Market wrap: Melbourne Cup day rate rise stunts market rally

WEEKLY MARKET REPORT

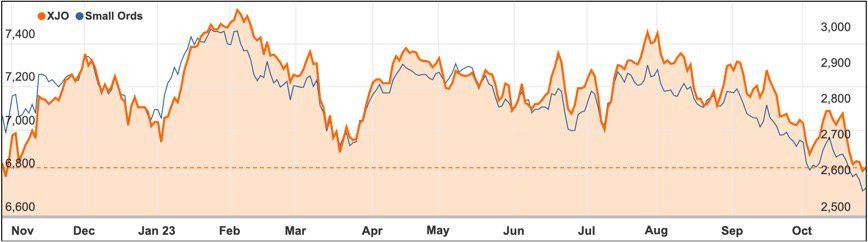

The high likelihood of a Melbourne Cup Day rise in official interest rates combined with weakness on Wall Street ensured that the Australian share market remained subdued and just above a yearly low.

Despite some resistance in the form of a 14.6 point or 0.2% rise in the ASX 200 to reach 6826.9 points on Friday, the market still fell 1.1% for the week to close in on the lowest point for a year after the US economy continued to run hot and the Reserve Bank toughened its stance against stubborn inflation.

One of the factors that pushed the market into a surprise positive end to a woeful week was some strength in the supermarket sector on the back of positive broker reports.

Supermarkets rally on broker reports

Consumer staples was the strongest of the six sectors that rose on Friday, led by a 2.1% rally in supermarket giant Coles (ASX: COL), with its shares closing at $15.29.

Morgan Stanley analysts had upgraded Coles after management moves to cut losses and invest in the supply chain while Woolworths (ASX: WOW) shares also climbed 0.7% on increasing investor confidence in the sector.

There were some other signs of optimism in the wake of general pessimism with shares in Silver Lake Resources (ASX: SLR) up 7.7% to $1.05 as gold closed closer to the glowing US$2,000 an ounce mark.

Shares in Champion Iron (ASX: CIA) also rose 6.9% to $6.94 on the back of a positive broking report from CLSA raised the miner to accumulate and a price target of $7.20.

Even the big banks shared some of the rare positive momentum with Commonwealth Bank (ASX: CBA) shares the pick of the bunch, with a 0.8% rise to $97.80, while the other three major banks all added between 0.2% to 0.7%.

Technology keeps disappointing

Unsurprisingly technology was a weak spot on the market after yet another Nasdaq wipeout with shares in Xero (ASX: XRO) down 1.7% to $104.52 and Altium (ASX: ALU) shares down 1.4%.

The 3.7% weekly fall of the local tech sector came hot on the heels of an earnings season sell-off in the US after disappointing results from mega-caps such as Google parent company Alphabet and Facebook owner Meta.

Shares in sleep disturbance company ResMed (ASX: RMD) were dumped by 4% to $21.56 after revealed falling gross margins in the September quarter due to rising regulatory, component and manufacturing costs.

Also falling hard were shares in pallet provider Brambles (ASX: BXB), down 5.7% while shares in healthcare company per cent and Healius (ASX: HLS) also fell 4.9%.

Buyback rescues Harvey Norman

One company that shook off some bad news was retailer Harvey Norman (ASX: HVN), with investors willing to forgive a 49% plunge in pre-tax profit and a 9% drop in sales for the September quarter, instead focussing on a planned buyback of up to 10% of the company’s shares.

Shares in Harvey Norman firmed by 4.8% to $3.72.

Small cap stock action

The Small Ords index fell 1.87% for the week to close at 2579.7 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Chimeric Therapeutics (ASX: CHM)

Chimeric Therapeutics reported positive interim results from a Phase 1A trial of its drug CLTX CAR T for late-stage brain cancer patients, conducted at the City of Hope center in the US.

The trial achieved a 55% disease control rate across all dose levels, surpassing the historical control rate of 37%.

The median survival rate was approximately 10 months, with some patients surviving beyond 14 months.

Chimeric’s chief executive officer, Jennifer Chow, highlighted the drug’s promising results and its potential benefits for heavily pre-treated, late-stage patients.

Algorae Pharmaceuticals (ASX: 1AI)

Algorae Pharmaceuticals has partnered with the University of New South Wales (UNSW) to enhance its AI platform, AlgoraeOS, for predicting new drug candidates.

The platform will have a particular focus on cannabinoid drug targets and will use complex data, including molecular profiles, to identify potential combination drug candidates.

Algorae chairman David Hainsworth emphasized the value of the partnership with UNSW and highlighted the expertise of Associate Professor Fatemeh Vafaee in AI.

Algorae anticipates that AI will play a pivotal role in future pharmaceutical R&D, with AlgoraeOS being central to this evolution.

Southern Cross Gold (ASX: SXG)

Southern Cross Gold achieved a record intersection of gold and antimony at its Sunday Creek project in Victoria, with Hole SDDSC082 returning 6.8 grams per tonne gold over 331.5 metres.

This result extends a previously drilled mineralised zone, and the hole revealed some of the highest individual intersections at Sunday Creek.

The company has four drill rigs operating and plans to complete 19 km of drilling until April 2024, targeting significant vein formations.

Managing director Michael Hudson emphasized the growing excitement about the project and its potential, highlighting the added value of significant antimony returns.

WA1 Resources (ASX: WA1)

Drilling results from WA1 Resources’ West Arunta project have revealed a significant extension of high-grade niobium mineralization in the Luni carbonatite complex.

The findings come from 12 new holes, revealing notable intersections in the western portion of the complex. Managing director Paul Savich noted that these results emphasise the potential global significance of Luni.

Niobium, a critical metal essential for the transition to a low carbon economy, is mostly produced by Brazil, accounting for 90% of global supplies.

Nimy Resources (ASX: NIM)

Nimy Resources’ Mons project in Western Australia has discovered a 54-metre zone of sulphide mineralisation in Block 2.

The discovery aligns with modelled moving loop electromagnetic (MLEM) plate locations, and additional electromagnetic surveys will soon commence for further insight.

Executive director Luke Hampson emphasized the significance of the 54m find, stating it aligns with their geophysics models.

The Mons project, primarily focused on nickel, has previously shown indications of significant mineralised systems, with high-grade nickel being a primary target.

Invictus Energy (ASX: IVZ)

Invictus Energy’s Mukuyu-2 appraisal well in the Cabora Bassa project has shown promising results.

The well exhibited strong gas shows, with levels around four times greater than the Mukuyu-1 discovery well.

Managing director Scott Macmillan emphasised the encouraging results from the Upper Angwa target and the potential in the previously untested Lower Angwa.

Zimbabwe, facing power shortages and aiming to double its grid capacity by 2025, could benefit from Invictus’ discoveries as the country seeks to bolster its energy supply.

The week ahead

The run up to the Reserve Bank’s Cup Day meeting on 7 November will be watched for any indications of a hotter than expected economic performance.

There is no shortage of that this week with retail trade numbers, cost of living and home price indicators coming on top of purchasing manager surveys which should give timely readings on activity and inflation.

Also filling out the economic picture across the country will be the CommSec State of the States, which will show up variations between the state and territory economies.

In the US there is one central focus on the Federal Reserve meeting on Tuesday and Wednesday, along with US jobs data across measures such as non-farm payrolls, earnings, unemployment and hours worked.

Most analysts think the Fed will hold rates steady but will maintain the higher for longer rhetoric.

Chinese purchasing managers’ indexes might also inform about how the sluggish recovery in that important economy are going.

Company annual meeting season is arriving with a vengeance in Australia with the Qantas (ASX: QAN) meeting sure to be a fiery affair as angry shareholders express their disappointment in the performance of the flying kangaroo.

Other meetings include BHP (ASX: BHP), Coles (ASX: COL), Domino’s Pizza (ASX: DMP), Downer EDI (ASX: DOW), Endeavour Group (ASX: EDV), GWA Group (ASX: GWA), Megaport (ASX: MP1), Nanosonics (ASX: NAN), Sims (ASX: SGM), Vicinity (ASX: VCX) and Zip (ASX: ZIP).

The US earnings season winds down during the week, which is just as well because share prices have been sinking despite generally stronger results.

Some of those reporting include McDonald’s, Pinterest, Amgen, BP, Caterpillar, Pfizer, GE Healthcare, Advanced Micro Devices, Kraft Heinz, Etsy, Qualcomm, PayPal, Roku, Barrick Gold, Eli Lilly, Moderna, Starbucks, Apple, Block and Shopify.