Weekly review: rare Friday rebound not enough for a positive week

WEEKLY MARKET REPORT

In a reversal of business as normal the Friday session was a rare positive one for the Australian share market but it wasn’t enough to end the week higher.

With bank stocks on the rise and the market up $26 billion, the ASX 200 added 86.4 points or 1.5% in the final session for the week to close at 5904.1 points

That means the ASX 200 finished the week down 0.6% after we followed a US rally that was powered by regulators dropping a major pressure test for US banks.

That was enough to drive a bit of a bank rally in Australia as well, with Westpac (ASX: WBC) leading the charge with a 57c or 3.3% rise to $17.99.

Banks and miners drive the rally

It was a similar scenario for the other banks with Commonwealth Bank (ASX: CBA) up $1.62 or 2.4% to $69.27, while ANZ (ASX: ANZ) rose 3% or 55c to $18.80 and NAB (ASX: NAB) added 49c or 2.7% to $18.40.

Not to be left out of the rally the big miners were also stronger, with BHP (ASX: BHP) adding on a round dollar or 2.9% to $36.05, while Rio Tinto (ASX: RIO) jumped $1.93 or almost 2% to finish just short of a century ay $98.99.

Fortescue Metals (ASX: FMG) also added 2.2% or 31c to $14.18.

However, the heavyweight rally was not enough to completely overcome the heavy losses of Thursday or to erase the worries that it could be much longer than expected before Australia and many other parts of the world can say the worst of the COVID-19 pandemic is behind them.

Qantas hit hard

One of the worst performers was the national airline Qantas (ASX: QAN), with investors stripping 38c or a whisker more than 9% off the stock to $3.81 after the airline resumed trade following its successful $1.36 billion institutional placement and the announcement that it would sack 6000 workers and cut $15 billion in costs.

Qantas will now raise $500 million from retail shareholders as it struggles to shrink to meet the much bleaker picture for air travel – particularly on international routes.

Meanwhile Virgin Australia (ASX: VAH) was thrown a lifeline by new owner Bain Capital, after the US private equity firm won a bid to buy the troubled airliner.

Virus is producing some winners

There was one mild positive to the growing tally of second wave infections of COVID-19 in Melbourne though, with share in Coles (ASX: COL) and Woolworths (ASX: WOW) both higher by 1.2% and 0.9% respectively as a new wave of panic buying of groceries upgraded sales projections even further.

Energy stocks were also up 2% courtesy of a rise in the oil price and property stocks continued to recover some ground with a 1.5% rise.

After being one of the few positive sectors during Thursday’s steep falls, it was the turn of defensive healthcare stocks to weaken with leading blood group CSL (ASX: CSL) falling 0.4% to $292.74.

Investors were probably also concerned by confirmation that fast-falling revenues and rising government spending had caused Australia’s budget deficit to balloon to almost $65 billion in May.

Small cap stock action

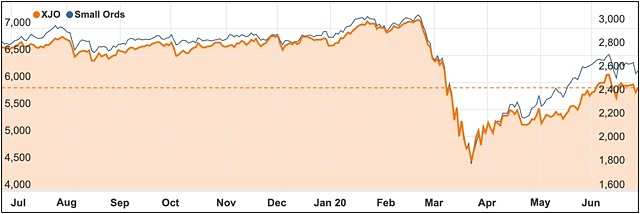

The Small Ords index fell 2.52% this week to close on 2614.7 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Strategic Elements (ASX: SOR)

Strategic Elements’ subsidiary Stealth Technologies impressed investors again this week with news it had filed three patents relating to its autonomous robotics technology.

Two of the patents are for Stealth’s “low-cost” solutions that increase reliability and mitigate against failures in autonomous robotic vehicles.

These patents cover Stealth’s redundant compute technology for autonomous vehicles and a low-cost emergency braking technology, which brings autonomous vehicles to a halt in the event of a power failure.

The third patent is for Stealth’s automated perimeter intrusion detection robotics. This technology enables fully automated perimeter intrusion detection system testing around the clock, which provides increased security and reliability.

Only last week, Stealth revealed it had inked a collaboration with US$100 billion company Honeywell to develop a fully autonomous security vehicle for perimeter security at WA’s Eastern Goldfields Regional Prison.

Meanwhile, Stealth is also conducting a program to integrate airborne drones with its ground based autonomous vehicle platform.

A prototype is scheduled to be ready in the December quarter.

Kalamazoo Resources (ASX: KZR)

Northern Star Resources has agreed to sell the Ashburton gold project to Kalamazoo Resources, which already hosts 1.65Moz in contained gold resources.

The project covers 217sq km with the full JORC resource totalling 20.8Mt at 2.5g/t gold for the 1.65Moz.

According to Kalamazoo, the project has already produced 350,000oz gold and has significant greenfield and brownfield exploration potential.

As part of the deal, Kalamazoo will pay Northern Star $17.25 million in cash under a deferred agreement.

The payment is contingent on Kalamazoo mining 250,000t of ore and producing 250,000oz gold.

There is also a 0.75% royalty payable to Northern Star on subsequent gold production.

Kalamazoo will begin exploration immediately, with Ashburton coming with a self-contained camp, core farm and supporting infrastructure.

Chief executive officer of Kalamazoo, Luke Reinehr, spoke with Small Caps this week about the acquisition and plans for the future.

Metalicity (ASX: MCT) and Nex Metals Explorations (ASX: NME)

WA goldfields explorers Metalicity and Nex Metals have revealed “spectacular” gold assays in the first 11 holes of a 44-hole program.

The 11 holes have confirmed extensive high-grade near-surface gold mineralisation at the project’s Leipold prospect, with 10 of the holes possessing a “significant” intercept.

Better results were 4m at 16.3g/t gold from 42m, including 3m at 20.7g/t from 42m; and 9m at 5.7g/t gold from 35m, including 2m at 17.9g/t from 40m.

Metalicity said the results from the remaining 33 holes are due in the coming weeks.

“With every drill hole completed, we continue to illustrate that Kookynie has the potential to be a prolific gold area,” Metalicity managing director Jason Livingstone said.

“The results are very shallow, which if converted to resources and reserves, could potentially be an open pit development.”

Leipold is one of seven main prospects at Kookynie, with the others comprising Champion, McTavish, Altona, Diamantina, Cosmopolitan and Cumberland.

Mr Livingstone said the next exploration would expand to include Champion and Altona.

Earlier this week, Metalicity expanded its footprint in the area with the application for a further 4,200ha bringing the entire Kookynie project to 11,000ha.

Rox Resources (ASX: RXL)

Other WA gold explorers that pulled up gold this week were Rox Resources and Venus Metals Corporation at the Youanmi project.

Rox owns 70% of the project, with Venus holding the other 30%.

Reverse circulation drilling at the project’s Grace prospect unearthed 4m at 88.81g/t gold from 27m, including 2m at 176.03g/t gold; 11m at 18.75g/t gold from 8m, including 3m at 61.27g/t gold; and 9m at 9.28g/t gold from 9m, including 2m at 33.53g/t gold.

Rox managing director Alex Passmore said the results were “extremely encouraging” and endorse the company’s interpretation at Grace.

He said the results will be added to with an upcoming diamond drilling program, with the company aiming to release a maiden resource later in the year.

Global resources for Youanmi currently total 2.4Mt at 2.97g/t gold for 1.19Moz.

Riversgold (ASX: RGL)

Junior explorer Riversgold has collared a new technical team to advance its Australian gold projects.

The company appointed Quarterback Geological Consultants to formulate and execute an exploration strategy for projects in WA’s eastern goldfields and South Australia’s Olympic Dam.

Riversgold noted the consultants will be paid solely on exploration success.

On the team is former Newmont Mining senior manager Simon Bolster. Mr Bolster was involved in the 1Moz Mount Monger gold discovery. He has also been appointed as a non-executive director to Rivergsold’s board and will receive 6 million options.

Other members of the technical team include former chief geophysicist to WMC Resources and IGO co-founder Peter Williams and Dr Marat Abzalov, who has 35 years’ experience and has worked for WMC and Rio Tinto.

Mr Bolster said he was excited to assist Riversgold with unlocking the potential of its portfolio.

“It’s not every day that you can get to join a company who holds more than 1,100sq km of tenements with all the right ingredients to host million-ounce gold systems,” he added.

Quarterback will receive 50 million performance rights upon reaching multiple milestones.

Chase Mining Corporation (ASX: CML)

Chase Mining Corporation hit massive sulphides in the first hole of a new drilling program at its Alotta project in Canada.

The hole has confirmed visual continuation of mineralisation reported in a 2019 intersection and extended to 99m below surface.

That 2019 hole was drilled late last year and returned 4.1m at 5.3% copper, 4.9g/t palladium, 0.9g/t platinum, 0.26% nickel and 12g/t silver from 55.3m.

Within that intercept was 0.5m at 22% copper, 34g/t palladium, 3.5g/t platinum, 0.78% nickel, 1.4% zinc and 65g/t silver.

Chase described the high-grade interval as “spectacular”.

In this latest intersection, Chase observed 13.54m of variably altered and mineralised porphyry.

Respiri (ASX: RSH)

eHealth respiratory diagnostic company Respiri has teamed up with the University of Edinburgh in Scotland, while gearing up to launch its technology in the EU.

The partnership will pave the was for Respiri to feed information from its proprietary wheezo diagnostic devices into a new data centre to advance research into respiratory conditions.

Respiri’s wheezo device is used to detect wheeze, which is a common symptom of asthma, COPD and respiratory disease. It is used to measure airway limitation.

The device is combined with machine learning and a software platform to provide personalised feedback of user’s data, which is also correlated with environmental factors.

Under the collaboration with the University of Edinburgh, data will be collected from wheezo and used in creating ways of delivering better care for people with asthma COPD and respiratory infections.

This partnership is also expected to expand Respiri’s patient experience program in the UK.

The company plans to hit the EU market next year, with a commercial launch targeted in Australia for the end of 2020.

Upcoming listings

Looking to make its way onto the ASX bourse in the near future is Aroa Biosurgery.

Aroa Biosurgery

New Zealand company Aroa Biosurgery plans to list on the ASX in July via a $45 million IPO.

The offer comprises $30 million in primary capital via the issue of 40 million new shares at $0.75 each. The remaining $15 million will be part of a sell-down via existing shareholders.

Once listed, Aroa is expected to have a market cap of $225 million.

Aroa has developed soft tissue regeneration technology known as Endoform to improve the rate and quality of healing in complex wounds and soft tissue reconstruction procedures.

The technology is believed to benefit hernia repair, breast reconstruction, trauma surgeries, limb salvaging and tumour resections.

Endoform acts as a scaffold to grow new tissue lost or damaged through disease or injury. It is derived from ovine (sheep) forestomach and allows a patient’s own cells to gradually grow into the matrix and build new tissue and re-establish blood supply.

Aroa already has five commercial products available in the US based on the Endoform technology.

The company’s products have regulatory approvals in more than 37 countries and are protected by 10 patents and 25 pending applications.

The company plans to trade under the ASX ticker ‘ARX’.

The week ahead

We begin a new financial year in the coming week but there will be no let up in the predominantly bad news filtering through from the past year as some major tier one announcements are made.

In Australia, there are many releases to look out for including figures on home prices, building approvals, international trade, job vacancies, retail trade and the often-revealing purchasing manager indexes.

Add to that the Australian Bureau of Statistics’ weekly “Household Impacts of COVID-19 Survey” and several releases on consumer confidence, credit and debit card spending and wages and private sector credit data for May and there will be many elements to clarify the picture of how Australia is coping with the economic downdraft caused by the pandemic.

Internationally, the US is probably the place to watch with a swag of new releases before the Independence Day holiday on Friday, which means markets only have four days of trading for the week.

The jobs numbers will be the big news item out of the US numbers but the minutes of the US Federal Reserve’s June meeting could also move markets if there is any hint about some fresh stimulus to battle the devastation that is happening as many states open up their economies far too early and suffer massive infection rises.

There are also a number of US measures of home sales, manufacturing activity, house prices, chain store sales and consumer confidence.

Another thing to look out for is Tuesday’s appearance before the US House Financial Services Committee of the Federal Reserve Chairman Jerome Powell and US Treasury Secretary Steven Mnuchin to testify about the COVID-19 response.

There are also some Chinese announcements that will be eagerly awaited, including manufacturing and services that could shed some light on how quickly or otherwise export demand for Chinese products is picking up.