Piedmont Lithium accelerates towards becoming a global lithium hydroxide producer

Piedmont Lithium’s initial lithium hydroxide chemical plant has an NPV of US$714m with potential for significant scale-up.

Piedmont Lithium (ASX: PLL, NASDAQ: PLL) plans to become one of the world’s few lithium hydroxide producers outside China and is targeting the rapidly expanding US lithium-ion battery and electric vehicle markets with its proposed North Carolina-based lithium hydroxide business.

The business could ultimately feature two chemical plants processing over 45,000 tonnes per year of battery-grade lithium hydroxide, according to recent company announcements.

Piedmont owns one site in Kings Mountain, North Carolina and is actively pursuing a site for a second facility, which is expected to be secured by year end.

The company will initially produce lithium hydroxide using spodumene sourced on the global market, then plans to include its own spodumene mining operations from its site in the heart of the Carolina Tin-Spodumene Belt as part of its expansion.

China produces about 80% of the world’s lithium hydroxide, and currently all the world’s hard rock spodumene is converted in China.

Piedmont plans to become one of only four integrated spodumene miners and lithium hydroxide producers globally – and the only one outside China.

Electric vehicle market

If its strategy comes to fruition, Piedmont could become the world’s lowest-cost lithium producer and an independent spodumene converter providing a US-based source of lithium for the rapidly growing global electric vehicle market.

It will have the only project in the US focused on converting spodumene to lithium hydroxide for the country’s battery storage and EV industries.

Lithium hydroxide is required in the high-nickel cathode materials required in longer-range batteries, and spodumene is the feedstock most commonly used to produce hydroxide.

There are 31 auto manufacturing plants and nine major international ports with access to Europe within a few hours’ drive of the Piedmont locations.

The company claims this will offer the US and Europe a critical, sovereign and alternate supply source of this high-quality lithium hydroxide which is vital in the lithium-ion batteries that power EVs.

Piedmont’s initial chemical plant would provide a superior logistic route for spodumene from Canada, Brazil, Western Europe and Western Africa which currently must travel via China before it arrives at OEMs (car manufacturers).

Piedmont president and chief executive officer Keith Phillips said he expects global automotive companies will increasingly seek alternative lithium hydroxide supplies to China as they roll-out the electrification of their fleets.

“North Carolina is ideally positioned to benefit given its proximity to major auto markets in the US and Europe, and the deep lithium talent pool resident in the region.”

“Our location provides a low-operating-cost advantage with a potential 98% reduction in the supply chain route length from mine to EV.”

“And most importantly, our Piedmont operations will be one of the cleanest and most energy efficient operations of its type in the world, with a positive ESG profile. OEMs prefer spodumene-sourced hydroxide for sustainability reasons. The chemical plant will be powered entirely by local low carbon sources, and will easily meet stringent US labour, environmental, and safety standards.”

“Our spodumene concentrate will only have a 30km (20 mile) journey through its production cycle. This compares to a traditional 18,000km (11,000 mile) trip for spodumene mined in Australia, transported to China for conversion and then shipped to the US Auto Alley,” he added.

Investors back Piedmont’s plans

Investors are backing Piedmont’s strategy, after putting cash into the company’s US public offering last month.

Under the public offer, Piedmont issued 2.065 million American Depositary Shares on the Nasdaq Capital Market (NASDAQ) to raise US$13 million (A$18.6 million), and a contemporaneous Australian private placement raised an additional US$7.6 million.

This will be used to continue development of the company’s Piedmont lithium project, including a definitive feasibility study, test work, permitting, and ongoing land consolidation.

‘Excellent’ economics in both scenarios

The topping up of its cash reserves follows Piedmont delivering a pre-feasibility study in late May that evaluated the viability of the initial chemical plant.

At the same time, a scoping study revealed even more robust economics into developing an integrated spodumene mine and lithium hydroxide plant.

Under the pre-feasibility study, the project was given a US$714 million net present value and 26% internal rate of return (IRR).

With spodumene sourced from the open market, the plant would generate 22,700tpa of lithium hydroxide for 25 years.

The initial capital outlay is estimated at US$377 million to deliver annual earnings before interest tax depreciation and amortisation of US$149 million.

Meanwhile, the scoping study gave a local spodumene mine and downstream plant an NPV of US$1.1 billion, with an after-tax IRR of 26%.

Forecast annual EBITDA has been estimated at US$218 million after capital expenditure of US$545 million.

Revenue under both proposals is based on an assumed long-term average lithium hydroxide price of US$12,910/t and annual lithium hydroxide production of 22,720t.

Piedmont spodumene project

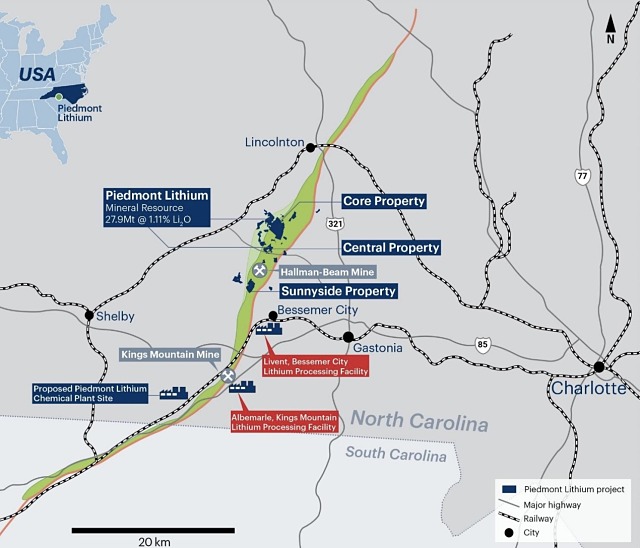

Piedmont’s namesake project is located in North Carolina’s Tin-Spodumene Belt and is along trend of the former Hallman-Beam and Kings Mountain mines.

The project is also near Albemarle and Livent’s lithium processing facilities.

Piedmont hosts a resource of 27.9Mt at 1.11% lithium for 764,000t of contained lithium carbonate equivalent.

The Piedmont Lithium project located in the world class Carolina tin-spodumene belt.

At the project, Piedmont is proposing to develop a shallow open pit quarrying operation, with most of the resource within 100m of surface.

Additionally, there remains potential for upside with mineralisation open along strike and at depth.

As well as producing a lithium hydroxide from spodumene, Piedmont is proposing to sell its by-products of quartz, feldspar and mica to help lower operating costs.

The scoping study assumes annual spodumene concentrate production of 160,000t after capital outlay of US$168 million to develop the mine and concentrator.

Premier location for lithium hydroxide plant

Piedmont claims North Carolina is a “premier” location to develop a lithium mine and downstream plant with the US state being the “cradle” of the world’s lithium industry and possessing more than 50-years in lithium processing experience.

The company pointed to nearby infrastructure, a deeply experienced talent pool, access to inexpensive power, and a stable regulatory environment with favourable taxes. Forbes Magazine rated North Carolina the best state to do business the past three years in a row.

Leveraged to take advantage of rising demand

Demand for battery-quality lithium hydroxide is expected to grow 39% each year through to 2028 as EV adoption takes off – fuelled by falling battery costs and the need to increase driving range.

Global EV sales have grown at a 60% compound annual growth rate (CAGR) since 2010.

With lithium-fuelled EVs enjoying a 67% reduction in emissions to a comparable internal combustion engine model, the world’s 13 top automakers plan to release more than 400 EV models in the next five years.

Additionally, with this greater range capability in the high-nickel batteries in new EV models, high-quality lithium hydroxide converted from spodumene is taking market share from lithium carbonate sourced from brine.

By 2023, it is anticipated the world will be in the midst of a lithium hydroxide shortage.

With lithium hydroxide prices at three-year lows, Piedmont expects annual EBITDA in its studies to rise $20 million for every US$1,000/t increase in the chemical’s price.

Meanwhile, a Roskill evaluation has placed Piedmont in the first quartile of the cost curve compared to other spodumene or lithium carbonate-to-hydroxide converters.

Over the next 12 months, to take advantage of this scenario, Piedmont plans to lock in requisite regulatory approvals, complete bankable feasibility studies, secure offtake agreements, and cement project financing.