The Santa Claus share market rally has continued to gather pace over the past week, with rising share prices for miners continuing to push the ASX 200 index higher, up 0.9% or 64.8 points to 7442.7 points on Friday alone.

That meant the local market has risen an impressive 3.4% for the week as the falling US dollar continued to feed into higher prices for commodities including many supplied by Australia such copper, gold, iron ore and natural gas.

Of course, the big news for the week was the US version of Santa – the US Federal Reserve – forecasting that official interest rates had peaked and that the world’s biggest economy was set for several interest rate cuts next year.

That led to an immediate rally in share prices globally and a weakening in the US dollar, which saw the Australian dollar close out the week a couple of cents higher at US67.1c.

Rising commodity prices power miners higher

The resulting rise in commodity prices in US dollar terms translated into a 1.9% jump in the materials sector on Friday alone, with the big highlight being the 1.4% rise in Fortescue Metals (ASX: FMG) share price to a record close of $27.85.

Unsurprisingly the other big iron ore producers Rio Tinto (ASX: RIO) and BHP (ASX: BHP) saw their shares up by more than 2%, helped along by rising copper prices.

Gold mining shares were also given a big boost as the price of the yellow metal surged to US$2,051 an ounce.

Dow hits a record high

The positive Australian share market action came on top of a fresh record high on the Dow Jones Index on Wall Street, which rose 0.4% to 37,248 points.

The S&P500 and the NASDAQ also rose, up by 0.3% and 0.2% respectively as investors anticipated a rosier outlook for shares over the next couple of years as interest rates begin to subside.

One company that has been in the news this week headed in the opposite direction with shares in Chemist Warehouse merger target Sigma (ASX: SIG) down 6.7% to 97.5¢, with plenty of speculation about whether the ACCC will approve the deal due to competition concerns.

That speculation was not helped after the regulator knocked back a proposed merger between pathology group Healius (ASX: HLS) and Australian Clinical Labs (ASX: ACL).

Potential interest rate falls were even reflected in the technology sector with shares in Afterpay owner Block (ASX: SQ2) up almost 4% to $110.80.

Shares in fellow buy-now pay-later firm Zip (ASX: ZIP) jumped an impressive 17.8% to 63c after the announcement of a US market BNPL rollout from 2024 in partnership with Google Pay.

Small cap stock action

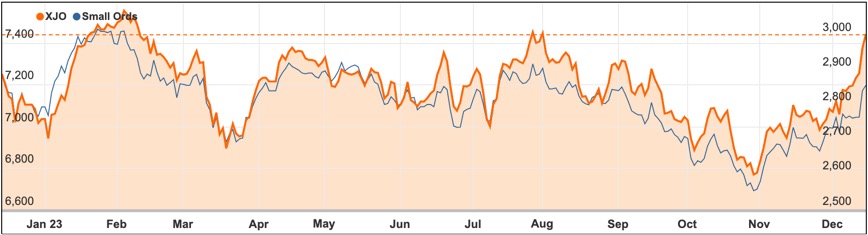

The Small Ords index rallied 3.17% this week to close on 2859.7 points.

Small cap companies making headlines this week were:

Volpara Health (ASX: VHT)

South Korean medtech company Lunit is set to acquire all shares of Volpara Health Technologies for $300 million, marking a significant expansion in the global medical AI field.

This acquisition combines Lunit’s FDA-approved INSIGHT suite, widely used in over 3,000 hospitals in 40 countries, with Volpara’s expertise in breast cancer detection software.

The unanimous support from Volpara’s board and major shareholders sets the stage for a shareholder meeting in early Q2 2024 to finalise the takeover.

This strategic merger is expected to provide substantial value to shareholders and accelerate the application of AI in cancer diagnosis and treatment.

Together, Lunit and Volpara aim to create advanced AI solutions for radiology and healthcare, significantly advancing the fight against cancer.

Nova Minerals (ASX: NVA)

Nova Minerals reported “exceptional” high-grade gold findings at its RPM North deposit in Alaska, with drilling results expanding the known mineralisation south, east and deeper.

Chief executive officer Christopher Gerteisen highlights the consistency and potential growth of the Estelle ore, with new drilling indicating substantial resource expansion, including up-dip surface mineralisation and deeper bonanza zones.

The results, set to enhance an upcoming 2024 pre-feasibility study, confirm continuous high-grade mineralisation and suggest significant resource extensions.

Nova’s strategic review at Estelle aims to reduce capital expenditure and accelerate commercial production.

The company plans further drilling, especially to the south and east of RPM North, where the deposit remains largely unexplored and shows promise for additional underground resource potential.

Barton Gold (ASX: BGD)

Barton Gold’s exploration at South Australia’s Tunkillia gold project has yielded a 20% increase in its mineral resource estimate (MRE) to 1.38 million ounces, thanks to a successful 15,200m drilling campaign.

The campaign uncovered new mineralisation at the 223 Deposit and 223 North satellite zone, raising the total Tunkillia resources to 1.38Moz of gold across 46.3 million tonnes at 0.93g/t, with 58% in the ‘indicated’ category.

The drilling extended the known strike at both ends of the 223 deposit, adding new zones and maintaining the high indicated classification.

Since acquiring Tunkillia in 2019, Barton has identified multiple depth extensions and new gold zones, with three MRE updates, adding a total of 413,000oz of gold at an average cost of ~$14/oz.

The latest MRE update includes around 800m of mineralisation near the 223 Deposit and 780m in the 223 North zone, with an estimated all-in cost of only ~$16/oz.

Titomic (ASX: TTT)

Titomic has formed a strategic partnership with Stärke Advanced Manufacturing in Adelaide, specialising in producing high-performance components for various sectors.

The collaboration aims to combine Titomic’s advanced manufacturing technology with Stärke’s industry expertise, targeting sectors like defense, aerospace, and automotive.

Titomic’s managing director, Herbert Koeck, highlighted the partnership’s potential to accelerate growth, foster knowledge exchange, and stay at the forefront of manufacturing innovation.

This week’s announcement follows Titomic’s recent expansion into the mining industry and the US market, marked by the sale of two D523 low-pressure cold spray systems in Western Australia and Texas.

The D523 systems, valued at $198,829, are noted for their unique no-heat repair capability and efficiency, particularly beneficial in the mining sector where equipment durability is crucial.

FireFly Metals (ASX: FFM)

FireFly Metals has discovered significant copper, gold, silver and zinc deposits at its Green Bay project in Newfoundland, Canada, following expanded analysis of historic drill results.

Formerly known as Auteco Minerals, which acquired Green Bay in October, found high-grade mineralisation outside the existing resource, indicating potential for rapid resource growth.

The ongoing 40,000m underground drilling program aims to extend known mineralisation and is supported by a newly constructed exploration drive for efficient and accurate exploration.

FireFly’s experienced management team, noted for their success with Bellevue Gold (ASX: BGL), is also leading a 750m exploration drill drive at Green Bay.

Additionally, FireFly holds interests in the high-grade Pickle Crow gold project in Ontario and the Limestone Well vanadium-titanium project in Western Australia.

The week ahead

This week in Australia the Reserve Bank minutes explaining the “hold” decision on December 5 will be out and the tone is likely to be more cautious than the US Fed, which seems to be fairly confident it has licked the inflation issue.

The RBA Board is likely to be more circumspect given the stubborn nature of Australian inflation so far and its reluctance to hike as far and as fast as some other central banks.

However, signs of a more hawkish RBA would do nothing to stop the Australian dollar charging even higher, particularly if commodity prices keep rising and the US dollar keeps weakening.

Also released during the week are the September quarter finance and wealth figures which are likely to show household wealth remaining close to record highs.

Overseas there are some US figures out on housing starts and home sales with the main event being economic growth numbers for September.

If the past week is any guide though, the animal spirits of investors are likely to remain the dominant factor in the run up to the Christmas / New Year break and it would not be a surprise to see the Santa rally continue right up until the presents arrive under the tree.