Oil markets suffer as coronavirus fears linger, gold becomes safe haven again

The worldwide threat of coronavirus has caused oil prices to fall while gold has recovered and is continuing to climb.

As the world reels from the rapidly-spreading coronavirus outbreak, oil is one of many commodities currently suffering from investor fears.

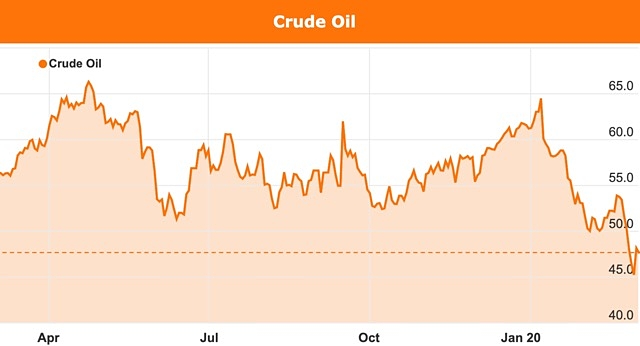

Oil prices last week fell to their lowest level in 13 months, but the anticipation of production cuts has recently helped to boost confidence.

And while many consumers have been panic-buying toilet paper in Australia’s supermarkets, investors are instead relying on gold’s traditional role as a safe haven asset.

Coronavirus fears hurt oil markets

Late last week, oil prices dived to their lowest level in more than a year amid investor fears that the fast-spreading virus could slow the global economy.

Last Thursday, Brent crude dropped as low as US$50.97 per barrel, while West Texas Intermediate futures fell to US$47.09/bbl – their lowest level since January 2019.

Crude oil prices in USD.

In early February, the joint technical committee of the Organization of the Petroleum Exporting Countries (OPEC) recommended extending existing production cuts of 1.7 million barrels per day (MMbpd) until the end of 2020, and to proceed with an additional 600,000bpd cut until the end of the second quarter.

OPEC Conference president and Algeria’s energy minister, HE Mohamed Arkab, said the recommendations were in response to the negative impact that the coronavirus epidemic has had on oil demand and oil markets.

OPEC has since called for further cuts of 1MMbpd, although Russia has yet to agree to any new adjustments.

OPEC and its partners are expected to meet in Vienna on Thursday and Friday to discuss additional steps to support the oil market.

According to Reuters, Russian oil producer Lukoil’s vice president Leonid Fedun said a 1MMbpd production cut would be sufficient to balance the market and lift prices to US$60/bbl.

The anticipation of OPEC’s proposal has led to optimism in the oil market, with prices rebounding this week to current levels of US$52.57/bbl for Brent crude and US$47.85/bbl for WTI.

Gold prices continue to rise

Meanwhile, investors have once again turned to gold as a safe haven to hedge against risk, sending prices for the precious metal upward.

On Wednesday, gold was trading at US$1,643 per ounce – up more than 3% from Tuesday and 2.7% over the past month.

Gold prices have been rallying since mid-2019 on declining economic growth and geopolitical uncertainty, stemming particularly from the US-China trade war and Australia’s falling dollar.

Gold price per ounce in USD.

Prices steadied at the start of 2020 but have now continued on their incline.

Gold is generally considered a safe investment as it typically retains its value during periods of volatility.

According to media reports, Goldman Sachs head of global commodities research Jeff Currie told clients that gold is “immune” to the virus.

“While so much about the current environment remains unclear, there’s one thing that isn’t – gold,” he said.

Mr Currie also noted that gold has outperformed other safe haven assets such as the Japanese Yen or Swiss Franc.

He said this is a trend he sees continuing “as long as uncertainty around the full impact of COVID-19 remains”.

Interest rates at new record low

The Reserve Bank of Australia has also responded to coronavirus fears, this week cutting the official interest rate to a record low of 0.5%.

In addition, the RBA indicated more cuts could be on the horizon to protect the Australian economy from a looming recession.

RBA governor Dr Philip Lowe said the virus outbreak is currently having a “significant effect” on the Australian economy, particularly in the education and travel sectors.

“The uncertainty that it is creating is also likely to affect domestic spending,” he added, noting that GDP growth in the March quarter is expected to be “noticeably weaker”.

The coronavirus threat continues

According to the latest statistics by the World Health Organization, there are more than 90,000 confirmed cases of COVID-19 infections globally, with over 80,000 of these in China, and more than 3,100 related deaths have been reported.

Last weekend, Australia reported its first death from the virus – a Western Australian man who was a passenger on the Diamond Princess cruise ship that was quarantined in Japan earlier this month. The man died on home soil after the Australian passengers were evacuated to Darwin for an extended quarantine period.

Australia also reported its first cases of human-to-human transmission of the virus, with two people contracting it without leaving the country.

As of Wednesday, there are currently 33 confirmed cases of COVID-19 in Australia.

In addition to travel restrictions that have been in place for the past month, the Australian government last week activated its health sector emergency response plan to tackle a predicted pandemic.

As a result, consumers have gone into panic mode with numerous reports circulating of household staples, especially toilet paper, being stripped from supermarket shelves nationwide.