Why the oil price could spike in the coming weeks

Oil prices recently rose to two-year highs with Brent Crude now above US$60 a barrel and WTI Crude seeking to pierce that level soon.

Much has been said, and rightfully so, about oil’s likely diminishing role in the long term future as we move off fossil fuels to more sustainable energy sources.

The most obvious industry that we will witness this shift is in the motor vehicle industry as the trend to electric vehicles is now well set in motion with billions of dollars being invested and government policy coming into play.

However that shouldn’t discount the role oil will play in the short to mid-term, as the world’s most traded commodity is still needed around the globe to power society, particularly with the rising middle class in many undeveloped nations seeking to increase the quality of their lifestyle.

Further to our current continued dependence on oil are more pressing matters that could see the price of oil rise sharply in the near term, the most alarming being recent events in the Middle East.

Middle East tensions mounting

Adding fuel to the fire of the recent rise in oil prices was Saudi Arabia’s purge of billionaires and princes, which the mainstream media is touting as a crackdown of the ongoing corruption in the gulf state, with two Saudi princes even being killed in the roundup.

There’s little doubt the country has been plagued by corruption and human rights violations but are the series of events currently taking place the answer to the nations woes?

Digging deeper under the surface it becomes clear that this was a well orchestrated and blatant power grab for the rapidly declining Saudi nation, at the same time war drums are being beaten throughout the Middle East supported by all the familiar parties in the region.

New dictator in Saudi Arabia is pro war

The newly installed de facto leader of the Saudi Kingdom is 32 year-old Crown Prince Mohammed bin Salman.

This is the same prince who in March 2015 launched war against one of the poorest nations, Yemen, that is now facing a hunger crisis of epic proportions.

Saudi Arabia’s new Crown Prince Mohammed bin Salman.

Much to the blind eye of the United Nations and other supposed worldly powers that are supposed to prevent such atrocities.

The Saudi’s, and allied nations, are blaming the Houthi rebels for overthrowing the former US and Saudi friendly leader in Yemen, with claims made that Iran was backing the change in government through Hezbollah.

To further highlight intensions, in May this year Salman warned, “We won’t wait for the battle to be in Saudi Arabia, instead, we will work so that the battle is for them in Iran, not in Saudi Arabia.”

Push for conflict with Lebanon and Iran

The Prime Minister of Lebanon, Saad Hariri, resigned under mysterious circumstances on November 4th whilst in Saudi Arabia. As a result, the Lebanese government is now on the brink of collapse.

Tensions are now mounting between regional Sunni powers and Iran (majority Shia), with both Bahrain and Saudi Arabia ordering its citizens to leave Lebanon.

Bahrain is also blaming Iran over a mysterious oil pipeline blast, which if history serves correct, could just as likely be a false flag event to try spark a major war.

As it is well known to some that the long term plan set in motion days after the now questionable September 11 terrorist attacks, if not prior, was that that the US planned to attack and destroy the governments of seven countries in five years. Those countries listed by US four star General Wesley Clark were: Iraq, Syria, Lebanon, Libya, Somalia, Sudan and Iran.

Trump even labelling Iran “a terrorist nation like few others”. Whilst perhaps true it seems odd that the US would ally with Saudi Arabia when even Trump previously accused the Saudi establishment for their role in 9/11, but I digress.

Looking back it’s easy to see how the public was sold on these wars over the years with talk of WMDs and other lies, this time will likely be no different as Lebanon and Iran are being placed on the chopping block.

A simple act by Iran of blocking the Straight of Hormuz could see oil prices surge overnight let alone once missiles are launched.

World renowned trends forecaster Gerald Celente believes oil prices will pierce through the US$100 a barrel level should war break out.

Instability in Iraq continues

Following the successful Iraqi Kurdistan independence referendum in September, the nation of Iraq is now fractured more than ever.

With Iraq being the fifth largest reserve holder of oil you can bet the fight to control the commodity is far from over. Simply put, if Iraq’s number one export was broccoli I doubt we would see the foreign intervention the country has seen over the decades.

All these factors are igniting concerns about oil production and stability in the region, making a bullish case for oil.

Saudi Aramco IPO

Seperate to the escalating tensions in the Middle East, the Saudi national oil company known as Aramco, is planning to IPO soon, a move which could make it one of the most valuable companies in the world.

The estimated market cap of the oil giant ranges between US$2-10 trillion, with a cost of production between $2-10 a barrel.

Aramco currently has the second largest proven crude oil reserves and is the second largest daily producer of oil.

No doubt with Aramco’s upcoming listing the Saudi’s want the oil price higher. For every few dollars the oil price rises translates to millions if not billions of dollars more in revenues.

OPEC and Russia agree to cut supply

Russia and Saudi Arabia have been strengthening business ties, particularly through their mutual dependence on oil.

The International Monetary Fund recently stated that Saudi Arabia needs oil prices at $70 per barrel in 2018 to break even on their budget, although others argue that is not the case.

With Russia claiming $40 a barrel is enough to see them by.

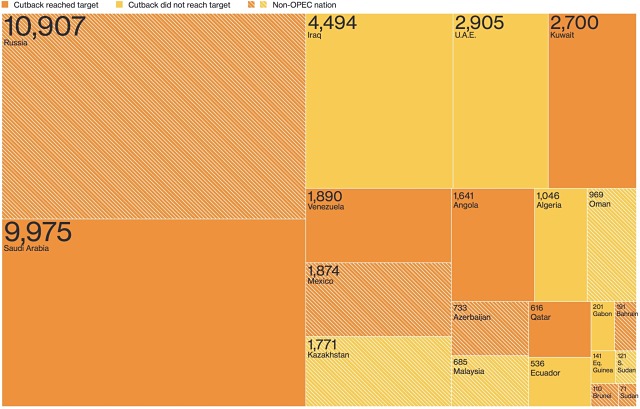

Production cuts of 97% were targeted in September amongst OPEC nations and others to keep supply from flooding the market, the outcomes of which are displayed here:

Crude oil production, thousands of barrels a day for September 2017. Sources: OPEC and Bloomberg.

However OPEC is facing stiff competition in recent times with influencing the oil price with countries such as Brazil, US, China, Canada and Mexico having an increasing influence on the commodity.

On November 30th OPEC will meet again in what many analysts predict will see agreements made to continue cuts in production beyond the presently agreed March 2018 end date.

Technicals of the oil price chart

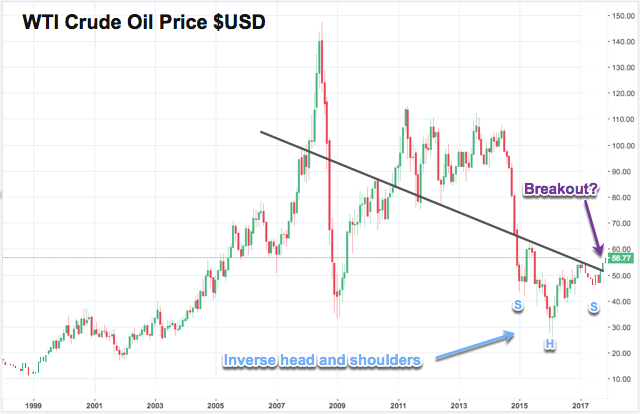

Looking at the technical charts for WTI crude oil, we see an inverse head and shoulders pattern potentially playing out.

This is typically seen as a bullish sign used in technical analysis that shows the reversal of a current downtrend, also referred to as a head and shoulders bottom.

Please note this in not financial advice and technical charts are not a guaranteed predictor of where prices will go. Please seek professional investment advice before making any investment decision.

If oil prices do indeed climb higher we could see stocks that are leveraged to the commodity also rise at a rapid rate.

For now all eyes remain on the Middle East to see what results over the coming day and weeks.