Weekly review: rare Friday rally sets positive tone for the share market

WEEKLY MARKET REPORT

A Friday rally added a positive tone to the Australian share market even as it fell further behind the US market rally.

A daily rise of 0.79% produced most of the weekly gain on the ASX 200 of 0.83% as technology stocks staged a rally, with the sector adding 2.34%.

All of the so-called WAAAX technology stocks were in positive territory after falls earlier in the week – WiseTech Global (ASX: WTC), Afterpay (ASX: APT), Appen (ASX: APX), Altium (ASX: ALU) and Xero (ASX: XRO).

Energy stocks finally have a day in the sun

Friday was also a good day for the energy and materials stocks, helping to push the ASX 200 index to 6766 points.

Oil and gas giant Woodside (ASX: WPL) was up an impressive 1.37% and Origin (ASX: ORG) was up 3.79% while giant miner BHP (ASX: BHP) added 2.6% and the more concentrated and non-oil Rio Tinto (ASX: RIO) was up 0.8%.

The energy stock gains were no surprise after oil prices rallied after the huge US COVID-19 stimulus plan was passed amid rising refining margins and recovering road usage in the US and Europe.

With more people driving due to the pandemic and US$1.9 trillion in US pandemic payments about to start flowing to lower income groups, the understandable assumption is that oil usage could recover quite quickly.

Australian market firmer across the board

The Australian market recovery was solid across all sectors of the share market, taking a lead from the stronger energy, materials and technology sectors.

There were pockets of weakness, with some of Thursday’s boom in travel stocks retracing as the initial excitement about the Federal Government’s $1.2 billion air travel stimulus wore off.

Flight Centre (ASX: FLT) was a good example, down 4%.

There was some company specific news around with Nine Entertainment (ASX: NEC) and WIN Network signing a new regional television affiliation agreement for a minimum of seven years.

That will see WIN once again broadcasting Nine’s metropolitan free-to-air TV content.

Westpac puts money laundering breaches behind it

Westpac (ASX: WBC) also saw regulator APRA close its investigation into the bank’s anti-money laundering breaches.

Westpac will still be subject to a court enforceable undertaking to implement an integrated risk governance remediation plan.

Westpac shares slid slightly, down 0.33%.

Much of the Australian action mirrored what has been happening in the US, as investors there move into undervalued stocks that are more likely to run on rising consumer spending such as energy and financials and out of technology and other stocks that are trading on highly optimistic multiples.

In broader terms, the rotation out of growth and into value has also been helped by poor US consumer price data for February, which doused fears of a fast uptick in inflation and interest rates.

Small cap stock action

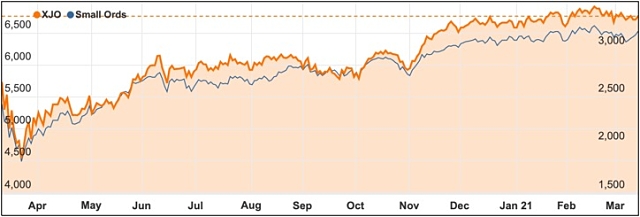

The Small Ords index gained 3.56% for the week to close at 3181.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Digital Wine Ventures (ASX: DW8)

In a market update this week, Digital Wine Ventures said during February 2021 its online beverage platform WineDepot had processed and shipped more than 10 times the number of orders it had in February 2020.

During February 2021, WineDepot shipped 20,684 cases, which was 931% higher than February 2020 and an increase of 32.4% on January 2021.

WineDepot processed 9,500 orders for February, which was up 918% on February 2020, and a 28% rise on the previous month.

Additionally, the Leaders for Climate Action has officially recognised WineDepot as a climate neutral business.

Zenith Minerals (ASX: ZNC)

With a copper deficit emerging globally, Zenith Minerals told shareholders this week it was fast-tracking exploration at its Queensland copper projects.

At the more advance project Develin Creek project, which has a resource of 2.57Mt at 1.76% copper, 2.01% zinc, 0.24g/t gold and 9.6g/t silver, Zenith will complete airborne and ground-based geophysical surveys followed by drilling.

Meanwhile, drilling at the Split Rocks gold project in WA had returned “strong gold mineralisation” at multiple targets.

Alice Queen (ASX: AQX)

After revealing it was completing a scoping study on its Horn Island gold project in Queensland, Alice Queen has boosted its portfolio with the acquisition of two Fijian gold projects.

Located on Fiji’s largest island Viti Levu, the most advanced project Nabila hosts the historic Mistry mine, which produced 1,720t at 13g/t gold for 746oz of contained gold.

Over on Fiji’s second largest island Vanua Levu is the second project Viani, which was explored in the 1980s and 1990s, with six shallow diamond holes returning gold.

Dart Mining (ASX: DTM)

Drilling at Dart Mining’s Granite Flat project in northeast Victoria has uncovered numerous gold and copper intersections in the first holes undertaken at the project in more than 20 years.

The maiden program comprised 42 holes drilled to a maximum depth of 50m and returned highlight gold intersections of 19m at 9.39g/t, including 3m at 41.1g/t from 28m; 4m at 3.23g/t, including 1m at 7.84g/t from 15m; and 9m at 2.1g/t, including 3m at 4.98g/t from 12m.

Notable copper hits were 19m at 0.61%, including 3m at 1.52% from 28m; 28m at 0.35%, including 9m at 0.73% from 7m; and 45m at 0.12%, including 8m at 0.38% from surface – with mineralisation identified throughout that entire drill intersection.

Silver was also identified with results of 19m at 19.2g/t, including 92.9g/t from 28m; and 5m at 40g/t, including 1m at 157g/t from 20m.

Incannex Healthcare (ASX: IHL)

Incannex Healthcare is progressing its IHL-216A drug candidate with an “extensive” in vivo study which will assess the protective effect of the drug in sports concussion.

Monash University’s Monash Trauma Group will be working with Incannex on the study, which will use a unique rate model of traumatic brain injury.

Incannex will assess TBI in the rat models by looking at potential behavioural, physiological and molecular changes that are usually associated with this type of injury, with all data to feed into clinical trial planning.

Impact Minerals (ASX: IPT)

While it continues advancing the Broken Hill project in NSW, Impact Minerals has also begun drilling at the Aspley prospect within its wholly-owned Commonwealth project in the state’s Lachlan copper-gold province.

The reverse drilling program at Aspley will comprise 3,000m and target a number of high priority induced polarisation geophysical and soil geochemistry anomalies.

Impact says these anomalies have similar characteristics to major porphyry copper-gold deposits around the globe.

Meanwhile, at the Platinum Springs prospect within Broken Hill, assays revealed numerous intercepts containing PGE, copper, nickel and silver.

Intervals returned notable grades of 10.3g/t 3PGE (gold, platinum and palladium), 3% copper, 3% nickel and 88g/t silver.

The week ahead

There are some big-ticket data releases coming up this week, with the labour force survey and a preliminary update on retail trade sure to provide plenty of pointers about how the Australian economy is recovering from the pandemic.

It is also a big week for Reserve Bank release with governor Dr Philip Lowe speaking on Monday and the minutes of the last RBA board meeting released the following day.

Other things to watch out for include household spending intentions, house prices, consumer sentiment and overseas arrivals and departures.

Overseas data to watch out for include Chinese retail sales, industrial production and fixed asset investment for January-February all likely to be strongly higher.

In the US the Federal Reserve Open Market Committee is meeting on March 16-17, with reaction to rises in the 10-year bond yields likely to be the most watched topic for discussion.

Other US data which will be closely watched include retail sales, housing and business investment.