RBA blows the whistle on Australia’s tax squeeze

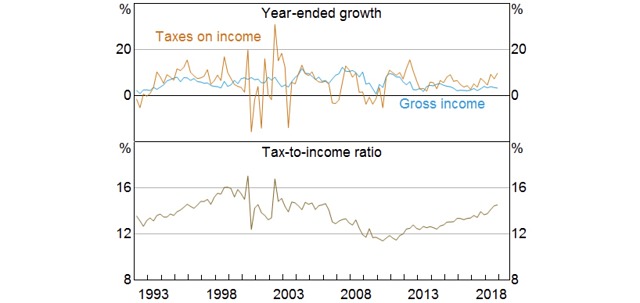

Over the past year, taxes paid by households increased around 8%, more than double the rate of growth in gross household income of 3.5%.

Thank goodness that the independent Reserve Bank is around to tell us the truth about what is happening to us all.

With an election looming, truth is about to become a rare commodity but we can thank the Reserve Bank for carefully demonstrating that our wages are lower than they should be, despite a quite tight labour market.

As if that news was not bad enough, now the RBA has now very clearly shown that we are all paying higher taxes than we used to.

Why that would be the case is a bit of a mystery but once again, as part of its job of keeping unemployment down and the economy running well, the RBA has worked out why taxes are not only going up but are rising at twice the rate of wages.

Tax payments highest for 20 years

Indeed, Australians are now paying tax on their income at the highest rate since the early 2000s, which seems quite unusual given that tax rates if anything have gone down since then.

As RBA assistant governor Dr Luci Ellis explained, this feeling of a cash squeeze at the household level is very important for the Australian economy, given that consumer spending makes up around 60% of Australian economic activity.

Australia’s household income and tax.

The cash squeeze might also explain why the Australian economy has been slowing for the last two quarters, leading to a per capita recession.

So why exactly have taxes been going up, putting a squeeze on household finances?

Tougher enforcement meets bracket creep

Well, the answer is a combination of a much tougher application of the existing tax law by the Australian Tax Office (ATO), along with the usual sinister bracket creep that keeps taxes rising due to the fact that the tax scales are not indexed for inflation.

According to Dr Ellis, the cash squeeze is much more likely to have slowed consumer spending than the much more commonly cited reason of falling property prices, which are said to make people feel less wealthy and liable to spend less through the “wealth effect.’’

Rather, Dr Ellis said a range of essential costs that are taken out households’ incomes and directly reduce the disposable income they have available to spend is the key factor in their decisions to keep the wallet firmly shut.

Taxes rising much faster than normal

“Income payable — the things deducted from gross income to calculate disposable income — increased by nearly 6% in 2018,” Dr Ellis said.

“This was significantly faster than growth in gross household income.’’

The main culprit was personal taxes, which Dr Ellis said have grown at a historically fast pace.

“A useful rule of thumb is that, in the absence of adjustments to tax brackets to allow for bracket creep, for every 1 percentage point of growth in household income, taxes paid by households will on average increase by about 1.4 percentage points,” she observed.

“In the past year, taxes paid by households increased by around 8%, more than double the rate of growth in gross household income of 3.5%.

“So, the ratio is more like a bit over two-to-one at the moment, rather than 1.4 to one. That is at the high end of the range this ratio reaches.”

This trend has been apparent for quite some time, too.

“What is noteworthy is that for all of the past six years, growth in tax paid has exceeded income growth by an above-average margin, at a time when income growth itself has been slow.”

Get ready for tax cut announcements

While the RBA analysis will allow both parties to helpfully justify some vote-buying election tax cuts, it also shows clearly that these “cuts’’ will only be returning some of the excess growth in tax payments that have put such a squeeze on consumers.

As for why the tax share has gone up so much, Dr Ellis noted that while interest rates on investment property loans are now higher than for owner-occupiers, overall the interest rate structure on mortgages is lower than it was a few years ago.

That would cause landlords to have lower tax deductions for interest payments at the same time as the significant run-up in housing prices over the past decade in many Australian cities will have increased the capital gains tax liability paid by investors who are selling a property.

Dr Ellis also pointed out that the ATO has become much more diligent in collecting revenue from individuals, with a crackdown on work-related deductions significantly boosting revenue, while a similar crackdown on rental property deductions underway now is sure to yield a similar crop of tax payments.