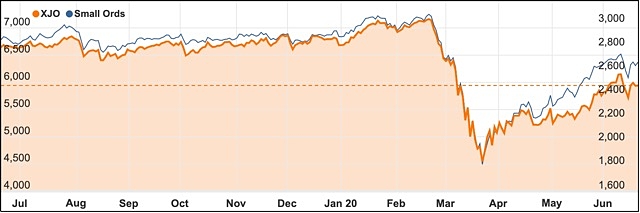

Once again, the Australian share market weakened a little to end the week but still managed to add 6.1 points, or 0.1% to close the week just shy of the 6000-point mark.

Earlier the market had risen rose above 6000 points after very impressive May retail trade figures showed that shoppers had flocked back to stores as COVID-19 restrictions began to lift with an astonishing record 16.3% jump in retail sales.

The good news wore off gradually as the day wore on with the big banks and miners gradually pulling down the ASX 200, leaving the overall market up 1.6% for the week – the seventh weekly rise of the last eight week.

Share trading activity rising

Trading volume was up substantially, with the 1.95 billion shares traded on Friday being almost double the ten-day average.

The reopening of major Brazilian iron ore operations weighed on iron ore prices and Australia’s big miners.

Miners and banks disappoint

Rio Tinto (ASX: RIO) fell 1.4% to $96.28, BHP (ASX: BHP) lost 1.9% to $35.01 and Fortescue Metals (ASX: FMG) was down 1.5% to $13.79.

It was a similar story for the big banking stocks which showed some strength on the morning retail figures but lost that 1.3% bump as the day wore on.

ANZ (ASX: ANZ) was the worst of the big four banks, down 1.73% to $18.75.

NAB (ASX: NAB) was down 0.6% to $18.67 and Commonwealth Bank (ASX: CBA) lost 0.5% to $68.68 but Westpac (ASX: WBC) was able to swim against the tide and closed up 0.4% at $18.17.

Tech shares and retailers have a good day out

Tech shares had a good day with Altium (ASX: ALU) up 6.6% and Wisetech Global (ASX: WTC) jumping 7.8% with buy now pay later stock Afterpay (ASX: APT) adding 1.5% to hit $58.96.

As you might expect with the rebound in retail sales, retail stocks were broadly higher, led by Wesfarmers (ASX: WES) which gained 1.4% to $43.14 and gaming giant Aristocrat Leisure (ASX: ALL) which rose 1.5% to $26.88.

Retailers like Adairs (ASX: ADH) and Nick Scali (ASX: NCK) rallied on a combination of the better retail environment and positive sales updates over the second half.

Adairs reported modest growth in store sales but online sales soared an amazing 92% compared to the previous year as locked down consumers hit their keyboards to improve their surroundings.

Adairs sales for the financial year to date are up 15% while it also reinstated a sales forecast of $385-390million for the financial year – pushing shares up 10.5%.

It was a similar picture for Nick Scali which reported weaker sales during the peak lockdown months of March and April, with orders rising strongly during May and June, which is expected to lead to a solid rise in profit for the first quarter of FY21.

News that Nick Scali would bring forward its deferred 25c a share interim dividend to June 29 from

October 2 helped to boost its stocks by 19%.

The sector was also helped by a 9.9% rise from car retailer AP Eagers (ASX: APE), which rose 9.9% and Dominos Pizza (ASX: DMP) which added 6.25%.

Health stocks were up overall, helped by a good performance from blood group CSL (ASX: CSL) which rose 0.8% to $288.25 and ResMed (ASX: RMD) up 0.9% to $25.28.

Small cap stock action

The Small Ords index rose 2.8% this week to close on 2682.2 points.

Small cap companies making headlines this week were:

Respiri (ASX: RSH)

Wheezo developer Respiri has secured a two year agreement with the Pharmacy Guild of Australia to create a pharmacist course on optimising asthma patient care including using its wheezo device and app in detecting wheeze.

The agreement is with the guild’s Learning and Development (GuildED) division, which is the learning destination for all pharmacists, pharmacy assistants and interns across Australia.

Respiri and GuildED plan to collaborate on creating an accredited Continuing Professional Development online training course for pharmacists on optimising asthma patient management.

The course will focus on asthmatic children and will also cover the role of using devices to detect wheeze, which will include Respiri’s eHealth software as a service device and app.

Respiri chief executive officer Marjan Mikel said he expects commercial sales of wheezo will grow in the pharmacy space.

Meteoric Resources (ASX: MEI)

Gold explorer Meteoric Resources has snapped up an “incredibly significant” project in Western Australia.

The company is acquiring the Palm Springs gold project and historic Butchers Creek mine in the state’s Kimberley and only 30km from Halls Creek.

Speaking on the Small Caps podcast, Meteoric managing director Andrew Tunks described the asset as a “great opportunity” for the company and said that he was “very bullish” on the project’s prospects.

In consideration for the asset, Meteoric will issue the vendors $1 million in cash and shares.

Palm Springs has undergone little modern exploration since 1997 and has been kept in private hands.

The Butchers Creek open pit mine previously produced 52,000oz gold at 2.1g/t.

All-up, Palm Spring encompasses 12,500ha and hosts more than 60 known gold occurrences outside of Butchers Creek.

Wisr (ASX: WZR)

Consumer lending company Wisr has boosted its loan originations by 48% over four weeks.

The company has attributed the growth to “exceptionally low exposure” to high-risk COVID-19 sectors.

During the first two months of the June quarter, Wisr achieved $23.1 million in new loans, delivering $9.3 million in April and $13.8 million in May. This represented month-on-month growth of 48%.

Wisr noted the loan origination numbers in May were similar to pre-COVID-19 levels. This was despite the company maintaining its March tighter credit policy in response to the pandemic.

In May, settled loan volumes exceeded $4 million for the first time.

Rox Resources (ASX: RXL) and Venus Metals Corporation (ASX: VMC)

WA-focused Rox Resources reported a hit this week of 25m at 34.79g/t gold at the Grace prospect within its Youanmi project.

Within that intercept was a high-grade interval of 6m at 140.7g/t gold.

The company noted this was the deepest intercept to-date and extended mineralisation along strike and down dip.

This week’s assays are from a 3,000m drilling program that is testing depth and strike extensions at Grace.

Rox managing director Alex Passmore described the results as “very impressive”.

The company’s positive drill results follow it acquiring a further 20% stake in the project, bringing its ownership up to 70%, with Venus Metals Corporation holding the remaining 30%.

Kairos Minerals (ASX: KAI)

Kairos Minerals has almost doubled the size of its Croydon gold project after applying for two new exploration licences – lifting its landholding from 389.8sq km to 773.6sq km.

The new ground is immediately south-east of the existing holding and includes the south-eastern edge of the Sisters Supersuit intrusions.

Part of the rationale for increasing its landholding in the area is the ongoing exploration success of De Grey Mining’s nearby Hemi gold discovery.

“Evidence from the recent Hemi gold discovery suggests that the margins of these large intrusive features where they intrude granites [are] now highly prospective for new gold discoveries,” Kairos executive chairman Terry Topping said.

The company plans to review results from aeromagnetic surveys across the project and will create access to drilling the Mt York and Fuego prospects.

Stavely Minerals (ASX: SVY)

Victoria-focused explorer Stavely Minerals revealed this week it had intersected a “monster” copper-gold hit at the Cayley Lode within its Thursday’s Gossan prospect.

Diamond drilling at the load unearthed 87m at 1.74% copper, 0.57g/t gold and 20g/t silver from 140m.

The broad intercept contained multiple higher-grade intervals of 24m at 4.19% copper, 1.27g/t gold and 53g/t silver; 0.8m at 24.1% copper, 1.16g/t gold and 249g/t silver; and 1m at 1.30% copper, 10.05g/t gold and 48g/t silver.

Another diamond drill hole confirmed the Cayley Lode extends at least 1.5km along strike. This drill hole produced assays of 23m at 1.07% copper and 0.11g/t gold from 339m, including 1m at 9.44% copper, 0.22g/t gold and 6.4g/t silver.

Mineralisation along the 1.5km remains open in both directions and down dip.

“It is fair to say that we continue to be amazed by the scale of this mineral system and we may have to contemplate an acceleration of our drilling program to define the full extent of the Cayley Lode and other mineralised structures including the Copper Lode Splay and the north-south structure,” Stavely executive chairman Chris Cairns noted.

Resource drilling at the Cayley Lode is now more than 50% complete.

BPH Energy (ASX: BPH)

BPH Energy emerged from a self-imposed trading halt with news its 23%-owned investee Advent Energy was anticipating a final decision and approvals regarding its drilling application to the National Offshore Petroleum Titles Administrator (NOPTA).

As announced to the ASX in February this year, Advent, which holds an 85% in PEP11, applied to NOPTA to enable drilling within the permit – with the primary drill target being Baleen.

PEP11 covers 4,576sq km and contains “significant structural targets” that could possess multi-trillion cubic feet natural gas resources.

“PEP11 remains one of the most significant untested gas plays in Australia,” BPH Energy stated.

“The PEP11 joint venture has demonstrated considerable gas generation and migration in the offshore Sydney Basin, with the previously observed mapped prospects and leads being highly prospective for gas.”

Joint venture partner Bounty Oil and Gas owns the remaining 15% interest in PEP11.

In addition to the positive news for its investee Advent, BPH noted it was looking for new opportunities after raising $333,600 in a placement late last month.

Advent and its wholly-owned entity Asset Energy have served notices of demand on MEC Resources to recover more than $835,000 in incurred costs.

BPH claims MEC is likely to repay these costs.

On Friday, BPH revealed investee Cortical Dynamics will work with the US division of Dutch technology giant Philips to increase adoption and functionality of its Brain Anaesthesia Response Monitor (BARM) system.

The agreement between Cortical and Philips is a non-exclusive licence and Philips will install BARM into its IntelliView and Patient Information Centre monitoring systems.

Splitit Payments (ASX: SPT)

Buy now pay later company Splitit Payments inked a multi-year deal with Mastercard to accelerate adoption of its payment instalment program worldwide.

Under the deal, Splitit will leverage Mastercard’s partner network to boost its payment instalment service to consumers and merchants.

Splitit will integrate its instalment solution with Mastercard’s technology as a network partner to assist merchants with delivering seamless and secure consumer experiences at checkout – both instore and online.

“We are very excited to be partnering with Mastercard who share our strong commitment to accelerating the adoption of instalment payments globally,” Splitit chief executive officer Brad Paterson said.

“It is a major plank in our strategy to grow through strategic partnerships to make Splitit a household name,” he added.

Splitit, who recently made its way onto the All Ords index in the quarterly rebalance, now has a market cap of $377m, despite revenues for Q1 of 2020 only being US$657k.

Constellation Technologies (ASX: CT1)

Constellation Technologies has collared its first-ever customer contract in China.

The contract is with Beijing BHZQ Environmental Engineering Company (BHZQ).

Under the deal, Constellation Technologies will provide BHZQ with a new operational management solution for a large-scale ecological corridor construction project it is managing in Beijing.

All-up, the contract is expected to be worth RMB2.28 million (A$480,000) to Constellation Technologies, with the majority of the payments anticipated within the next two months.

Constellation Technologies will leverage its existing IoT architecture and expertise to build a new operational management system for BHZQ.

As part of it, Constellation Technologies will provide hardware, SaaS for one year, and local software as well as a two-year maintenance and support.

The week ahead

We’re in for an interesting week as the figures surrounding the early period of the COVID-19 lockdowns continue to filter through and experts such as the RBA governor Dr Philip Lowe provide commentary.

Dr Lowe is taking part in the ANU Crawford Leadership Forum which is looking at the Global Economy and COVID-19 – so his views will be eagerly awaited.

On Tuesday, the regular ANZ-Roy Morgan weekly reading on consumer confidence is due along with a raft of other data including the ‘flash’ CBA purchasing managers survey results, weekly CBA card spending data and preliminary May data on exports of goods and services.

The Australian Bureau of Statistics (ABS) gets in on the act on Wednesday, issuing a special COVID-19 report, looking at Provisional Mortality Statistics for the period from January to March 2020.

Other releases to look out for during the week include the May data on skilled vacancies, the March quarter “Finance and Wealth” numbers, job vacancies for May and detailed Labour Force figures.

Overseas there is a range of things to watch for including Chinese 1 and 5-year loan prime rates for June, US data on home sales, economic activity, store sales, purchasing activity, home prices and most importantly jobless claims and final GDP estimates for the March quarter.

New Zealand’s official interest rate decision will be announced on Wednesday.