It is now official – the Reserve Bank has admitted that the door is open for further official interest rate cuts this year below the current 1%.

The minutes of its latest meeting showed the RBA remains worried about the state of the jobs market and the lack of wages growth experienced by Australian workers.

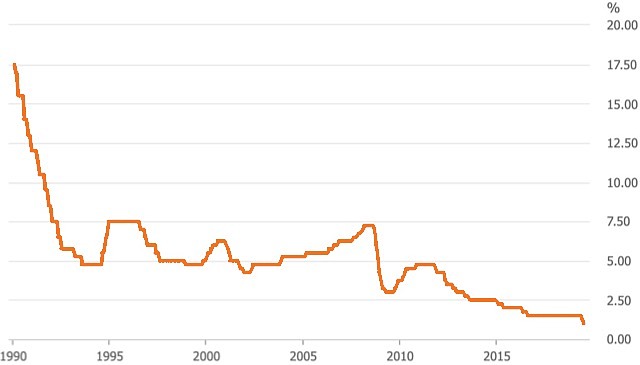

The RBA cut the official cash rate to an all-time low of 1% at the July meeting, following an identical 0.25% reduction in June.

RBA worried about the jobs market

The minutes show that the RBA remains worried about softness in the jobs market and had a serious discussion about employment trends right across the country.

Financial markets have already priced in a further interest rate cut by February of next year but some analysts think the RBA might even act earlier, cutting rates again in November if there has been no improvement in September quarter inflation.

“The [RBA] board would continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time,” the minutes said.

Forward indicators point to weaker jobs market

The minutes also show the bank is concerned that job advertisements and business employment intentions are all pointing to a slowing in jobs growth in the rest of this year and they pointed to a continuing elevation in the under-employment level.

“Although there had been a modest pick-up in wages growth in the private sector, wages growth had remained low overall. In combination, these factors suggested that spare capacity was likely to remain in the labour market for some time.”

Tax cuts may not be enough to stimulate economy

The downward bias for interest rates remains for the RBA despite the boost to household incomes from the Federal Government’s tax cuts, with the effect of those cuts to some extent overruled by the drought which is cutting farm incomes and the tough housing markets in Melbourne and Sydney.

“While the pipeline of construction work yet to be done in New South Wales and Victoria remained high, liaison contacts expected housing construction could drop off more sharply because pre-sales activity had been so weak,” the minutes said.

Lower rates force an ASX rethink on negative yields

The potential interest rate cuts have forced a rethink by the Australian Securities Exchange (ASX: ASX) which is now testing its systems to ensure it will be able to cope with the trading of negative interest-rate products.

The exchange has produced trial environments so that market participants can test their processes for interest-rate futures prices that are greater than or equal to 100.00, with firms performing the trials including JPMorgan Securities, Goldman Sachs and HSBC Bank.

Australia’s three-year bond yield has already fallen below 1% for the first time ever in June and with the RBA on a potential cutting path, it is not beyond the realms of possibility for yields to turn negative.

Bond yields already below 1% and $17 trillion of negative yield bonds

Right across the world there has been an increase in negative-yielding bonds, with more than $17 trillion of bonds now trading with yields below zero as central banks including the US Federal Reserve and the European Central Bank continue to ease monetary policy.

In effect, bonds that trade with a negative yield mean that the investor is actually paying money for a government to look after the money until maturity.

Obviously, many bond traders still think that is a solid deal, given a positive view of the currency the bond is issued in and a lack of creditworthy alternatives.

The ASX trading platform at the moment restricts orders entered in interest-rate futures products where prices are greater than or equal to 100.00 and option strike listings are also restricted to being under 100.00.

The ASX’s $47 trillion interest rate derivative market is claimed to be the largest in Asia and trades a wide range of products related to bank bills, bond futures and options.