Sayona Mining expands lithium footprint in Canada

Lithium exploration in Canada continues to pick up steam and interest in the new-age mineral continues to grow, with Sayona Mining (ASX: SYA) announcing today that it has formally committed to expanding its lithium asset portfolio in Canada.

Sayona has initiated a progressive acquisition of the Tansim lithium exploration project, a land area spanning 12,000 hectares and including several highly prospective tenements.

The asset is being acquired through an acquisition agreement with Matamec Explorations, including staged payments of cash, exploration commitments and a net smelter royalty payable to Matamec should Sayona achieve 100% ownership.

Tansim is considered as a high-grade prospect situated 82 kilometres south-west of Sayona’s existing (and flagship) Authier Lithium Project.

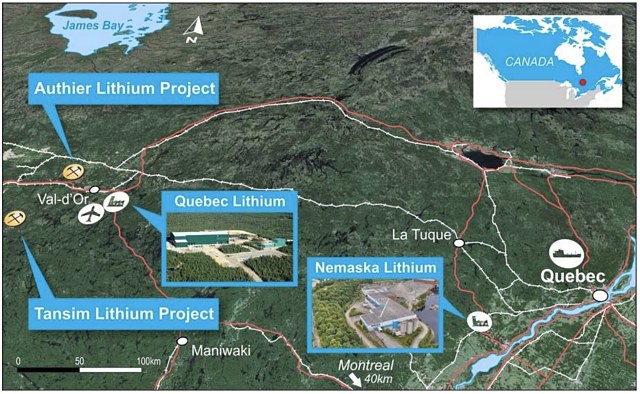

Location map of the Tansim lithium project.

Sayona remains focused on the Authier Lithium project as its flagship project, although Tansim is expected to provide several economic diversifiers and could potentially improve Sayona’s chances of establishing successful lithium mining operations in Canada. Authier has the potential for a simple, open-cut mining operation with competitive mining costs of $2.90/tonne average LOM, with a mine life of 15 years. All in all, Authier is an advanced, near term development project with construction forecast to commence in the second half of 2018 and first production in late 2019.

Meanwhile, the new acquisition comprises 65 mineral claims of 12,000 hectares, and is prospective for lithium, tantalum, and beryllium. Historical exploration on the property has included mapping, sampling, geophysics and preparation of a Canadian NI43-101, a formal estimate of the project’s economic viability in similar contrast to JORC guidelines used by miners in other parts of the world.

The staged nature of the acquisition enables Sayona to obtain an initial 50% interest in the property through the expenditure of CAD$105,000 for claim renewal costs of the property. Furthermore, Sayona intends to spend at least $200,000-$350,000 as part of exploration and development of Tansim.

“The Company [Sayona] is excited to have another exciting lithium project in close proximity to the Authier project. The Company will draw on its significant experience and expertise in lithium geology in the region, developed through more than 20,000 metres of drilling and exploration at Authier. Tansim demonstrates stand-alone potential but could be developed as a complimentary satellite operation to Authier, where the Company is currently completing a Definitive Feasibility Study,” said Corey Nolan, Chief Executive Officer at Sayona.

Future exploration activities will include reinterpretation of historic geophysical data, mapping and sampling of the pegmatites to define drilling targets. The short-term focus exploration activities will include reinterpretation of historic exploration and geophysical data until the end of winter in April.

Sayona is also engaged in mapping and sampling as part of field activities to define additional drilling targets.

At the current time, Sayona is focusing on two targets as its most prospective: Viau Dallaire and Viau.

Viau Dallaire

Viau Dallair is a 300 metre long dyke, dipping 40 degrees north, and 12-20 metres in thickness. Three channel samples include:

- 3 metres @ 1.40% Li20,

- 15 metres @ 0.84% Li20; and

- 95 metres @ 0.94% Li20 (including 7.3 metres at 1.77% Li20).

A small reconnaissance survey was performed in 2016 by Matamec at Viau-Dallaire showing confirming the presence of coarse-grained granitic pegmatite dykes containing 10-30% spodumene.

Viau

Pegmatites at Viau have been mapped up to 200 metres long and 30 metres wide. Selective samples have returned high grades of up to 2.77% Li20 and 1.37% Li20 over 3.2 metres, respectively.