Melbourne stockbrokers to unite for 30th anniversary of stock market crash

To mark the upcoming 30th anniversary of the calamitous Black Monday, Melbourne’s financial community is gathering at The George on Collins on 19th October 2017.

Co-ordinating the event is the pioneer of Australia’s online broking industry Richard Symon. Currently director of Fiscus Capital, Symon’s illustrious career spans multiple executive appointments including chief executive officer of NSX Ltd – the operator of the National Stock Exchange of Australia, and affiliate of the ASX.

Many pertinent members of Australia’s financial community will be present including representatives from the Financial Services Foundation, and the Stockbrokers and Financial Advisers’ Association.

The gathering is a rare opportunity to rub shoulders with major influencers within the stockbroking community as well as catch up with past colleagues and hear from those who witnessed the crash.

Sequoia Financial Group (ASX: SEQ) is generously providing finger food, with Small Caps also supporting the event.

Entry is $10 and you will automatically go into the draw to win a top shelf bottle. Money raised from the entry fee, and a percentage of every drink purchased, will be donated to the Financial Services Foundation and children’s charity Variety.

The event kicks off 6pm, Thursday 19th October 2017 at The George on Collins, 162-168 Collins Street, Melbourne.

RSVP: if you wish to attend contact Richard Symon via phone on (03) 8613 8844 or email: [email protected].

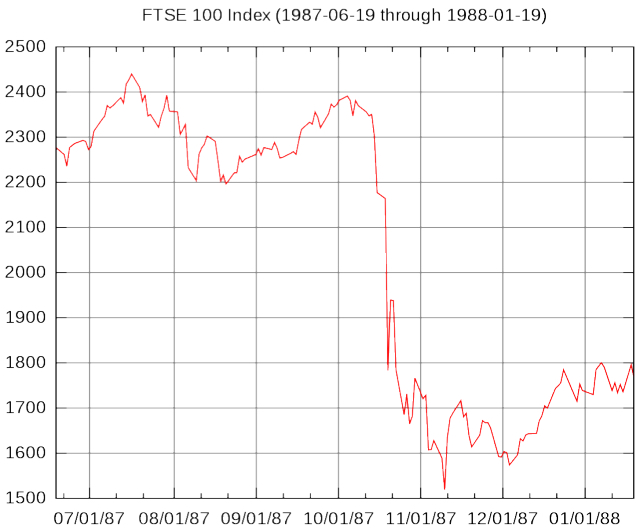

Black Monday stock market crash 19th October 1987

Several theories abound regarding the Black Monday trigger, but most authorities agree it was a result of a variety of factors including the end of a bull run, implementation of program trading, excessive valuations and sheer panic selling.

Events of that fateful day began with strong selling pressure on the New York Stock Exchange at open that morning and heavy selling in the futures market. Selling began to spiral and rumours the NYSE would be shutdown triggered panic selling as traders feared the market would close locking them into their stock positions.

The Black Monday stock market crash.

The panic selling causing systems to become overwhelmed and confusion reigned. The day ended with the Dow Jones Index collapsing more than 22% – the biggest one-day plunge since World War 1.

The ensuing scramble to sell off stock caused chaos around the world, with financial markets in Hong Kong, Australia, Spain, United Kingdom, the US and Canada plummeting between 22.5% and 45.5% in the ensuing days.