Sandfire hands A$1.2M to Auris Minerals to earn a stake in WA copper assets

Copper major Sandfire Resources (ASX: SFR) has forked out A$1.2 million to Auris Minerals (ASX: AUR), giving it the opportunity to earn up to a 70% stake in Morck’s Well East and Doolgunna copper projects in Western Australia.

Sandfire will also spend at least A$2 million on exploring the projects over two years.

Auris jointly owns Morck’s Well East with Fe Limited (ASX: FEL), with Auris possessing 80% and Fe the other 20%.

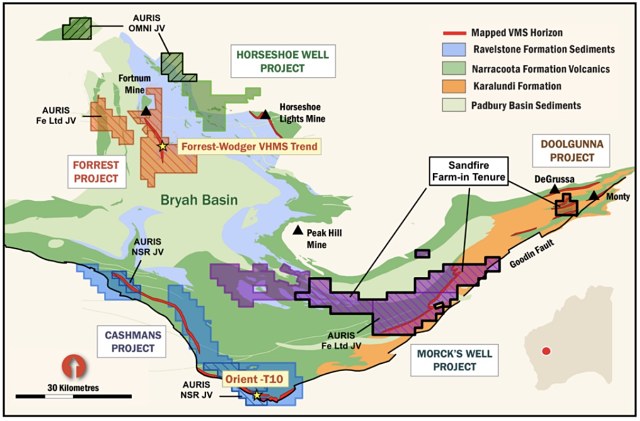

Meanwhile, Auris wholly-owns Doolgunna, with both projects believed prospective for copper and on part of the Bryah Basin which hosts Sandfire’s DeGrussa and Monty high-grade copper deposits.

Auris Minerals’ projects with the Sandfire farm-in agreement tenements highlighted with black outline.

“Sandfire have proved themselves to be very successful explorers with both the DeGrussa and Monty discoveries and Auris is pleased to have the expertise of the Sandfire team explore this part of our ground while we continue to explore our substantive holdings in other parts of the basin,” Auris chief executive officer Wade Evans claimed.

The agreement between Auris and Sandfire allows Sandfire to earn a 70% interest in the projects once its has discovered a deposit on the assets containing more than 50,000 tonnes of copper and progressed the discovery to completion of a feasibility study.

In addition to its payment to Auris, Sandfire will hand over A$300,000 to Fe, with both transactions to be made in either cash or Sandfire shares.

If Sandfire completes a feasibility study on Morck’s Well East, the project’s ownership will comprise Sandfire 70%, Auris, 24% and FE 6%.

However, ownership of the Doolgunna project will be split 70:30 to Spitfire and Auris, respectively.

Auris’ other projects are believed prospective for copper and gold include Forrest, Cashmans, Horseshoe Well and Chunderloo. Auris has also identified vanadium, titanium and iron mineralisation at its Citra prospect, with aircore drilling during the December quarter returning an 80m intercept grading 0.23% vanadium from near-surface.

Shares in Auris rocketed more than 50% in trade to sit at A$0.051 by mid-afternoon.