Weekly review: President Biden looking good for the share market as Australian economy continues to recover

WEEKLY MARKET REPORT

Trump is out, Biden is in and so far, the signs are not too bad for the Australian share market.

Granted, the ASX 200 pulled away from 11-month high on Friday but for the week the market was strong and still added 1.3% – even after a 0.3% reversal on Friday.

In broad terms, investors were happy with Joe Biden’s inauguration as US President, looking forward to the injection of further US stimulus to get the US and the world economy through the rest of the COVID-19 pandemic.

Of course, time will tell and if the plans for power sharing in the US senate start to throw a curve ball then some of the early optimism could easily dissipate but so far, the change of President has not been the shock that some might have expected.

Australian stocks benefitting from stronger spending

Here in Australia, upwards profit pressure is also building with the economy continuing its excellent recovery from the COVID-19 lockdowns, with companies exposed to higher consumer spending doing particularly well.

That includes retailers that have been reporting excellent results along with companies with exposure to building, renovation, job and real estate advertising and general economy facing stocks such as banks, media stocks and mining services.

Iron ore stocks take a breather

Not all of that was evident on Friday with the banks and iron ore miners taking a breather as the ASX 200 fell a little to close at 6800.4 points after a strong three sessions of gains.

The miners were led lower by BHP (ASX: BHP) down 1.9% to $46.13, Rio Tinto (ASX: RIO) 2.1% lower to $119.32 and Fortescue Metals (ASX: FMG) which dipped 2.2% to $24.32.

Fortescue’s fall happened despite remarks by chairman and founder Andrew “Twiggy” Forrest that preliminary net profit after tax (NPAT) for the first half for 2021 will be in the range of US$4 billion to US$4.1 billion – a big jump from last year’s US$2.45 billion thanks to elevated iron ore prices.

Retailers on the rise

Even in a cooling market there were plenty of positives with the retail companies Woolworths (ASX: WOW) and Wesfarmers (ASX: WES) having a great time. Wesfarmers rose 2.2% to a new record high of $53.41.

Other companies pushing up the index included CSL (ASX: CSL), telco Telstra (ASX: TLS) but the hot run of the buy now, pay later stocks took a pause with Afterpay (ASX: APT) and Zip Co (ASX:Z1P) both down.

Lynas and Coca Cola improve

One of the real highlights of Friday’s trade was rare earths miner Lynas (ASX: LYC) which rose 13.7% to hit a seven-and a half year high of $5.56, after the company made a deal with the US Department of Defence to build a commercial light rare earths separation plant in Texas.

Another stock that rose on better-than-expected news was Coca Cola Amatil (ASX: CCL) which lifted 0.9% after a December quarter update where drink volumes sold continued to be affected by COVID-19 related lockdowns but were improving towards the end of 2020.

That means pre-tax earnings are still running behind the year behind but not as far behind as feared.

The big banks were lower, with NAB (ASX: NAB) the worst offender down 0.7% to $24.12.

Small cap stock action

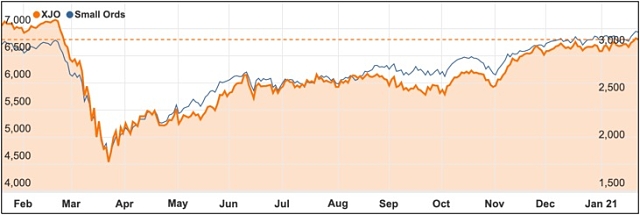

The Small Ords index rose 2.71% this week to close at 3170.8 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Lifespot Health (ASX: LSH)

Toronto-based cannabis investment fund Ela Capital has scooped up almost $800,000 worth of shares in Lifespot Health.

Lifespot claims this deal is the first time a major North American cannabis investment fund has invested in an Australian company.

Chief executive officer Matthew Golden told Small Caps he anticipates further North American cannabis investment vehicles will follow suite taking an interest in Australian cannabis stocks – because Australia is a “prime growth market”.

Medlab Clinical (ASX: MDC)

The US FDA has granted Medlab Clinical investigational new drug status for its lead candidate NanaBis, which was developed for treating cancer-related bone pain.

IND status paves the way for the CBD and THC-based NanaBis formula to be used in phase III trial in the US and joins the UK and Australia as approved trial regions.

During the trial, NanaBis will be evaluated as a monotherapy for treating cancer-induced bone pain.

Hammer Metals (ASX: HMX)

Hammer Metals’ has uncovered more copper-gold during a second round of drilling at its Mount Isa East joint venture with assays at hand from two holes at Trafalgar and one each at Shadow and Even Steven South.

Managing director Daniel Thomas said the results, particularly at Trafalgar, were “very encouraging”.

The two holes at the Trafalgar prospect hit mineralisation with a best result of 55m at 1.12% copper and 0.30 grams per tonne gold from 119m, including 16m at 1.77% copper and 0.49g/t gold from 149m.

Montem Resources (ASX: MR1)

As Montem Resources gears up to restart operations at the Tent Mountain mine next year, exploration at its Chinook Vicary project continues to yield success.

Montem completed 13 holes at Chinook Vicary, which returned maximum cumulative coal thickness of 61.1m and an average cumulative thickness of 22.7m.

A scoping study for Chinook Vicary is due for completion this month.

Angel Seafood (ASX: AS1)

Angel Seafood sold a record 2.4 million oysters during the December 2020 quarter, which was 36% higher than the amount sold in the corresponding December 2019 period.

The certified organic pacific oyster producer also reported a 35% increase in quarterly revenue to $1.8 million with cash receipts from customers 11.7% higher at $1.6 million.

Angel Seafood chief executive officer Zac Halman described the December quarter as “busy and productive”, claiming it was driven by the company’s three-pillar growth strategy which aims to double oyster production to 20 million annually.

De.mem (ASX: DEM)

Water treatment company De.mem achieved its first cash flow positive operational quarter for the three months ending December 2020.

Driving the maiden cash flow positive quarter was record sales and revenue which saw the company bring in $5.6 million – up 53% on the previous all time high during the September quarter.

All-up for CY 2020, De.mem hit its upgraded guidance taking in $16 million in cash for the period.

Blackstone Minerals (ASX: BSX)

Nickel explorer Blackstone Minerals signed a letter of interest with Singapore-based commodity trader Trafigura, which will see Blackstone taking nickel and cobalt from Trafigura.

The material will be fed through Blackstone’s proposed downstream processing plant which aims to supply products for Asia’s rapidly growing lithium-ion battery sector.

Blackstone managing director Scott Williamson said taking in third-party nickel and cobalt will add scale and reduce risk for its proposed Ta Khoa nickel mine and downstream processing facility.

The week ahead

With the Australia Day holiday shortening the coming trading week, the big news to look forward to are inflation readings which are out on Wednesday.

The Reserve Bank is in unchartered territory with ultra-low interest rates, so inflation readings assume a greater importance with analysts ready to pounce on any sign that consumer prices might be rising faster than expected.

Other local figures to be released include credit and debit card activity, consumer confidence and CommSec’s state of the states report, which will map the pandemic recovery path of the various states.

Offshore, the US Federal Reserve’s open market committee meeting is not expected to result in any policy changes but will still be watched for any traces of backing away from the current ultra-loose monetary policy.

Other US statistics include manufacturing, home prices, economic growth, personal spending and employment costs.

Chinese industrial profits and purchasing manager indexes round out a surprisingly busy roster of statistical releases.