Piedmont Lithium (ASX: PLL) ended the June quarter with US$18.88 million in cash reserves as it gets to work on its definitive feasibility report in the coming months.

The company says, in its report for the three months to June 30, that it completed an updated scoping study for its integrated mine-to-hydroxide project in the US state of North Carolina.

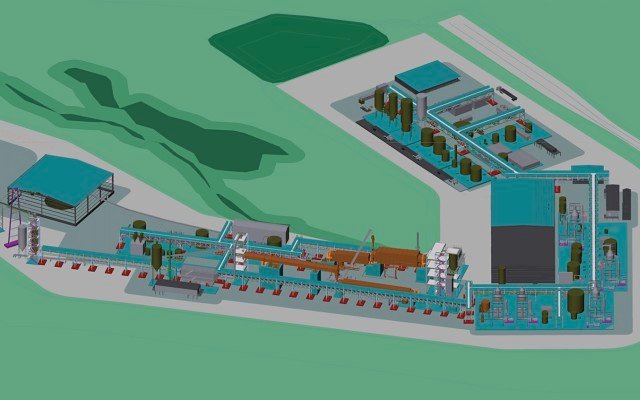

Piedmont, which is dual-listed on the NASDAQ exchange, is planning to produce 22,700 tonnes per annum of battery-quality lithium hydroxide in North Carolina, targeting electric vehicle and battery supply chains in the US and globally.

The company has reported a resource of 27.9 million tonnes of mineral resources grading 1.11% lithium oxide. Its project area is located on the Carolina Tin-Spodumene belt in North Carolina which hosted the Hallman Beam and Kings Mountain mines that provided most of the world’s supply of lithium between the 1950s and 1980s.

During the June quarter, Piedmont also completed a pre-feasibility study (PFS) for its proposed lithium hydroxide chemical plant at Kings Mountain. This study highlights a business model where that plant would convert spodumene concentrate bought on the world market into battery-grade lithium hydroxide.

Meanwhile, Piedmont also entered into a memorandum of understanding with Perth-based Primero Group for the delivery of the concentrator on an engineer, procure and construct basis.

Primero would also operate the plant for six years.

North Carolina offers exceptional infrastructure

President and chief executive officer Keith D Philips said he was very pleased with progress made during the quarter on Piedmont’s 100%-owned project.

“The PFS and scoping studies both demonstrate the economic benefit of developing a lithium chemical business in North Carolina … given its exceptional infrastructure, low operating costs and competitive tax regime,” he added.

The project is located in a region which hosts research and development centres for lithium and battery storage, major high-tech population centres and downstream lithium processing operations.

Robust balance sheet after capital raisings

“Piedmont’s robust balance sheet provides the ability for the company to continue to progress the development [of] the Kings Mountain site,” said Mr Philips. “We will be actively working on a definitive feasibility study in the coming months.”

During the June quarter the company completed a US public offering of 2,065,000 of its American Depositary Shares (ADS), each representing 100 of its ordinary shares, to raise US$13 million (A$18.6 million).

Piedmont also received commitments from existing non-US institutional and sophisticated shareholders, along with directors, for 120 million of fully paid ordinary shares, raising US$10.8 million.