Technology firm Silex Systems (ASX: SLX) and Canadian uranium producer Cameco Corporation have signed a binding agreement to buy GE-Hitachi Nuclear Energy’s stake in uranium technology company Global Laser Enrichment (GLE).

Today’s news follows an announcement made back in February 2019 that a term sheet had been signed between the parties.

Under the binding deal, GE-Hitachi’s 76% stake will be divvied up with Silex acquiring a 51% interest in GLE and Cameco increasing its existing stake from 24% to 49%.

GLE is the exclusive licensee for Silex’s laser-based uranium enrichment technology and the transaction is expected to provide an ideal path to market for GLE.

“Successful closing of the agreement will enable GLE to continue the development program for the SILEX technology at the test loop facility in the US, and to potentially move towards commercialising the technology through the Paducah project,” Silex chief executive officer Michael Goldsworthy said.

He said the company is also encouraged by the willingness of Cameco, one of the world’s largest uranium and nuclear fuel suppliers, to step up to a 49% interest in GLE.

The purchase agreement is valued at a total of US$20 million, with the duo required to pay GE-Hitachi four annual payments of US$5 million, deferred until the first year after GLE generates US$50 million in revenues.

The deal also includes a three-year site lease for the test loop facility in Wilmington, North Carolina, with options to extend the lease term, as well as a transition services agreement providing for site support services from GE-Hitachi during the transition period.

In addition, the test loop activities will be jointly funded by Silex and Cameco (51:49) until closing or termination of the agreement. This funding is estimated to be around US$330,000 per month, with Silex’s monthly share equating to around US$170,000.

Silex will also be required to pay S$1.125 million to GE-Hitachi to reimburse costs held over from the previous term sheet signed between the parties.

Silex noted that the acquisition does not affect its licence agreement with GLE, under which Silex is entitled to a perpetual royalty of at least 7% on revenues generated by GLE from future use of its technology, including the Paducah tails re-enrichment project in Kentucky, US.

The purchase agreement remains subject to obtaining US Government approvals and other factors.

Silex also revealed it has agreed on several documents supporting the restructure of GLE, which includes an option for Cameco to purchase an additional 26% stake in GLE from Silex to increase its interest to 75%.

Silicon Quantum Computing project launch

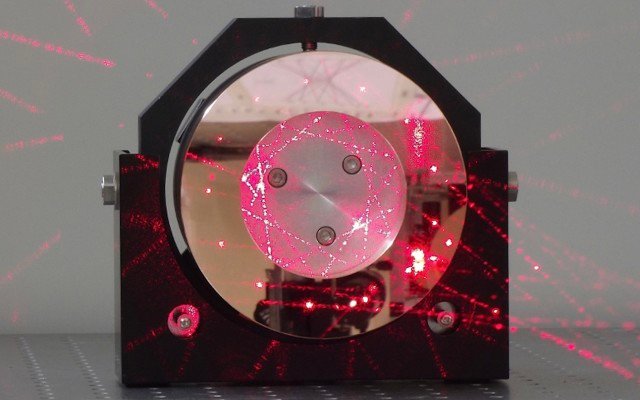

Meanwhile, Silex has launched a research and development project to develop a process for the commercial production of high-purity Zero-Spin Silicon (ZS-Si) using a variant of the company’s laser isotope separation technology.

ZS-Si is a unique form of isotopically enriched silicon required for the fabrication of next-generation processor chips to power silicon-based quantum computers.

This project launch is the result of a product offtake deal announced last week between Silex and Silicon Quantum Computing (SQC), under which the latter has agreed to make three annual payments of $300,000 as an offset against future purchases of ZS-Si produced by Silex.

In addition, SQC signed a subscription agreement to acquire $900,000 of fully paid ordinary shares in Silex through a private placement. This brings the total value of Silex’s deal with SQC to $1.8 million.

SQC is aiming to commercialise silicon-based quantum computing in conjunction with the University of New South Wales (UNSW), which is also expected to support the ZS-Si project by way of contributions.

Silex shares had climbed 17.65% to $0.40 on today’s news by afternoon trade.