Ghana gold explorer Cardinal Resources (ASX: CDV) is now the target of a takeover battle between powerful Russian and Chinese bidders.

London-headquartered — but Russian-controlled — Nord Gold (Nordgold), which has gold interests in Russia, Canada and French Guiana, is offering $0.66 per share in cash to Cardinal shareholders. This offer is 10% higher than the existing $0.60 per share bid from Chinese major Shandong Gold Mining.

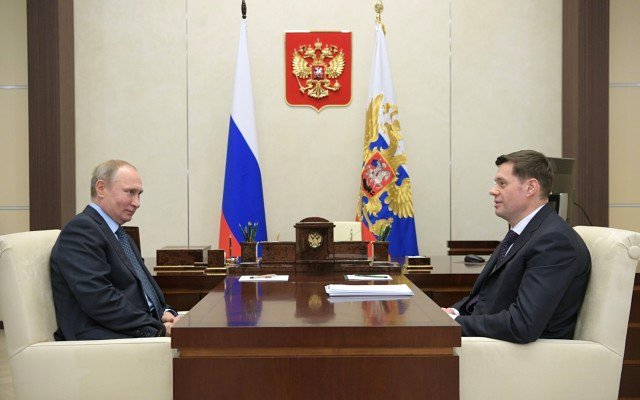

Nordgold is controlled by Alexey Mordashov, and his two sons Kirill and Nikita. They own 99.94% of the company.

Nordgold has shown previous interest in Cardinal: in March it acquired 99.44 million shares and now holds 18.71% of the company. Nordgold had made an initial takeover proposal for Cardinal but nothing further eventuated — until now.

The new offer is unconditional — but only for 170 million Cardinal shares, to give Nordgold a 51% controlling stake.

Shandong’s offer is conditional on receiving regulatory approval here and in China.

Nordgold already has Australian foreign investment approval

Nordgold revealed in its bidder’s statement today that it applied for Foreign Investment Review Board approval in April and this was granted on 9 July.

Mr Mordashov is reported to be Russia’s fourth richest man. The son of two steelworkers, he now owns the steel and coal giant Severstal and has various other substantial interests including a substantial holding in TUI, the British travel and airline group.

In June, Cardinal’s board endorsed the all-cash Shandong offer, but today issued a “take no action” advice to shareholders in relation to the Nordgold bid.

Cardinal is the owner of two gold exploration assets in Ghana, Bolgatanga and Subranum, together comprising about 734sq km of granted tenements.

These projects have a mineral reserve of 138.6 million tonnes at 1.13 grams per tonne gold, for a contained 5.1 million ounces. A feasibility study has put development costs at $US390 million (A$558 million).

The projected mine life is 15 years averaging 287,000oz per annum production.

Nordgold assets

Nordgold was created to house spun-off gold projects owned by Severstal.

The company operates 10 mines across four countries (Russia, Kazakhstan, Burkina Faso and Guinea) but the Cardinal portfolio would join its large development list.

The main projects — all at exploration stage — are Uryckh near Irkutsk, Siberia, with a published resource of 1.76Moz of gold; Montagne d’Or in French Guiana, where Nordgold spent US$30 million (A$43 million) to earn a 55% stake and which has proven and probable resources of 2.75Moz; and Pistol Bay in Canada’s Nunavat Territory near the coast of Hudson Bay, where there is a published resource of 1.58Moz.

Soon after the market opened today, Cardinal shares hit an early high of $0.695.