It’s been 12 months since rumours began swirling over Rio Tinto’s (ASX: RIO) alleged copper discovery in Western Australia’s Pilbara, with recent satellite images revealing a hub of activity at the site and sparking a land grab in the area.

Images have surfaced of a camp set up in the region’s Paterson Province, along with drill rigs and other equipment and infrastructure including a helicopter landing pad.

However, despite repeated attempts to get Rio to confirm or deny the discovery, the company has remained stoically mute.

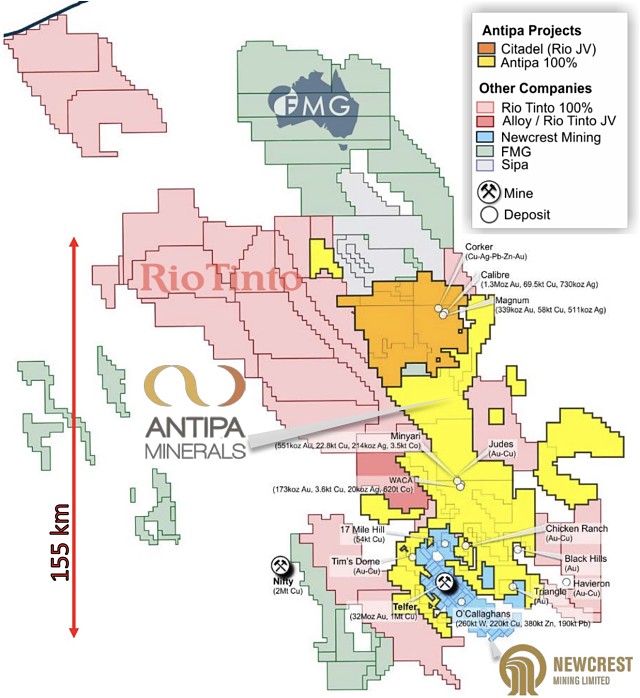

The only giveaways are the images and Rio’s land grab in December last year, which saw the company increasing its presence in the area from 2,335 square kilometres of wholly owned and joint venture tenements to almost 13,000sq km.

Not to be left behind, Twiggy’s Fortescue Metals Group (ASX: FMG) also made a strong play for land in the province, increasing its stake from nothing to 5,310sq km that same month.

Small cap nearology

The majors aren’t the only explorers in the new playing field, with several small cap stocks also active in the area including Metalicity (ASX: MCT), which announced only this morning it had pegged up 2,166sq km of exploration licences in the province.

According to Metalicity, the exploration licence applications adjoin Rio Tinto’s land and lie within a corridor that hosts “numerous underexplored copper occurrences”.

Antipa Minerals (ASX: AZY) is also present in the Paterson Province – owning three projects, which combined, encompass 5,500sq km of prospective land.

The tenements extend within 3km of Newcrest Mining’s (ASX: NCM) Telfer gold-copper-silver mine, which produced 425,536 ounces of gold and 16,212to of copper in the 2018 financial year.

Rio has also managed to get its fingers in Antipa’s copper pie and is earning up to 75% in the company’s Citadel asset.

The mining major recently drilled 3,050m across several copper-gold targets within the project, with assays now pending.

According to Antipa, the Paterson Province is “highly prospective” but “grossly underexplored”, despite quite a few historical discoveries.

In addition to Antipa, Rio got its hands on some of Alloy Resources’ (ASX: AYR) land in the province this year, after inking a joint venture in June to earn-up to 85% by funding exploration.

Alloy executive chairman Andy Viner said he hoped that Rio fast-tracked the discovery of copper and gold throughout its tenement.

Red Metal (ASX: RDM) and Sipa Resources (ASX: SRI) also have a presence in the province, with both companies owning tenements.

Rio puts backs itself via off-market buy-back

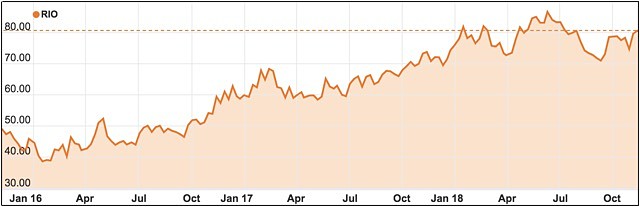

Meanwhile, as the rumours continue circulating, Rio’s faith in its current share price journey has been evident after it scooped up A$2.87 billion shares via an off-market buy-back.

The company bought-back 41.2 million shares at $69.69 each – representing 2.41% of the group’s ordinary shares on issue.

“We are delighted to be returning US$2.1 billion to our Rio Tinto shareholders through this off-market buy-back,” Rio Tinto chief executive officer Jean-Sébastien Jacques said.

“Strong demand has enabled us to return the maximum amount, and at a discount of 14%.”

A further US$1.1 billion (A$1.53 billion) shares will be snapped up between February next year and February 2020.

Rio Tinto’s share price was last trading at $82.58.