Weekly review: rising bond yields keep Australian market in sell mode

WEEKLY MARKET REPORT

The ongoing tug of war between bond investors and central banks is showing no signs of abating, with growing concerns the central banks could be on the losing side and be forced to raise interest rates earlier than expected.

That view was reflected in three straight days of falls on the ASX 200, which lost 0.9% for the week and 0.6% on Friday alone to close at 6708.2 points.

Iron ore, oil and Wall Street all sources of weakness

Some of the themes that have been winners earlier in the year have now sold off, with the big iron ore miners continuing to lose ground while oil prices fell a sharp 7.1% due to the chance of further COVID-19 lockdowns in Europe, sending down the prices of energy stocks.

Wall Street was also a drag on the local market, with dovish comments from the US Federal Reserve not enough to calm bond markets, with long end bonds spiking due to inflation fears, causing plenty of collateral damage – particularly for technology companies.

Ten-year US Treasury bonds reached a yield of 1.75%, reflecting the inflationary fears and in another concerning sign the Bank of Japan dropped its annual target for stock purchases, which was surprising given its insatiable appetite for bonds for many years.

Falls come despite promising employment numbers

The local sell-off came despite some really promising data releases – particularly the better than expected 89,000 increase in Australia’s February employment which sent the jobless rate down from 6.3% to just 5.8%.

There is still a long way to go on employment to get some wages growth through the system but this is a promising start, not that you would know it from the share market.

BHP (ASX: BHP) took the honours as the worst of the iron ore players, with its oil division only adding to the pain, producing a 1.7% loss for the week to $44.90.

Rio Tinto (ASX: RIO) was also down 1.5% for the week, closing $109.06 while the third force in iron ore – Fortescue (ASX: FMG) – also fell 1.4% to $20.01.

Even the once reliable banks were disappointing amid the inflation fears, with Commonwealth Bank (ASX: CBA) down 2.1% for the week and NAB (ASX: NAB) 0.7% lower.

ANZ (ASX: ANZ) was flat for the week but the recovering Westpac (ASX: WBC) broke the trend, rising 0.3%.

If there was a bright spot it was healthcare stocks, which increased 1.3% for the week despite falls on Friday.

That indicates some rotation into more defensive areas of the market as everything else wilts.

Small cap stock action

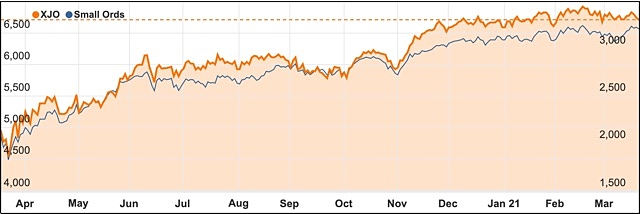

The Small Ords index rose 0.8% for the week to close on 3206.5 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Creso Pharma (ASX: CPH)

Creso Pharma kicked-off the week with news it was acquiring Canada-based Halucenex Life Sciences, which is an established psychedelic-assisted psychotherapy company.

Halucenex is focused on developing therapeutics for treatment-resistant depression in those suffering from post-traumatic stress disorder and other illnesses.

Creso followed the acquisition news with an announcement Halucenex was gearing up for a phase two clinical trial that tests the efficacy of psilocybin (the active ingredient in magic mushrooms) in veterans and first responders suffering from PTSD.

As part of this, Halucenex has appointed True North to act as lead investigator in the trial which is scheduled to start in June.

Creso finished the week with news its Canadian subsidiary Mernova is continuing its strong sales growth underpinned by three new purchase orders including one for its pre-rolled cannabis joints that are sold under the Ritual Sticks brand.

De.mem (ASX: DEM)

Another small cap to announce a strategic acquisition this week was water treatment company De.mem which is scooping up Perth-based chemicals company Capic – enabling De.mem to expand into WA.

All-up, the acquisition values Capic at $5.1 million, with De.mem to pay $3.4 million in cash and $1 million shares.

Additional future milestone payments up to $750,000 are also part of the deal, with these to be split into three lots of $250,000 and are payable 50% in cash and 50% shares.

Capic already services 50 of WA’s blue chip resources customers including BHP, Northern Star Resources and Pilbara Minerals.

Sparc Technologies (ASX: SPN)

Sparc Technologies’ graphene-based additives have been found to have “outstanding” anti-microbial properties when incorporated in an epoxy coating.

Flinders University researchers carried out test work on various graphene additives with one of the additives evaluated found to cause complete destruction of E-Coli bacteria when included in a coating.

Sparc managing director and chief executive officer Mike Bartels said the anti-microbial results were “outstanding” and encouraged the company in its plans to develop a graphene additive product for a multitude of anti-microbial coatings applications which have multi-billion-dollar markets.

Navarre Minerals (ASX: NML)

Aircore drilling at Navarre Minerals’ Glenlyle project in western Victoria has generated “outstanding” gold and silver results.

The company’s latest assays come from expansion aircore drilling at the project’s Morning Bill prospect and returned notable results of 38m at 7.8g/t silver from 73m, including 1m at 41.5g/t silver; 65m at 0.3g/t gold from 16m, including 1m at 3.1g/t gold; and 16m at 2.7g/t silver from 29m, including 1m at 18.3g/t silver and 1m at 18.0g/t silver.

Navarre managing director Ian Holland said although it was still early days in exploring the Morning Bill mineral system, the company theorises the prospect could emerge as one of its best mineral discoveries in Victoria.

Investigator Resources (ASX: IVR)

Explorer Investigator Resources’ Paris project has continued to generate very high-grade silver results.

The company received the latest results from a 20,500m drilling program completed at the end of last year, with one hole comprising a 15.7m intersection grading 1,084g/t silver, within a wider intercept of 26m at 674g/t silver.

Other notable results were 31m at 336g/t silver from 44m, including 22m at 453g/t from 51m; 20m at 134g/t from 107m, including 12m at 177g/t; 2m at 191g/t from 82m; and 10m at 144g/t from 104m, including 6m at 211g/t silver.

Investigator managing director Andrew McIlwain said the flow of positive drill results continued to support the company’s confidence in the project.

Blue Energy (ASX: BLU)

Queensland and Northern Territory gas player Blue Energy has signed a non-binding heads of agreement with Origin Energy (ASX: ORG) to supply 300 petajoules (PJ) of gas over 10 years, the second such deal that represents foundation gas volume for a proposed new pipeline from the North Bowen Basin.

In December the company signed a similar deal with Energy Australia covering 100 PJ over a 10-year supply period.

Blue Energy has been at the forefront of the push to build the new pipeline to supply the east coast market.

This plan would see the North Bowen Basin connected to the major Queensland gas hub at Wallumbilla.

The Queensland state government is backing a preliminary study and the federal government calling for development of the basin.

Crowd Media (ASX: CM8)

Crowd Media has achieved a commercial milestone after revealing it had executed an agreement giving investee Forever Holdings a licence to use its AI conversational platform.

The deal is the first time Crowd has granted another company commercial access to its platform with the licence paving the way for Forever to use the technology for 12-months under a SaaS contract worth $215,000 over the period.

Forever can use the platform for an additional five months for an extra $90,000.

Crowd chairman Steven Schapera said the licencing agreement with Forever represented a “significant milestone” for the company as it advances its commercialisation plans.

Matador Mining (ASX: MZZ)

Canada-focused explorer Matador Mining has continued to unearth gold during drilling at its Cape Ray gold project in Newfoundland.

At the Window Glass Hill target, drilling has expanded the known mineralised area and returned recent results of 8m at 5.5g/t gold from 43m; 1m at 14.7g/t gold from 19m; and 21m at 1g/t gold from 92m.

Matador executive chairman Ian Murray said the assays at Window Glass Hill “continue to impress” and highlight the potential for increasing resources.

Mr Murray said the company was finalising its upcoming exploration plans and will provide an update on these early in the June quarter.

The week ahead

There is nothing about the coming economic releases over the next week that stands out as a potential circuit breaker so the chances of a market turnaround probably lie more with a change of sentiment.

There is still plenty to watch out for with credit and debit card spending, consumer sentiment and some trade numbers that are likely to be strong worth the wait.

One that could appeal to a wider audience is the December quarter National Accounts, which tracks household wealth, which has been tracking stronger despite the pandemic headwinds.

In the September quarter, total household wealth (net worth) rose by 1.7% to a record high of $11,351.1 billion, up 3.5% on a year ago, so any improvements on that will be welcome news.

A quick division by the Australian population will allow you to see which end of the curve you occupy.

Overseas the main action will continue to feature the delicate and troubled relationship between the US and China, with China’s decision on its loan prime rate which currently sits at 3.85% for a year due on Monday.

On the US side, there is a rash of housing figures which should paint a comprehensive picture of the housing market is in the US while the December quarter GDP numbers and jobless claims will be of interest.

With all of the focus on inflation, personal finance data will be watched carefully because it contains an inflation estimate.