MinRex Resources targets battery metals sector with new cobalt, scandium, copper and nickel projects

Gold explorer MinRex Resources (ASX: MRR) has followed other battery metal hopefuls in attempting to secure a slice of the cobalt, scandium, copper and nickel markets with its proposed acquisition of three projects in New South Wales and Western Australia.

Under the project acquisition terms, MinRex will pay A$100,000 non-refundable deposit and issue 1 million issue shares to the vendor Clean Power Resources. Further shares and options and cost reimbursements will be issued upon reaching certain milestones – amounting to 24.65% of MinRex’s issued capital.

Commenting on the acquisitions, MinRex executive director Simon Durack said the MinRex board was “encouraged” by the assets’ geology, which includes a historical resource of 4.6 million tonnes grading 0.09% cobalt, 40 grams per tonnes scandium, and 0.61% nickel for the 105 square kilometre Pacific Express project in NSW.

Clean Power Resources’ geology team undertook a recent aeromagnetic geophysical survey over Pacific Express which revealed previous drilling had been in “significant magnetic anomalies”.

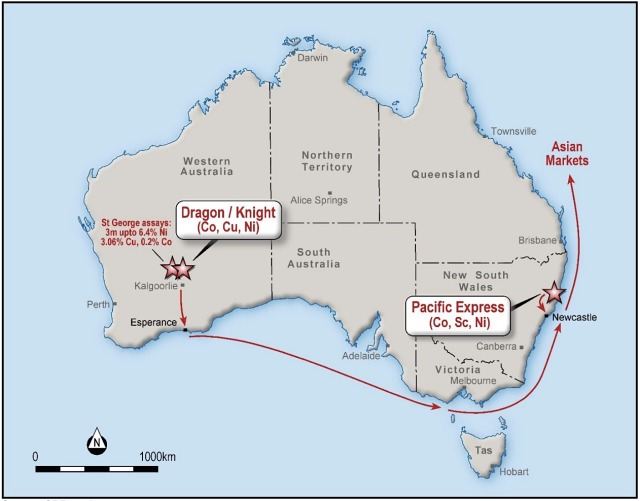

The other two projects are Knight and Dragon, which encompass 352sq km and are based in WA.

The projects are in proximity to St George Mining’s (ASX: SGQ) tenements where drilling has intersected up to 6.4% nickel, 3.6% copper and 0.2% cobalt. Additionally, older assays returned a 0.72% cobalt sample from just outside the projects.

Location map of MinRex Resources’ proposed assets.

Talisman Mining (ASX: TLM) also has contiguous ground to Knight and Dragon and produced 39,000t of nickel between 2008 and 2013.

According to MinRex, all three projects are close to key ports and infrastructure.

“The opportunistic acquisition of these highly prospective assets delivers exposure to in-demand specialty metals cobalt and scandium in the first instance, then nickel and copper,” Mr Durack noted.

He added the company plans to upgrade the JORC 1996 resource to JORC 2012 code at Pacific Express as part of its plan to fast-track exploration across the three projects.

Once due diligence has been completed, MinRex plans to undertake a desktop review, legacy database compilation, and geological modelling.

The proposed transaction remains subject to due diligence, grant of tenements as well as shareholder and regulatory approvals.

If due diligence and regulatory approvals go to plan, MinRex anticipates settling the acquisition at some stage in early June, once shareholders give the green light.

Cobalt market

Less than a week ago, the cobalt price hit a new decade high of US$95,000 per tonne – a far cry from the commodity’s low point of its 2016 bottom of just over US$20,000/t.

In the past six months alone, the cobalt price has rocketed more than 58% from just above US$60,000/t in September to its recent new peak.

Numerous analysts have attributed the rocketing price to minimal exploration investment during the downturn combined with the booming uptake in the lithium-ion battery.

This has led to a tight supply situation and industry analyst CRU expects cobalt demand will exceed production this year creating an 885t gap. This is predicted to widen to 5,340t by 2020.

The market reacted positively to today’s news with MinRex’s share price shooting up almost 30% by mid-afternoon to A$0.09.