Nuclear medicine developer Radiopharm Theranostics (ASX: RAD) has acquired a private US venture that is seeking to overcome the widespread patient resistance to current common prostate cancer treatments.

Radiopharm will pay US$4 million (A$5.9 million) in cash and scrip for the New York-based Pharma15 Corporation, founded by radiopharmaceutical scientists Professor David Ulmert and former investment banker Suzanne Dance.

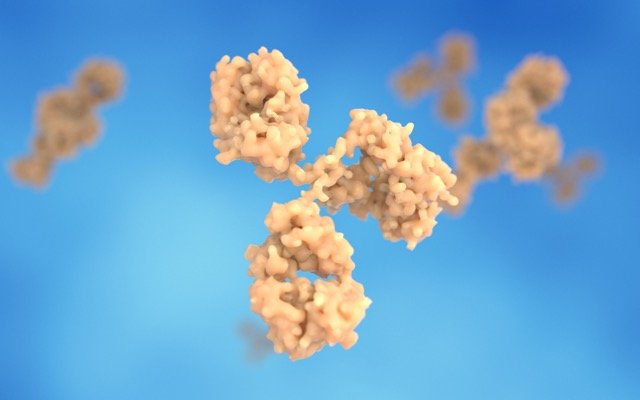

Pharma15’s programs seek to overcome patient resistance to therapies that target the prostate-specific membrane antigen, or PSMA.

“With this agreement, we are looking at the potential next generation of radiopharmaceuticals in prostate cancer to go beyond PSMA and to continue innovation for patients suffering from this disease,” Radiopharm chief executive officer Riccardo Canevari said.

While the acquired assets are in preclinical stage, he said the company wanted to secure them in its pipeline before other competitors may have.

Pre-eminent cancer therapy development experts

The deal sees Professor Ulmert and nuclear science expert Professor Ken Herrmann join Radiopharm’s scientific advisory board.

Dr Herrmann holds an MBA from the University of Zurich and is a professor and chair of nuclear medicine at the University of Duisburg-Essen in Germany.

Radiopharm executive chairman Paul Hopper said that along with their Pharma15 colleagues, these men were recognised as pre-eminent cancer therapy development experts.

“In addition, through the Pharma15 acquisition Radiopharm further improves its access to strong academic networks in Europe and the US.”

Acquisition terms

Under the terms of the latest deal, Radiopharm will acquire all of Pharma15’s shares, with the consideration half in cash and half in Radiopharm shares.

Half of the cash component will be paid now, with the remainder in one year’s time. The shares will also be issued in two equal instalments, with the initial 10.4 million shares priced at 14.31 cents each. The valuation of the second tranche will be determined by the prevailing market price and exchange rate.

The purchase will be funded from Radiopharm’s existing cash reserves, while the shares to be issued are within the company’s existing 15% share issue capacity.

As a contingent consideration, Pharma15’s vendors receive a further US$2.3 million (A$3.4 million) in Radiopharm shares, if the US Food and Drug Administration (FDA) approves an Investigational New Drug application for a Pharma15 product.

This milestone is “unlikely to be achieved” before calendar 2025.

Radiopharm’s portfolio

Founded by Mr Hopper, Radiopharm listed in late 2021 on the back of assets acquired from parties including the Imperial College London, New York’s Sloan Kettering Memorial Hospital and the Technical University of Munich.

‘Theranostics’ refers to the use of radioisotopes to develop both diagnostic (imaging) tools to detect tumours, as well as actual treatments based on very specific targeting of the diseased cells.

Known as RAD 101, Radiopharm’s most advanced program is developing an imaging tool for brain metastases. The company reports positive results from a small phase II trial and plans to seek FDA approval for a larger phase 2b/III trial.

The company also has FDA ‘orphan device’ status for an imaging tool for the deadly and hard-to-detect pancreatic cancer, with the first patient in a phase I trial planned to be enrolled in April.