Natural gas prices surge as demand rises in anticipation of northern winter

Natural gas prices are off the charts, pointing to strong earnings potential for Australian LNG exporters.

Natural gas prices are soaring as the northern hemisphere begins to prepare for a very cold winter, all the while focused on a post-COVID-19 recovery, and as economies steer away from coal and aim to use cleaner energy sources.

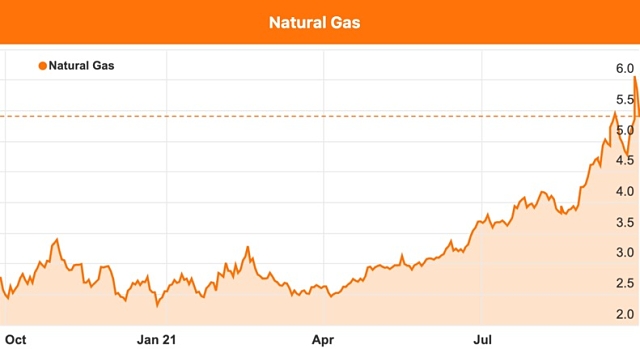

Prices have been steadily rising since May but skyrocketed in the last week to US$5.84 per thousand cubic feet (A$8.06/Mcf) on Wednesday, the highest it has been since 2014.

Natural gas prices have surged in recent months.

Many factors have contributed to the surging price, including Europe’s wholesale gas prices rising by 250% since the start of the year and global energy demand growing significantly as China and other major economies rebound from the pandemic.

In addition, calmer weather has reduced output from Europe’s wind turbines (which normally accounts for about 20% of UK power alone) and the continent’s aging nuclear plants are being phased out, making gas even more critical as governments warn of blackouts and factories closing.

According to reports, inventories at European storage facilities are at historically low levels for the first time this year (about 20% below the seasonal average) and pipeline flows from Russia and Norway have been limited.

US senior adviser for energy security Amos Hochstein told reporters there may not actually be enough gas for heating in parts of Europe “if the winter is actually cold”.

“It won’t be a recessionary value [for some countries], it will affect the ability to actually provide gas for heating. It touches everybody’s lives,” he said.

There are also concerns that economies that simply can’t afford the higher liquefied natural gas (LNG) prices, including Pakistan and Bangladesh, may have to go without the fuel they rely on.

The issue has sparked controversy in Pakistan with news outlets reporting oppositional politicians demanding an inquiry into purchases by the state-owned importer.

In Asia, LNG importers are paying higher prices than typical of this time of year in order to secure supplies, but desperation to ensure there is sufficient energy resources means coal and oil are seeming like viable options despite governments’ efforts to hit emissions targets.

Spot LNG cargoes in Asia are trading above US$20 per British thermal unit, a significant rebound from the low of US$2/MMBtu experienced during the 2020 market crash and the highest level for this time of year in over 10 years.

Rising gas prices parallel oil’s higher price

The rising gas prices coincide with higher oil prices as oil markets tighten and demand recovers amid supply disruptions caused by hurricanes in the Gulf of Mexico. As a result, US investment bank Goldman Sachs has raised its forecast year end price for oil to US$90 per barrel.

Although as Forbes petroleum economics analyst Michael Lynch argues, gas and oil’s correlation in price movements are “usually more coincidental than not” as their association stems from importers’ decisions in the 1970s to link internationally traded natural gas with oil prices based on their heat content.

“The logic for that is not much greater than linking coffee and tea prices based on their caffeine equivalence,” he said.

However, Goldman also predicted a bump in oil prices due to a colder-than-usual winter in Europe and Asia – a factor that certainly influences gas prices with utilities and physical traders already beginning to stockpile the commodity at “historically elevated rates”.

Carbon dioxide shortage leads to food supply concerns in the UK

Another problem stemming from the rising gas prices is that the UK will now be forced to pay five times more for carbon dioxide, according to the country’s environment minister George Eustice.

Citing the sharp rise in wholesale gas prices, US-owned CF Industries recently shut two UK sites that produced 60% of the country’s commercial carbon dioxide supplies.

This has led to concerns over food supply, since food-grade carbon dioxide is used to carbonate drinks, package meat and other fresh and baked products, and keep food fresh in transport (in the form of dry ice) among other food-related purposes.

The UK government has since agreed to pay the full operating costs – estimated to be tens of millions of pounds – to reopen one of CF Industries’ plants for three weeks “while the carbon dioxide market adapts to global prices”.

As part of the deal, Mr Eustice said carbon dioxide prices would rise from £200 per tonne (A$373.74/t) to £1,000/t (A$1,868.70/t).

Australian spot gas prices halve but LNG exports surge

While the higher gas prices are causing upheaval in the northern hemisphere, it could be good news for Australia with LNG being one of its biggest exports.

Additionally, east coast gas prices have halved in some regions thanks to the return of warmer weather and the impact of COVID-19 lockdowns in Sydney and Melbourne.

According to energy advisor EnergyQuest’s August report, spot gas prices fell dramatically in Wallumbilla, Queensland from more than $14 per gigajoule to $8.68/GJ, while prices halved in Sydney and Adelaide to $8.67/GJ and $8.81/GJ, respectively. Spot gas prices in Victoria also plunged from $15.35/GJ to $7.49/GJ.

Australia is typically getting into its low season for gas as it enters the warmer months of the year with the commodity usually benefitting most from heating demand in winter.

On the other hand, spot prices for cargoes of LNG are trading at their highest levels in a decade as demand from the northern hemisphere surges.

Australian LNG exports totalled 7.18 million tonnes in August, exceeding the 6.81Mt shipped in July and almost reaching the March record of 7.2Mt.

Australian players set to benefit from rising gas prices and LNG export demand

Earlier this week, Australian oil and gas major Beach Energy (ASX: BPT) announced its entrance in the global LNG market by means of a landmark long-term supply deal with UK energy giant BP.

Under a heads of agreement, Beach will supply BP’s Singaporean subsidiary with its entire 3.75Mt share of expected LNG volumes from the Waitsia stage two gas project onshore Western Australia. Supply is forecast to commence in the second half of 2023.

Small cap players aiming to make strides in the Australian LNG market include Blue Energy (ASX: BLU), which recently raised $10 million to fund a drilling program to build gas reserves at its North Bowen Basin project in Queensland.

Blue managing director John Phillips noted how the disruption to gas supply is resulting in significant industrial and power generating chaos in the UK, saying “the critical importance of developing new domestic gas supply is apparent to investors”.

One small cap that could help alleviate carbon dioxide shortages is Vintage Energy (ASX: VEN), which confirmed commercial flow rates at its Nangwarry carbon dioxide discovery in South Australia’s Otway Basin in June.

Following the discovery, the Nangwarry field’s best case resource estimate has been upgraded to 25.9 billion cubic feet of saleable carbon dioxide.

The company believes it is now well placed to progress works towards establishing arrangements for commercial development of Nangwarry to produce food-grade carbon dioxide.

Another junior gas player in the Australian market is BPH Energy (ASX: BPH), which holds an offshore gas exploration project through its subsidiary Advent Energy where the much-anticipated Seablue-1 well is getting ever closer to being drilled.

Triangle Energy (ASX: TEG) holds oil assets as well as a stake in State Gas (ASX: GAS) that gives it exposure to the east coast gas market via its Reids Dome and Cattle Creek gas developments in Queensland.

The company is also seeking to secure the remaining 50% interest in the Mt Horner licence L7 from Key Petroleum (ASX: KEY), as well as 86.94% in exploration permit EP 437 located onshore in the North Perth Basin.

Combined, the Mt Horner targets have a gross best estimate prospective resource of 24.5 million stock tank barrels of oil, with the four gas targets having a total gross best estimate prospective resources of 165 billion cubic feet of gas.