Not enough gas: Queensland’s CSG-LNG sector faces supply crunch

In the past year alone, more than 3,000 petajoules of Queensland’s 2P gas reserves have been written off.

One third of Queensland’s $84 billion liquified natural gas industry will be on the brink of closure come 2025 due to a shortage of coal seam gas reserves, says consultancy EnergyQuest.

According to a new 130-page report which is set to be released in full next week, the supply concerns stem from an emerging forward reliance for feedstock on gas reserve estimates that could fall well below delivery expectations.

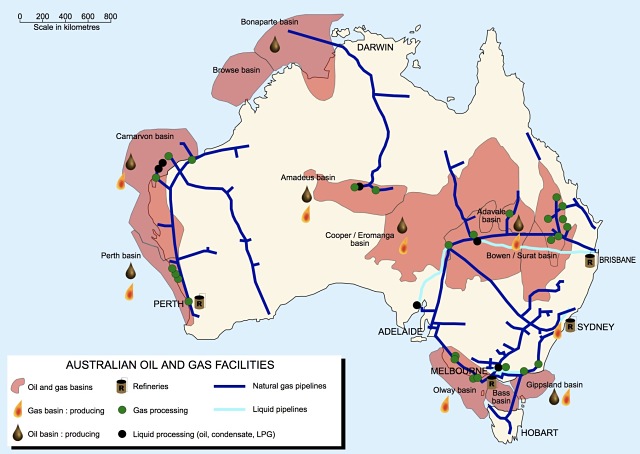

There are currently three LNG projects operating on Curtis Island, off Gladstone, comprising six trains. The projects rely on CSG sourced from Queensland’s Bowen and Surat Basins.

In addition to the majors Shell and Santos (ASX: STO), some smaller companies exploring in these basins include Blue Energy (ASX: BUL) and Comet Ridge (ASX: COI), with Senex Energy (ASX: SXY) actually producing.

Should EnergyQuest’s supply crunch be realised by 2025, output could be cut to four LNG production trains.

The forecast supply deficit could be exacerbated by potential political pressure for Gladstone LNG operators to divert gas to the domestic market, namely New South Wales and Victoria.

Changed market conditions

EnergyQuest’s analysis, which is underpinned by corporate and government drilling data from around 10,000 Queensland CSG wells, would certainly not come as a surprise to many industry spectators.

The simultaneous development of the LNG export projects a few years ago prompted an unprecedented CSG construction boom, as CSG explorers such as Arrow Energy, capitalised on the demand from the LNG developers to feed the massive plants.

When construction of the plants was underway, many analysts warned the LNG operators Shell, Origin Energy and Santos, that they had been too bullish in their reserve estimates.

EnergyQuest chief executive officer Dr Graeme Bethune told Small Caps that market dynamics had changed since that initial criticism over gas supply.

“The LNG operators were hoping there would be enough domestic gas in the market and there would also be significant gas development in NSW and/or unconventional gas discoveries in the Cooper Basin,” he said.

Major oil and gas hotspots across Australia.

“But, in fact, none of that has really happened and what has happened instead is that reserves in offshore Victoria have declined faster than expected.”

“One of the reasons we expect at least one of the LNG trains to effectively be mothballed is because of the need to divert gas into the sovereign states,” Dr Bethune explained.

LNG plants yet to achieve full capacity

Queensland CSG supplied 25% of east coast demand in 2018, and EnergyQuest anticipates this number to increase.

At present, the LNG plants are already operating below the full capacity of 25.3 million tonnes per annum compared with over 100% of nameplate performance occurring at west coast LNG plants.

According to EnergyQuest, the three Queensland CSG-LNG plants operated at an average 82% capacity in 2018, with the Santos-led GLNG project having already negotiated down its offtake contracts from 7.2Mtpa to 6Mtpa.

“Building six LNG trains in Queensland using CSG was bold and visionary but ultimately a bridge too far,” Dr Bethune said.

“Rather than Queensland exports ultimately rising to 25Mtpa, current export levels are likely to be as good as it gets and maintaining these will require drilling an ultimate total addition of more than 18,000 wells.”

According to estimates published by the Queensland Government, 2P CSG reserves peaked in June 2015 at 42,733 petajoules. By June 2018, 2P reserves were down to 35,074PJ, a drop of 7,660PJ after only 3,570 PJ of production.

EnergyQuest noted that Arrow Energy’s Surat Basin acreage is the major potential source of uncontracted 2P reserves, but 80% of this is in the least certain category.

Should Queensland end up with four LNG trains, Dr Bethune said it would not be a complete disaster.

“Queensland will still be one of the world’s biggest LNG exporters,” he told Small Caps.

2018 was a record year for LNG exports from the Port of Gladstone totalling 20.58Mt.