Oil prices have crashed more than 30% after OPEC failed to reach an output deal with its allies, triggering a price war between Saudi Arabia and Russia.

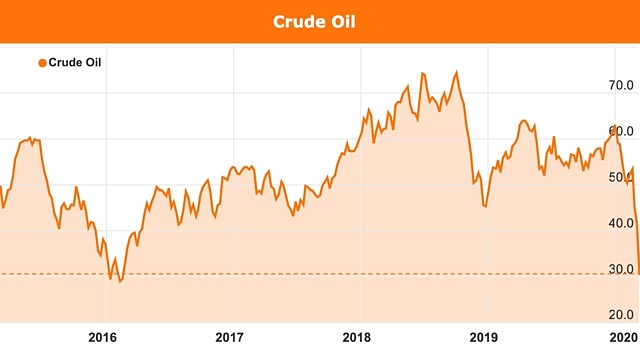

Mere seconds after the market opened on Monday, global benchmark Brent crude futures fell 31.6% to US$31.02 per barrel, its lowest level since February 2016.

By mid-afternoon trade, West Texas Intermediate futures were also down 33.1% to US$27.60/bbl, exceeding its worst-ever trading day recorded at the start of the Gulf War in 1991.

By late Monday, Brent was still trading 25% lower at US$33.66/bbl while WTI crude futures were down 27% to US$30.10/bbl.

This is the latest blow to a market that is already suffering from the spread of COVID-19 and particularly, as a result of government-imposed travel bans.

Global demand for energy has plunged, along with the airline and tourism industries, as people have cut back on travel around the world and businesses have scaled back or shut down in the wake of the health crisis.

Analysts are concerned the virus outbreak will continue to slow economies, leading to even lower demand for energy.

OPEC fails to reach output deal

The crash is being attributed to the Organization of Petroleum Exporting Countries (OPEC)’s failure to strike a deal with its allies regarding production cuts, which was anticipated to alleviate the negative impact the coronavirus has had on the oil market.

As oil prices took a dive last month, OPEC proposed to extend existing oil production cuts of 1.7 million barrels per day (MMbpd) until the end of 2020 and proceed with an additional 600,000bpd cut until the end of the second quarter.

However, talks broke down in Vienna last week with Russia refusing to agree to OPEC’s deal.

Furthermore, the OPEC+ meeting concluded with no directive for the production cuts currently in place, which are set to expire at the end of March. This effectively means nations will be free to pump at will.

Over the weekend, Saudi Arabia further escalated the situation by slashing its official selling prices for April by $6 to $8, which analysts have said was an effort to retake market share and heap pressure on Russia.

The kingdom also hinted at ramping up production by more than 2MMbpd, which means a potential supply glut could add further pressure to prices.

Goldman Sachs analyst Damien Courvalin was quoted by media to have said the OPEC and Russia oil price war “unequivocally started this weekend when Saudi Arabia aggressively cut the relative price it sells its crude by the most in at least 20 years”.

“The prognosis for the oil market is even more dire than in November 2014, when such a price war last started, as it comes to a head with the significant collapse in oil demand due to the coronavirus,” he said.

Analysts including Goldman Sachs, as well as former Exxon senior Middle East advisor Ali Khedery, have warned of huge geopolitical implications and prices dropping as low as US$20/bbl.

Although others including political risk consultancy Eurasia Group told media they are hopeful that Saudi Arabia and Russia can come to an agreement.

In particular, Iran and Venezuela have been named as producers that would suffer the most from crashing prices, since their oil-based economies are already under pressure from US sanctions.

Impact on the ASX

The Australian stock market lost more than $137 billion in value on Monday, representing the biggest single-day loss since the Global Financial Crisis.

At close of trade, the ASX 200 index had fallen 7.33% or 456 points to finish at 5,761.

Oil and gas stocks led the losses, with major players Woodside Petroleum (ASX: WPL) dropping 18.3% to $21.50 and Santos (ASX: STO) losing more than a quarter of its value to $4.89.

Papua New Guinea-based oil producer Oil Search (ASX: OSH) sank 20% on Monday morning and continued to slide by more than 35% by afternoon trade to close at $3.30.

Beach Energy (ASX: BPT) has also lost close to 20% of its value, falling to $1.33 by close of trade.

Of the small cap oil and gas stocks, Karoon Energy (ASX: KAR) and Pancontinental Oil & Gas (ASX: PCL) have taken the biggest dives, respectively falling 47% and 50% by close of trade on Monday.