Market wrap: share market searching for a new theory as interest rate cuts evaporate

WEEKLY MARKET REPORT

Investors are scrambling around looking for a new investment thesis after the long-awaited prospect of global official interest rate cuts continued to fade out of view.

A combination of stubbornly resurgent inflation in the United States, the potentially worsening war in the Middle East and the prospect of a US election campaign all contributed to uncertainty and here in Australia dragged the market lower.

All of which led to a 25.5 point or 0.3% fall on the ASX 200 on Friday to 7788.1 points, with the only consolation being that our market still managed to end the week up a skinny 0.3%.

Some of the fizz seems also to be coming out of the AI driven trade on the US market and some local factors also seemed to stop the local market from following Thursday’s US rise on the S&P 500.

Supermarkets heading down, down

Eight of the 11 sectors ended the Friday ASX session lower with the regulatory focus on our concentrated supermarket sector helping to drag down the share prices of the giants Coles (ASX: COL) and Woolworths (ASX WOW) down 1.1%, with the consumer staples sector the worst hit on the entire market, down 0.9%.

Things weren’t much better for the big miners with shares in BHP (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue (ASX: FMG) all lower.

Similarly, energy stocks went off the boil, with Woodside Energy (ASX: WDS) down a solid 1.3% to $30.20.

The fall came after major superannuation shareholder fund investor, HESTA, said it would vote to re-elect the oil and gas giant’s chairman Richard Goyder as environmental advocates agitate to remove him from the board.

Tech stocks end higher

It wasn’t all bad news on the local market though, with the technology sector up 0.5%, with WiseTech (ASX: WTC) one example, rising a handy 1.2%.

Defensive stocks had a good day too with the utilities sector rising 1.2%, with Origin Energy (ASX: ORG) up a solid 2.4%, having agreed to invest up to $300 million to acquire Yanco Delta from Virya Energy, one of the largest and most advanced wind and energy storage projects in New South Wales.

Seven finally snares Boral

In one of the more interesting market moves for the day, shares in Boral (ASX: BLD) rose 1.5% after the protracted takeover bid for Australia’s biggest concrete and cement group by Seven Group (ASX: SVW) was finally waved through by independent directors.

Investors were not as positive about former market darling and Pizza franchise owner Domino’s (ASX: DMP) with its shares down a hefty 7.5 % to $40.17 after it updated investors on a strategy to revive its struggling offshore operations.

Similarly, investors in the struggling casino operator Star (ASX: SGR) saw its shares fall 7.3% to 50.5c after high rollers continued to abandon its gaming rooms.

Small cap stock action

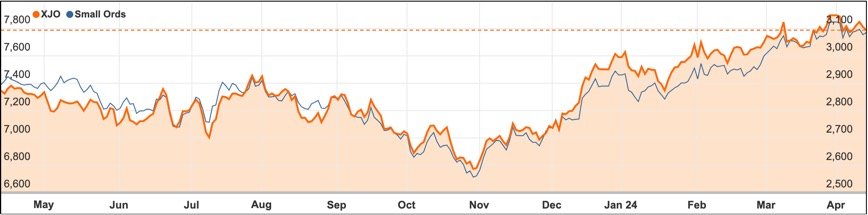

The Small Ords index rose 0.48% for the week to close at 3084.6 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Elevate Uranium (ASX: EL8)

Elevate Uranium’s Koppies project in Namibia has seen a 20% increase in its JORC-inferred mineral resource estimate (MRE), now at 57.8 million pounds, due to an aggressive expansion program.

This growth also boosts the company’s overall Namibian uranium resources by 10% to 103.8 million pounds and global resources to 152.2 million pounds.

The mineralisation at Koppies is notably shallow, with about 95% of the resource located within 18.5 meters of the surface, enabling potentially low-cost mining operations.

Elevate is integrating its U-pgrade beneficiation technology—developed initially for the Marenica project—to enhance the processing of Koppies’ similar mineralization.

The company is preparing for detailed metallurgical testing of bulk samples from Koppies, scheduled for shipment to Perth in the second quarter of 2024, to advance the project further.

Krakatoa Resources (ASX: KTA)

Krakatoa Resources reported promising assay results from reconnaissance work at the Turon copper-gold project in New South Wales, including high grades of gold and copper from 17 rock chip samples at the Mount Rosette gold and Jews Creek copper prospects.

The best results featured up to 1.24 grams per tonne gold and 10.45% copper, with significant levels of molybdenum and tin also present. In the sample area, historical alluvial gold workings and several unexamined intrusive-related targets were noted.

At the Jews Creek South target, historic hard-rock workings were found, and samples taken from the area showed high levels of gold, silver, copper, and various other metals, indicating the presence of an intrusive-related system.

Krakatoa’s chief executive officer, Mark Major, emphasised the strong and encouraging results, highlighting the project’s potential in light of increasing copper demand and rising gold prices.

Forrestania Resources (ASX: FRS)

Forrestania Resources reported high-grade gold samples from field work at the Ada Ann and Bonnie Vale North prospects within its Eastern Goldfields project in Western Australia, with samples reaching up to 49 grams per tonne.

The exploration included reviewing historic data and capturing new samples from unrecorded and historic drill spoils at both prospects, revealing high-grade intersections such as 49g/t, 15.7g/t and 13.5g/t gold.

Ada Ann, located near the 5.3 million ounce Mungari gold operation, has shown considerable exploration potential, particularly since no drilling has been conducted there in the last 15 years.

Bonnie Vale North, located in a geologically favorable area near the Kunanalling Shear Zone, displayed potential through a large drilling program conducted in the late 1990s with findings of consistent, though lower-grade, gold mineralisation.

Recent assaying by Forrestania of drilling by Outback Minerals near the same shear zone has also indicated that gold mineralization is open at depth, enhancing the prospect’s exploration appeal.

Cosmos Exploration (ASX: C1X)

Cosmos Exploration has reported high-grade rare earth element (REE) assay results from rock chip samples at its Byro East project in Western Australia, with top values of 2.20% total rare earth and yttrium oxide, surpassing previous highs.

These samples, part of a larger set of 363 rock chips, revealed substantial concentrations of neodymium and praseodymium, which are among the most critical REEs globally.

Recent explorations have identified a new mineralised trend, L5, alongside the previously known trends at Byro East, extending the potential mineralisation zone around the 3.5 km long Leatherback magnetic high.

The findings underscore the multi-element potential of the area, with correlations found between cerium, neodymium and monazite for light REEs, and yttrium and xenotime for heavy REEs.

Additionally, Cosmos is exploring the potential for nickel, copper, and platinum group elements (PGE) in the region, with promising initial results including an assay of 0.54% nickel near electromagnetic conductors indicative of metal sulphides.

Anatara Lifesciences (ASX: ANR)

Anatara Lifesciences is currently recruiting for Stage 2 of its Phase II clinical trial in Australia to evaluate the efficacy of its gastrointestinal reprogramming (GaRP) product for treating irritable bowel syndrome (IBS).

The double-blind trial, to be conducted across Melbourne, Sydney and Brisbane, involves up to 100 participants who will be randomised to receive either the GaRP product or a placebo, following a selection of the optimum dose from Stage 1.

The trial, which includes a wash-out period and eight weeks of treatment with periodic reporting, aims to build on the positive results from Stage 1, which showed a reduction in IBS symptoms in over 50% of the 61 participants.

GaRP is designed as a complementary medicine to aid in gastrointestinal tract lining restoration and gut microbiome balance, addressing chronic conditions like IBS and inflammatory bowel disease.

Anatara is also exploring further applications of its technology in human healthcare and animal health, while discussing partnerships to advance GaRP’s market presence given the unmet needs in IBS treatment.

Prospect Resources (ASX: PSC)

Prospect Resources has expanded its battery minerals portfolio by acquiring an 85% interest in the Mumbezhi copper project in north-western Zambia for about $9.82 million in cash and shares.

The project, explored by Orpheus Uranium over the past decade, has demonstrated promising results through 50 reverse circulation and diamond drill holes, suggesting the potential for low-cost open pit mining of copper and cobalt.

Prospect’s acquisition includes commitments to pay an additional $3.78 million upon defining a mineral resource exceeding 500,000 tonnes of copper, alongside inheriting all historic geological data as Orpheus withdraws any legal claims.

The Mumbezhi project lies within the Central African Copper Belt, the world’s largest sediment-hosted copper province, surrounded by major copper mines including Barrick Gold’s Lumwana and First Quantum Minerals’ Sentinel and Kansanshi.

The acquisition not only extends Prospect’s reach into Africa’s critical minerals sector but also positions Mumbezhi as a potentially flagship project in their portfolio.

The week ahead

There is not much to look forward to on the statistical front In Australia this week, with the March jobs figures the main highlight.

It will be difficult for these figures to improve on February’s numbers which saw an incredible jump in jobs of 116,500 as the unemployment rate fell from 4.1% to 3.7%.

With the participation rate rising to a stellar 66.7% it is hard to imagine that the March figures could improve on that performance although given the contrary “bad news is good news” state of markets some moderation would probably be welcomed.

Either way, we are still likely to see an unemployment rate below 4% in average terms over the past couple of months which is a stellar achievement.

Looking overseas New Zealand inflation numbers for the March quarter are worth keeping an eye on, along with a slew of Chinese data including March quarter economic growth and March numbers for retail sales, production, investment, unemployment and home prices, plus an interest rate decision by the People’s Bank of China on Monday.

There are a mix of things to watch for in the US including the beige book, retail sales and housing numbers but a slew of earnings reports will also be released.

Companies reporting their results will include Charles Schwab, Bank of America, Johnson & Johnson, Morgan Stanley, United Airlines, Netflix, American Express and Procter & Gamble.

Markets thrive on profit information so this profit season could be vital in either adding or subtracting to market momentum.