The fallout from the coronavirus pandemic continues to impact businesses nationwide, with Village Roadshow (ASX: VRL) and Event Hospitality & Entertainment (ASX: EVT) among the latest casualties.

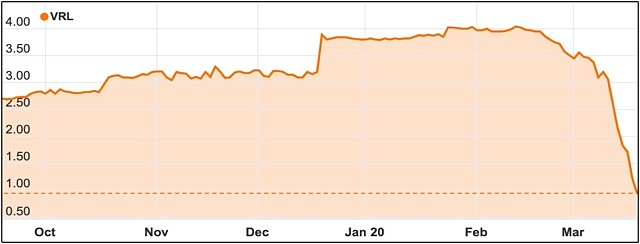

Village Roadshow – which has weathered an almost 80% share price drop in the last month – today announced there had been an “escalation of disruption” to its Cinema Exhibition and Theme Parks business units from COVID-19.

Major studios are reported to have rescheduled a number of new movies previously slated for release by mid-year.

The movies will now be released in 2021 with the delays expected to have a significant adverse impact on the division’s trade.

Village Roadshow’s Theme Parks division – which is headquartered on the Gold Coast and operates Warner Bros Movie World, Sea World, Wet’n’Wild, Paradise Country and Australian Outback Spectacular – has reported reduced visitor numbers particularly from the international tourism market.

Possible closure

Combined with weaker forward bookings and lower annual pass sales to domestic tourists, Village Roadshow chief executive officer Clark Kirby said the reduction in international tourists has made “recent trading challenging”.

“Based on international precedent, it is possible that Australian cinemas and theme parks may be closed for a period of time, which would have a significant adverse impact on [our] earnings during that period,” he said.

“The company is working on contingency plans for this eventuality.”

Given the dynamic and uncertain nature of COVID-19’s business impacts, Mr Kirby said it would be “extremely difficult” to predict the overall consequence on results for the 2020 financial year.

“We are taking decisive action to mitigate adverse impacts on our businesses and implementing cost reduction strategies to reduce the potential impact on group earnings and cashflows,” he said.

Cost savings include scrapping senior executive bonuses for the 2020 financial year; a freeze on non-essential and uncommitted capital expenditure, travel, recruitment and advisory work; and an immediate reduction in senior executive salaries.

Salary reduction

Event Hospitality & Entertainment chief executive officer Jane Hastings has voluntarily offered to reduce her base pay by $200,000 for up to 12 months from April to help mitigate the current impacts of COVID-19.

The group’s chairman and non-executive directors have also elected to forgo 20% of their director fees for the same period.

“The group’s balance sheet remains strong and whilst it’s hard to predict how long COVID-19 will impact trading, I am confident we will be well positioned to return to growth once the impact has passed,” Ms Hastings said.

“While our primary focus at this time is the health and safety of employees and customers, these cost reduction measures in addition to our revenue strategies are important to assist the group’s earnings during an extremely challenging trading period,” she said.

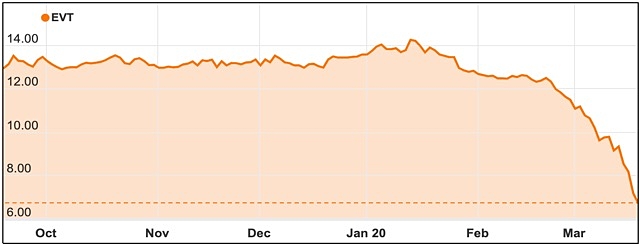

Last month, Event announced strong results for the half year ending 31 December and speculated on the possible impact that a COVID-19 trading environment would have on second half performance.

Ms Hastings confirmed the group will still pay shareholders an interim dividend of $0.21 per share announced with the results.

Event operates 835 screens across 94 venues in Australia and New Zealand under brands including Event, Moonlight Cinemas, Greater Union and Birch Carroll & Coyle.