As nickel market dynamics firm and the pipeline of nickel exploration projects remains dry, the outlook for the commodity continues to look bullish, with some analysts claiming we are headed for a supply crunch in the not-too-distant future.

To talk about the situation, the American Chamber of Commerce (AmCham) invited Poseidon Nickel (ASX: POS) chief operating officer Michael Rodriguez to present in-depth discussion and analysis on the phenomenon the nickel market is hurtling towards.

As an executive of Australia’s emerging class one nickel producer, Poseidon, Mr Rodriguez told Small Caps what we are now seeing arise in the nickel market are the kinetics to drive another resources boom. This time, however, the fuel isn’t China. It’s technology.

Or, more specifically, the clean energy revolution, which is powering the rapid global uptake of the lithium-ion battery.

Mr Rodriguez said he’d thought the China-fuelled resources boom was a “once in a life time boom – never to be repeated”.

However, he said recent advances in technology have resulted in “a seismic shift in the way power is generated”.

He said this presented an opportunity for some strategic metals that are used in the lithium-ion battery, like nickel.

“Lithium has already gone for a run. Cobalt has already gone for a run – they’re are essentially four times what they were just over a year ago.”

But, Mr Rodriguez pointed out they’re much smaller markets compared to nickel.

“Because of the smaller market, they were the metals that were going to be influenced quickly by these developments.”

Nickel market dynamics

As one of the key minerals consumed in the lithium-ion battery’s cathode, Mr Rodriguez is certain nickel will be impacted.

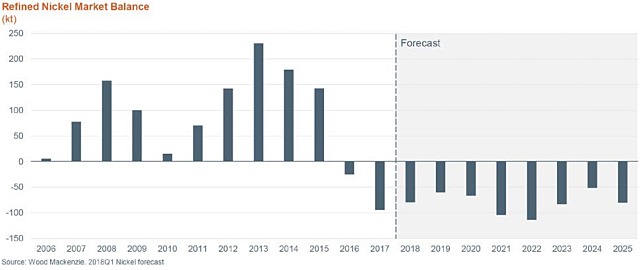

He pointed to the lack of new nickel projects in the pipeline and the fact demand is already outstripping supply. He added that governments around the world were mandating targets for electric vehicles to account for a certain number of vehicles on the road.

“Norway will no longer produce internal combustion engines as of 2019. That’s it.”

“Then, across other regions like California for example, they’ve mandated by 2025 that 25% of all vehicle registered need to be electric vehicles.”

According to Mr Rodriguez, global vehicle and battery manufacturers are fearful they will not secure a steady supply of raw materials to meet this demand.

“That’s why you’ve got companies like Volkswagen, Daimler, Tesla – they’re out now talking to miners, because they’re concerned about being able to feed the raw materials into their giga battery factories.”

“All of a sudden you’ve got a huge change in the nickel market.”

At the upcoming presentation, Mr Rodriguez will go in-depth about the fundamentals propelling this phenomenon – covering everything from the nickel supply pipeline, the diverging market, the amount and type of nickel required, government regulations for electric vehicles in various regions, the increasing uptake of the battery in other renewable energies, and his thoughts on where the market is headed and how quickly it will happen.

Mr Rodriguez has more than 30 years’ experience in mining and metals, with a substantial portion of that time spent in nickel.

Poseidon Nickel’s short-term plans

One nickel producer that is poised to take advantage of the emerging nickel renaissance is Poseidon Nickel.

The company used the global financial crisis to position itself for the market upturn. During the slump, the company secured itself essential infrastructure and pegged up prospective ground in readiness for resuming production.

Poseidon also continued building its nickel resource inventory to 400,000 tonnes of contained nickel within Western Australia.

Currently, Poseidon is one of Australia’s largest ASX-listed sulphide nickel stocks and one of the few with advanced projects.

The company has a very clear strategy on pulling the trigger to resume production at its advanced high-grade Silver Swan mine.

Once in operation, Silver Swan cash flow will be diverted into restarting production at the nearby Black Swan pit and plant, with revenue from these operations to be diverted into further exploration and developing other advanced assets in the region.

With no new major nickel discoveries in the last decade, Poseidon is strategically positioned to feed the nickel supply deficit and benefit from the rising price when it comes.

Event details

If you want to hear Mr Rodriguez’s presentation and be part of this vital conversation, he will be speaking between 12pm and 2pm on 18 May in Perth.

Further details on the event can be found here.