Cannabis is on track to quadruple into becoming a multibillion-dollar industry over the next 10 years – acting as both a production and distribution hub for the Oceania region.

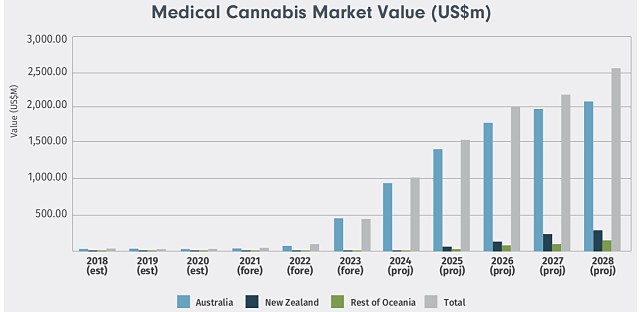

Followed by New Zealand, Australia will represent the largest market that generates around US$2.5 billion (A$3.5 billion) per year in 2028.

That’s the verdict of a new research report titled The Oceania Cannabis Report published by Australian research consultancy group Prohibition Partners, as part of its exploration into commercial, legal and social trends in the region, in order to provide a detailed analysis of the area’s medical, recreational and industrial cannabis markets.

Oceania is comprised of more than 30 countries and territories, including Australia, New Zealand and the numerous Pacific Island Countries and Territories (PICT) of Polynesia, Micronesia and Melanesia.

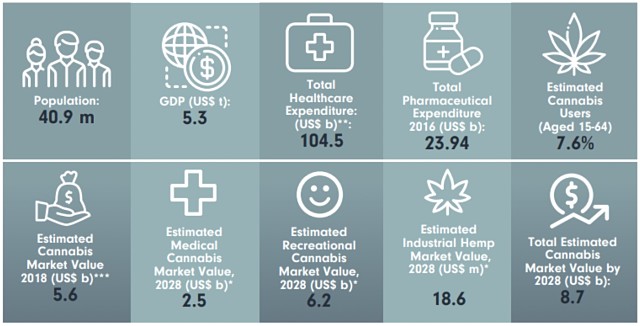

Despite sporting a relatively modest population – Oceania contains a mere 41 million people – the region generates a total of US$5.3 trillion (A$7.3 trillion) in annual GDP.

For medical cannabis companies, one of the key market indicators reveals commerciality is total healthcare spend, which in Oceania stands at US$104.5 billion (A$145 billion) per year.

But Oceanic countries may be less indicative of torrential demand, and more-so a supply-rich savannah, especially when it comes to cannabis.

Blooming supply line

According to the new research report, the cannabis industry in Oceania is in “an exciting phase of development” with Australia poised to become a “production powerhouse” in the region while New Zealand considers legalisation of both medical and recreational cannabis by 2020.

At present, Australian production is only just getting started, which has meant the vast majority of cannabis products are currently supplied by Canadian growers. Many, of which, have decided to set up in Australia via collaborations with Australian firms.

According to Prohibition Partners’ report, the expanding medical cannabis market will boost the bottom line of Canadian companies for whom Australia is a major export market.

But that may only be the tip of the iceberg given what Australia could produce with its advantageous climatic conditions, strong investment flows and plenty of fertile conditions for labs and growing facilities, required to generate a conveyor belt of high-quality cannabis products over the coming decade.

According to pharmaceuticals wholesaler company Anspec and its chief executive officer Peter Comerford, Australia is perceived as the de-facto “most trusted source” of medicines in the region as well as fresh produce and raw commodities.

It is estimated that more than 72% of Australian exports are destined for Asia, worth around US$16 billion (A$22.1 billion) every month.

Currently, mining and agriculture make up the lion’s share of these exports – but Australian legislators intend to add cannabis cultivation and overseas shipments to its already-impressive export list.

To Asia with pot

Australia’s biggest international markets in recent decades have been countries such as China, Singapore, Indonesia, and Japan, with the “Made in Australia” reputation continuing to bloom rather nicely, even for products such as milk powder.

In the cannabis industry, Asian countries are also expected to liberalise their drug policies and unshackle cannabis from its historical restriction to form a “strong cultivation and export framework in Australia”, that has the capacity to feed mushrooming Asian demand.

China, the largest of Oceania’s export partners, accounts for more than 30% of exports to Asian countries and is forecast to have a medical cannabis market worth US$128.8 billion (A$178 billion) in the near future.

The second largest export partner, Japan (12% of Australian exports) is expected to mature into a US$11.6 billion (A$16 billion) medical cannabis market.

However, these numbers are highly dependent on the rate of medicinal cannabis adoption by consumers, many of whom still perceive the drug as a potentially dangerous substance – despite the growing body of evidence that suggests it can be safely applied in a range of products including cosmetics and even repurposed to help veterinary care.

Prohibition Partners says the region could become very attractive to investors in the near future as Australia leverages its optimal growing conditions in order to offer a superior product, in comparison to Canadian growers which have a relatively higher cost base to produce the most commercially-viable strains.

Going forward, increasingly-more favourable legislative conditions are also expected.

“Anticipated changes to the law will create an environment that will enable the region to capitalise on strong growth within the industry,” the report says.

Potentially as a sign of things to come for larger countries, Oceania’s smaller island nations such as the Commonwealth of Northern Mariana Islands recently moved from “total prohibition to “total legalisation” for both medical and recreational use.

The report claims that although foreign companies have had a head start, they come into Australia without really knowing the local market, while domestic Oceanic companies are “ramping up operations” with the ultimate aim of securing a larger piece of global market and to be ready to pounce as first-movers, as and when cannabis products become more ubiquitous while Aussie and Kiwi consumers start to buy them in droves.

Demand-side

Oceanic demand is most-influenced by Australia, the region’s largest economy.

While the current number of Australian medicinal cannabis users stands at around 1,000, the Oceania report forecasts this number to reach almost 400,000 by 2028 – a monumental growth rate that suggests a thriving industry over the coming decade.

To date, estimates of demand for medicinal and recreational cannabis consumption indicate a healthy market that is restricted by existing legislation rather than a lack of demand.

“In states such as Victoria, patient numbers are low, because of the process rather than the demand,” says the report.

In August 2018, WA-based Little Green Pharma became the first company to grow and produce medicinal cannabis for sale in Australia. Although the company is part-owned by Canadian LGC Capital, this milestone move could help to reduce the country’s dependence on Canadian imports.

With more Canadian and Australian companies setting off into the field to establish vertically-integrated operations that serve growing demand around the world, the implication for investors is that a strong connection between Canadian and Australian companies will only benefit both countries – as they emerge as the world leaders in advancing both cannabis consumption and production, in both medicinal and recreational applications.