, which would result in Silex acquiring a 51% interest in GLE and Cameco increasing its interest in GLE from 24% to 49%.

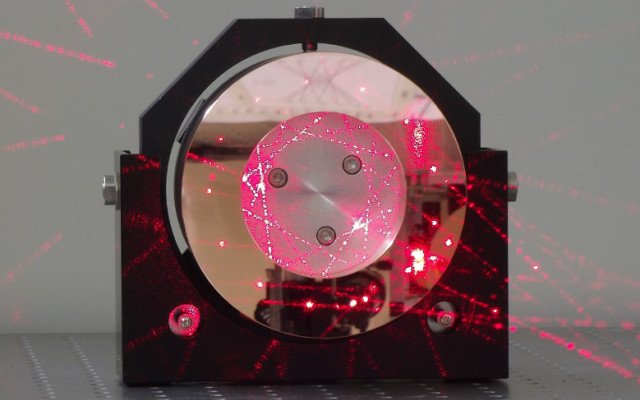

GLE is currently the licensee for SILEX, a laser-based uranium enrichment technology created by Silex Systems.

Silex chief executive officer Dr Michael Goldsworthy said the proposed transaction provided an ideal path for the continued commercialisation of its technology in the US.

“Should the binding purchase agreement be successfully completed, this will provide a viable path for the commercialisation of the SILEX technology through the Paducah project,” he said.

“The most pleasing aspect of this deal is the willingness of Cameco, one of the world’s largest uranium fuel providers, to step up to a 49% stake in GLE.”

The parties are hoping to execute the agreement by the end of April this year. The agreement remains subject to obtaining US Government approvals and on a 2016 sales agreement remaining in full force.

Agreement terms

Under the term sheet, funding for the continuation of GLE’s Wilmington Test Loop activities will be paid pro-rata by Silex and Cameco to the tune of US$300,000 per month.

The term sheet also provides for a deferred purchase price of US$20 million payable to GEH in four consecutive annual instalments of US$5 million.

Silex said itself and Cameco were working through several ancillary documents which will support a restructure of GLE under the proposed transaction, including a new shareholders’ agreement for the governance of GLE after the term sheet is finalised.

Technology commercialisation efforts

The term sheet aligns with Silex’s focus on commercialising SILEX.

The technology was licenced exclusively to GLE in 2006, a business venture comprising GE, Hitachi and Cameco, with the consortium seeking to deploy the technology in the US.

However, the future of the SILEX technology was placed in doubt last June when efforts to restructure GLE stalled after GE-Hitachi disclosed it was seeking to exit the venture.

This forced the consortium to place the commercialisation efforts at Paducah on hold.

Despite the hiccups, Silex said the Paducah commercial opportunity remained an ideal path to market for its SILEX laser enrichment technology.

Though, Silex noted that further work on market access issues, and a recovery in the uranium market price were required to reduce associated risks at Paducah.

Uranium prices have been in the doldrums since the Fukushima nuclear disaster in 2011, but grained traction during the last half of 2018 to end the year at US$28.50 a pound.

Elsewhere, Silex said it would continue its commercialisation efforts at GLE’s test loop facility in Wilmington, North Carolina, albeit at a reduced capacity.

This work is being undertaken in parallel with commercialisation efforts at Silex’s Lucas Heights facility in Sydney.

Shares in Silex soared 41.2% to $0.24 in late morning trade.