Nova Minerals (ASX: NVA) has delivered upgraded gold recoveries from pre-feasibility metallurgical test work at the RPM deposit within its Estelle project in Alaska.

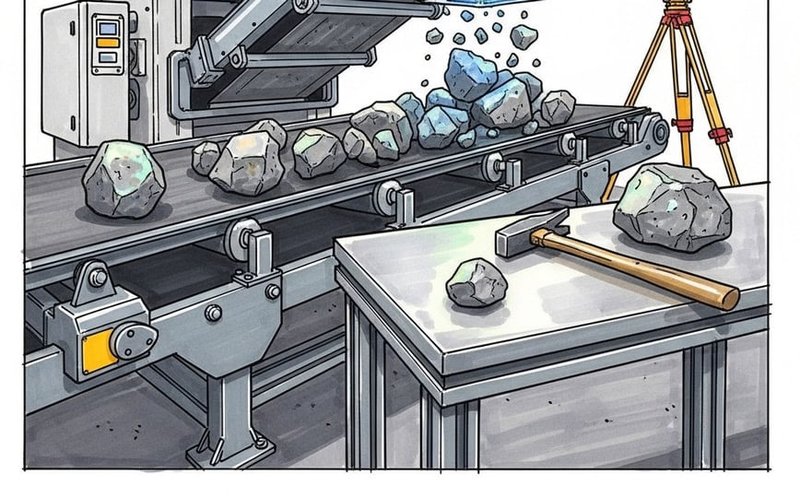

The company partnered with METS Engineering to evaluate the orebody’s amenability to sensor-based ore sorting technology at the facilities of Steinert Mining.

Steinert has recommended that Nova adopt a multi-pronged approach to the project’s flowsheet — incorporating ore sorting, heap leaching and carbon in pulp (CIP) / carbon in leach (CIL) processing — to obtain a relatively high-grade concentrate in a low-mass yield.

High-Grade Feed

Nova expects the advanced sorting technology to increase the volume of high-grade feed to Estelle’s processing circuits, optimise resources and maximise orebody value.

Ore grading more than 2 grams per tonne gold will be fed directly into a carbon in pulp (CIP) / carbon in leach (CIL) circuit to optimise recovery.

Ore below 2g/t gold will be processed through an ore sorter—where single-pass testing on a 1,000 kilogram bulk sample from Estelle upgraded the material from 1.32g/t to 5.72g/t.

Lower-grade ore will undergo heap leaching, with column tests showing gold recovery potential as high as 68.7%.

Nova will conduct additional engineering and economic trade-off studies to determine the optimum size of a heap leach operation and CIP/CIL plant to achieve the best economic outcomes for the Estelle project.

Proven Technology

Particle density x-ray transmission ore sorting is a proven technology many mines implement worldwide as part of a pre-treatment concentration process.

X-rays examine the density of the rock being sorted in order to separate a target mineral, ore or element from the waste rock prior to haulage, crushing and processing stages.

Rejecting a considerable proportion of lower-grade rock before processing effectively increases the mill feed grade and reduces energy requirements and tailings generation.

This can result in a more environment-friendly mining operation with improved overall mine efficiencies and economic benefits.

Quality and Scalability

Nova chief executive officer Christopher Gerteisen said the RPM results show the “exceptional quality and scalability” of the Estelle project.

“The ability to extract up to 68.7% gold from lower-grade material through heap leaching combined with a 4.33 times upgrade using ore sorting technology is a significant technical breakthrough,” he said.

“Our flowsheet approach has the potential to be a best-in-class strategy for maximum gold recovery, efficient capital deployment and lower processing costs.”

Estelle Drilling Program

Nova launched a 15,000m drill program across the Estelle project area in June with a focus on advancing the RPM and Korbel deposits toward feasibility and permitting, and initiating a maiden gold-antimony resource at the Stibium prospect.

Surface sampling at Stibium defined a substantial mineralised zone with 12 rock samples grading 30% antimony to a maximum 60.5%, 10 soil samples grading 0.1% antimony with a high of 2.8%, 16 rock samples with a minimum grade of 5 grams per tonne gold to a maximum 141g/t, and 35 soil samples from 1g/t gold to 25.6g/t.

“With gold and antimony trading near historic highs, the strategic significance and potential economic return of these near-surface assets underscores our planned strong growth trajectory and long term value proposition,” Mr Gerteisen said.

DoD Antimony Grant

During the quarter, Nova progressed a US Department of Defence grant application to fast-track an antimony mineral resource estimate and commence antimony production at Estelle.

A successful application would enable the company to deploy additional diamond rigs and extend its 2025 campaign to include drilling at Stibium and initial testing at the prospective Styx target.

Peer companies MP Materials and Perpetua Resources have previously secured US government funding to advance domestic antimony supply, highlighting the program’s potential to support strategic mineral development.

Financial Metrics

Nova had $9.08 million cash at hand and no debt at the end of June, with the company raising $18.4m subsequent to the period through a US offering for drilling and exploration programs, feasibility studies and general working capital.

Notable expenses during the period included $1.9m in exploration and evaluation costs, $432,000 in administration and corporate costs including marketing and share registry fees, and $797,000 in investor relations and consultancy advice fees relating to the US antimony grant.

Payments to related parties totalled $262,000 and included executive management remuneration and non-executive director fees.