If there is one lesson we should all learn, it is never to get on the wrong side of a nerd – and particularly not a group of nerds and gamers.

It is a lesson some Wall Street hedge funds will never forget as one of the greatest short squeezes ever seen causes almost limitless financial pain for some of the self-professed “smartest guys and gals in the room.’’

The company in question is called GameStop (NYSE: GME) which in Australia is best known for its successful chain of EB Games stores.

The hedge funds and fellow travellers decided this company was too old school with more than 5,000 brick and mortar stores, limited online sales, poor profits and a billion dollars of debt to service.

Elon Musk ‘sets’ the sell price using marijuana

So, they started selling the stock hard, borrowing stock and short selling it, confident that they could pick up the shares cheaper down the track.

It appears some may even have been running potentially illegal “naked shorts” – relying on the stock being cheaper down the track and having no physical shares to back up their short position.

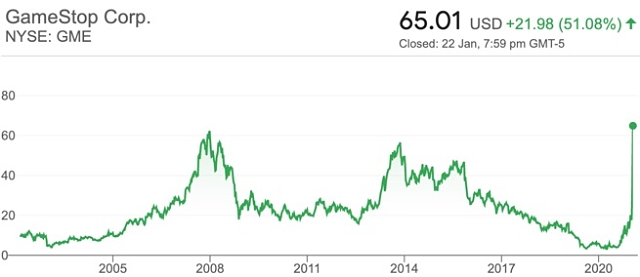

Incredibly, 68% of the company’s shares were officially short sold all the way down to US$2 a share – a long way from around the US$20 mark the stock was trading at in early January just before the latest shorting controversy.

Some people claim that the stock was unofficially actually shorted to greater than 140% of the available stock, which is obviously an impossible and very dangerous position for those doing the shorting should they get caught in a squeeze and forced to buy stock that is not easily available – and certainly not at a palatable price.

Indeed, some of the nerds now engaged in battle have set an aspirational and incredible sell price of $420 – a tribute to Musk and also to marijuana, with 20 April a popular holiday celebrating cannabis culture.

When Tesla stock hit $420, Musk tweeted: “Whoa … the stock is so high lol,” also having a crack at his infamous “funding secured” run in with the Securities and Exchange Commission that cost him his position as Tesla chairman.

Nerds become instant multi-millionaires as the hedge funds bleed billions

What these financial geniuses hadn’t reckoned on was the power of a Reddit forum – specifically one subreddit called WallStreetBets – that has accumulated a very strong following among a group of day traders and nerds who swap theories and ideas about what it going on in markets.

This forum had been closely following an e-commerce billionaire and Chewy.com pet food founder called Ryan Cohen who actually thinks GameStop has a bright future and decided to buy stock and join the board and help to improve the company.

His theory was that while trading games at a physical stores seemed like an old way of doing business, it has created millions of loyal customers who had joined the company loyalty program.

Cohen’s idea is that with a few tweaks, this loyalty database could be a highly valuable part of the company that the shorters had attributed absolutely no value to.

Also, with his experience in e-commerce behind it the company looks set to quickly improve, particularly with new games and consoles arriving while the world is still in the teeth of a stay-at-home pandemic.

Let the war begin

The result was worthy of one of those realistic and violent war games that GameStop sells but, in this case, the two sides were the shorters versus the nerds.

The battle is continuing but so far the nerds are winning easily, taking an estimated $3 billion off the hedge funds and in the process turning many of the nerds into paper multi-millionaires.

What the hedge funds hadn’t anticipated was what would happen if a forest of day traders started buying up the available stock in the company – the very stock that they needed to buy at a much cheaper price to fulfil their short positions and create new ones.

That is the very definition of a short squeeze because the shorters need to buy the stock, no matter where the price lands and no matter how much it costs them.

After fading for a while well below US$40 a share, the GameStop share price suddenly took off like a rocket on 12 January.

Last Friday alone it rose 51% to close at US$65.01 and at one stage it was the most actively traded US stock valued above US$200 million, with millions of shares changing hands every few minutes.

There have been several trading halts caused due to the immense volatility in GameStop shares.

Getting hold of GameStop shares is now extremely difficult with most US exchanges showing no shares available for borrowing or even purchase.

Bear walks as money talks

It all became too much for one of the main shorters, Andrew Left of Citron Research, who claimed he was walking away from the stock because of what he called an “angry mob” that has “terrorized” him and his family.

Left said he still believes the GameStop share price is due to collapse, but will no longer comment on the company because Citron has become a target of “an angry mob who owns this stock.”

“This is not just name calling and hacking, it includes serious crimes such as harassment of minor children,” Left said in a letter released on Twitter.

“We are investors who put safety and family first and when we believe this has been compromised, it is our duty to walk away from a stock.”

A video in which Left makes a case for GameStop shares being overpriced has been a surprise hit on YouTube, with more than 82,600 views and plenty of less than complimentary comments from WallStreetBets members.

Left claimed that he was being harassed by GameStop supporters “who are ordering pizzas to my house or signing me up for Tinder” to harass him.

“If you want to save the company, take your energy, go out there and actually buy something from GameStop, because that is the only thing that saves this,” he wrote.

Share issue could be a great idea

That might not be the entire story though, with the GameStop board surely now considering an issue of new shares at or below its new, lofty share price that would deal with several problems at once – getting rid of a lot of debt, using the amazing appetite for its shares to its advantage and setting the company up for a more profitable future.

Longer term, it is interesting to consider what might happen to the newly enriched and excited Reddit nerds, who are already buying stock in other heavily shorted companies to run sequels to their GameStop short squeeze.

Will they retain their anarchic setup of stonkers and nerds, or will they effectively form their own hedge fund, bravely going long everywhere others are going short?

It is hard to tell but you have got to admire the sheer enthusiasm of these adventurous traders, one of whom said: “Papa Cohen will take us all to mars, suit up homies it will be a bumpy ride to the [rocket emoji] so u don’t fall off.”