Northern Cobalt dominates NT for cobalt exploration with grant of latest tenements

Northern Cobalt (ASX: N27) has pegged up more ground around its flagship Wollogorang cobalt project in Australia’s Northern Territory – boosting its cobalt landholding in the region by 341%.

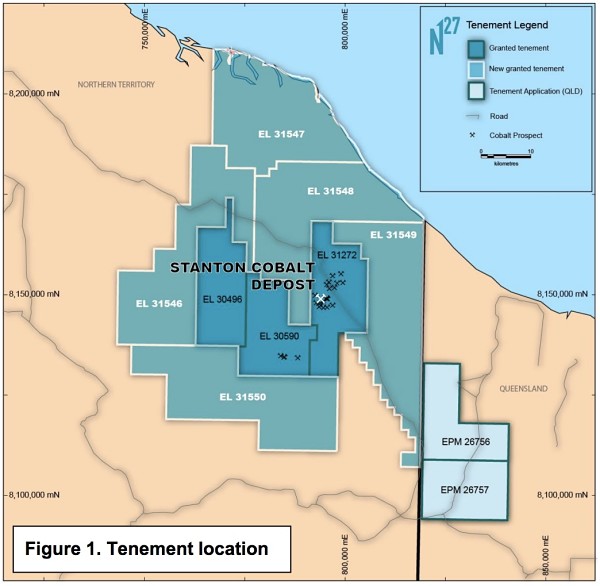

Five new tenements surrounding the existing project have now been granted, which has increased the project’s tenure from 1,131 square kilometres to 4,986sq km.

“The Stanton cobalt deposit is only the beginning in the region for Northern Cobalt,” Northern Cobalt managing director Michael Schwarz said.

“As our geology team begins to unlock the exploration space of the metalliferous Gold Creek Volcanics, we see the potential for multiple examples of cobalt mineralisation in the region – hence, the securing of the ground position announced today,” Mr Schwarz added.

Wollogorang now stretches throughout the Northern Territory’s top end in the east and hugs the Queensland border. A further two tenements are also under application for prospective ground across the border in Queensland.

According to the company, historic rock chip samples taken from the Queensland tenements under application returned elevated cobalt values.

Location map of Northern Cobalt’s new tenements.

Meanwhile, Northern Cobalt has planned a more definitive approach to exploration which will involve using airborne geophysical data and a mobile drill rig to pull out samples for analysis beneath the sedimentary cover.

The next round of airborne magnetics and radiometric surveys are due to fly over both existing and newly granted tenements prior to the upcoming drilling campaign once the wet season has subsided.

Final drilling results from last year’s campaign at the Running Creek and Felix prospects are anticipated in the coming week. Assays will also include results from extensional drilling at Stanton.

To date, drilling at the flagship deposit, Stanton, has revealed mineralisation remains open in all directions.

Better results from Stanton have included 11m grading 0.29% cobalt, with a 2m interval containing 2.33% cobalt, 0.45% copper and 1.01% nickel.

Stanton has a current inferred resource of 500,000 tonnes grading 0.17% cobalt, 0.09% nickel and 0.11% copper.

Earlier this month, Northern Cobalt kicked off a scoping study on Stanton and hopes to publish an updated inferred resource by the end of the current quarter, with a further upgrade to indicated status scheduled for the end of June.

Mineralisation identified so far at Stanton and other deposits within Wollogorang is primarily sulphide and non-refractory – reducing processing expenses by eliminating the need for roasting to eradicate contaminants such as iron.

With more than half the world’s cobalt arising out of the Democratic Republic of Congo, which has struggled under human rights violations and political instability, Northern Cobalt has positioned itself as an upcoming reliable cobalt source from a stable mining jurisdiction.

The cobalt price hit decade heights again this week tipping US$80,500 a tonne on the 19 January, driven by the battery sector and news the DRC Government plans to increase royalties to 3.5%. The increase is close to becoming law after the new mining code got through the country’s National Assembly.

Under the new code, the royalty could be pushed even higher to 5% if cobalt becomes classified as a “strategic” metal.

This could place a myriad of DRC miners at risk of losing profits, or worse.

In response to the hike, investors have turned their attention to more “stable” supply sources including Northern Cobalt.

Shares in Northern Cobalt had an early morning run spiking at A$0.52 before settling at A$0.50 – up more than 3%.