Queensland Bauxite consolidates position in medical cannabis with double acquisition spree

After several months of tiptoeing in and around the medical cannabis market (and almost two months spent in a trading halt), Queensland Bauxite (ASX: QBL) has plunged in two feet first by carrying out a “transformational” company acquisition of a cannabis company.

The resources company has been broadening its horizons for over 6 months, flirting with the idea of commercialising medical cannabis and signing a range of commercial deals to generate revenues from one of the most rapidly-growing market sectors in the world.

However, Queensland Bauxite stunned the market late last night by announcing a double-barrelled acquisition spree: the buyout of the remaining 45% in its existing subsidiary, Medical Cannabis Limited (MCL) and entering into a legally binding heads of agreement to acquire the entirety of Medcan Australia, an established medical cannabis producer with all the necessary licencing and infrastructure in place to commence production and sales of high-grade cannabis.

The Medcan takeover is to be done entirely in scrip with the issue of 250 million QBL shares. However, to ensure the acquisition occurs smoothly and to support its set of acquisitions, the company said it intends to conduct a capital raising under a prospectus to raise up to A$5 million at a price of 8 cents per share (a 63% premium to the last closing price of 4.9 cents).

Upon completion, Medcan’s founders Craig Cochran, and Gareth Ball will take up an 8% stake in the newly-created entity comprised of Medcan and MCL.

The two founders will also receive “quarterly issuance” of 2.25 million shares as part of “arm’s length” management contracts that will see the two leading figures retain an active role in the newly-created business over the next 2 years.

Importantly, all additional shares to be issued by to MCL shareholders and to Medcan shareholders, will be subject to a 24-month escrow period which thereby ties the new people to the newly-formed business.

With its strong surge into medical cannabis Queensland Bauxite has also said that its mining roots will not be forgotten after the MCL and Medcan acquisitions are completed.

Queensland Bauxite will be comprised of two separate operating divisions with the latest report out from company being that it is continuing its “discussions with a number of groups including end users for off-take” of bauxite from South Johnstone, the explorer’s flagship project in Queensland.

“With Medcan integrated into the broader MCL group, we intend to produce high CBD and other THC rich variations of medicinal cannabis, as well as other cannabinoid variations to be used in research to manufacture patient-specific products in accordance with the existing legislative framework.

“This is another step forward for patient access in Australia and globally, with patients to have direct access to legally produced Australian GMP manufactured products of the highest standard and quality control,” said Andrew Kavasilas, founding director of MCL.

Manufacturing medical cannabis

Medcan currently holds an Office of Drug Control (ODC) medical cannabis production license and also possesses an experienced management and production team with a contract to supply already in place.

The acquisition effectively enables the MCL group to legally grow and cultivate both THC and CBD medicinal cannabis products in Australia. The acquisition will essentially springboard Queensland Bauxite into supplying the burgeoning global markets for medical cannabis products with Australia at the heart of its operations.

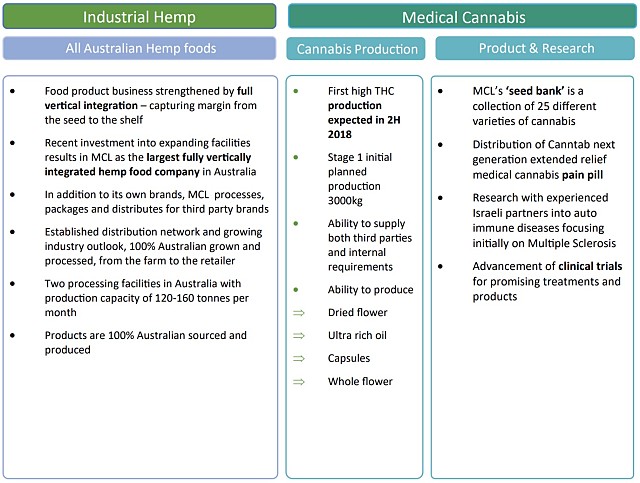

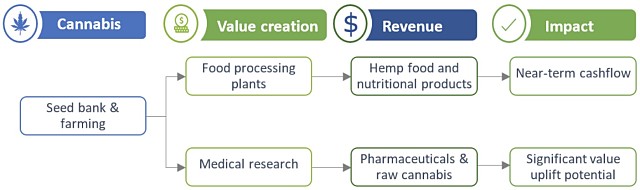

The deal between MCL and Medcan will establish Queensland Bauxite’s second vertically integrated ‘seed to consumer’ business in medicinal cannabis.

MCL is the only medicinal cannabis company in Australia with two complete fully vertically integrated businesses: nutritional hemp and medicinal cannabis.

Medcan’s ODC license assists MCL to realise and fulfil its aim to cultivate medical Cannabis in Australia and manufacture its own GMP pharmaceuticals, nutraceuticals and therapeutics for distribution and sale to the Australian market and international export market, with the potential to return significant revenues for MCL.

One key aspect already on the horizon is the building of a “state-of-the-art cannabis cultivation and production facility” with the sole purpose of producing high THC/CBD medicinal cannabis products “by year-end.”

According to a market statement from Queensland Bauxite, Medcan’s facility will carry out automated cultivation techniques allowing complete control of the growing environment – including climate control systems monitoring temperature, humidity, CO2 levels and integrating advanced nutrient delivery systems.

Nitty gritty details

The flurry of transformational acquisition activity will require internal Board and shareholder approval as well as official confirmation from the ASX.

However, Queensland Bauxite said that it had already spoken to the largest shareholders of QBL and were confident that these vital acquisitions have the support of QBL’s largest shareholders.

“All the directors of QBL and MCL unanimously approve and recommend these acquisitions for the benefit of all QBL and MCL shareholders,” the company said.

As a further logistical change, Queensland Bauxite has also decided to acquire the remaining 45% of MCL and takes its ownership to 100%. The full acquisition completely incorporates MCL into Queensland Bauxite for the benefit of all Queensland Bauxite shareholders.

“The value of MCL and Medcan combined is greater than the sum of the individual businesses. Both parties achieve value uplift with clear and deliverable synergies,” said Ms Pnina Feldman, executive chairperson of Queensland Bauxite.

Medical Cannabis profile

MCL is an unlisted public company incorporated on 16 March 2015 for the purpose of capitalising on the industrial hemp seed industry and the medical cannabis market in Australia. MCL is backed by an intellectual property portfolio, initially developed by Mr Andrew Kavasalis for more than a decade and continues to be developed by Mr Kavasilas and the MCL team.

MCL’s strategy is to leverage the intellectual property and management expertise it has in the cannabis sector to become a leader in the distribution of medical cannabis products and solidify its position as Australia’s premier hemp food company.

The company has three key divisions spread across 4 subsidiaries – Vitaseeds, Hemp Hulling Co, Vitahemp and Vitacann.

Overall, the combination of brands and subsidiaries leverage the company’s seed bank as well as its growing, cultivating, retail products and medical applications.

The news of Queensland Bauxite transformational acquisition is expected to have a significant impact on the company’s shares when they recommence trading on the ASX this morning.

In their last trading session on 1 May 2018, Queensland Bauxite shares closed at $0.049 per share thereby valuing the company at around A$78.1 million.