Perth-based fintech Marketech has unveiled a new online stock trading platform that aims to bring cutting-edge technology to the traditional ASX retail market.

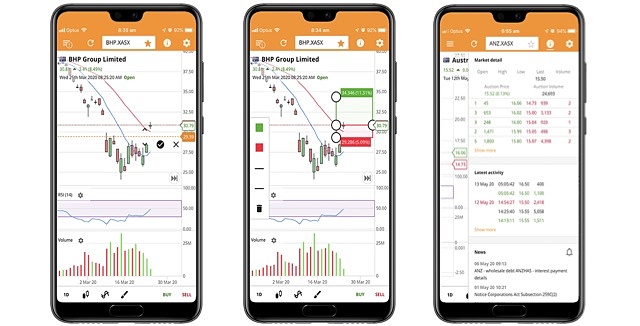

The cloud-based Marketech Focus platform, which can be accessed through a mobile-based app or via PC, allows users to trade ASX shares and track stock market data in real-time.

Speaking with Small Caps, Marketech managing director Travis Clark said the company’s objective is to provide affordable access to detailed market information on-the-go for the “busy trader” who wants to keep abreast of the continual changes.

“We’re trying to give investors an additional edge. It’s rare to be able to find something that is mobile, easy to use, offers a fair ‘fee for service’ and provides a large amount of market detail,” he said.

New technology for a traditional market

While many alternative investment options have benefitted from new technology developments, there have been limited new offerings for traditional ASX investors. This is despite studies showing almost one in three Australians own listed shares.

Marketech is well positioned to capitalise on this large and existing market, which has grown from strong and new interest in ASX capital markets in recent months.

“While there’s some incredible new developments like apps that help you budget, or help you invest your small change into things like exchange traded funds, the technology the majority of people would use [to trade shares on the ASX] is the same as it’s been for a number of years,” Mr Clark said.

The company’s platform is designed to be used on any device, with the mobile app being first and foremost, rather than an “afterthought”.

“We’ve started at mobile and worked backwards, by taking the large amount of information in a stock exchange and delivering it in such a way that it’s still usable and readable for the retail user,” Mr Clark said.

Proprietary platform offers high value for low cost

Another highlight of Marketech Focus is its cost competitiveness, a feature relevant to the current climate as many brokers join the ‘race to the bottom’ on rates.

According to Mr Clark, the Australian owned and operated company’s ability to pass on cost savings to its customers stems from the fact that it built and continues to develop its own proprietary platform, instead of paying to license a third-party platform.

“We are a tech firm; we’re not just repackaging someone else’s platform. Because it is ours, we are constantly listening to what people want and aim to stay abreast of new technology to continue to better the platform and its delivery on an ongoing basis,” he said.

Mr Clark said the company’s primary objective is to give people a cost-effective way to access information they need to make an informed decision on investing “without breaking the budget”.

Marketech claims its monthly subscription service is significantly lower than comparative models offering similar functions.

“We have been able to deliver a superior product at a much better price through the use of new technology. We’re not cheap by cutting corners,” he said.

In saying this, Mr Clark pointed out how the Australian market differs from the United States, where trading platforms and brokers have recently been offering zero commissions.

In the US, a ‘market maker’ or liquidity provider quotes a buy and sell price of shares with the aim of making a profit on the bid-ask spread.

“Often, when a US brokerage house places a trade and they send it to a market maker to place that trade, they get a kickback from the market maker,” Mr Clark said.

“It’s like subcontracting out the job of the market maker, and that doesn’t exist on the ASX. So, zero brokerage in Australia is unlikely to happen, unless you’ve got an alternative revenue source like selling your client data or forcing them to consume advertising content.”

“There is almost an absolute price at which things just can’t get cheaper, unless the user becomes the product that is for sale,” he added.

Investors at higher risk of losses without information

Marketech’s platform launch comes as concerns have been raised that retail investors are not understanding or getting sufficient information to make educated investment decisions.

Last month, the Australian Securities and Investments Commission (ASIC) issued a warning to retail investors of the risk of timing price trends during volatile market conditions, such as that triggered by the COVID-19 pandemic.

The corporate watchdog said there had been a “substantial” increase in retail activity across the securities market since the coronavirus outbreak including more than three times the amount of new retail investors entering the market.

“There is concern that retail investors don’t have enough information to make decisions and because they’re not getting that information, they’re putting themselves at risk of loss,” Mr Clark said.

“If you’re looking for the absolute lowest-cost way of transacting the market, you’re probably putting yourself at risk of not having the information that you need. It’s like shopping around for the cheapest doctor or second-hand brake parts,” he added.

“With the stock market, the more information you have, the greater potential you have of actually succeeding and the markets change constantly – so you should have access to that information wherever you are.”

Mr Clark said if price is a factor in a trader’s decision-making process, Marketech Focus users will not be “blocked out by high-costs or put themselves at risk of not staying informed”.

“We truly believe if someone is not getting the market information that Focus provides then they’re doing themselves a disservice, especially at the small caps end of the market,” he added.

Platform highlights

In addition to its low fees, Marketech claims its platform’s high-level functions are fast and easy to use, even if a user is inexperienced in the market.

Some stand-out features include customisable charts, the ability to set price, volume and news alerts and full market depth. And you can trade directly on the chart, which is very handy when choosing where to enter and exit a trade.

Another important aspect of the platform is that users can buy and sell their own shares held under their own Holder Identification Number (HIN), instead of being pooled in trust accounts or buying highly leveraged contracts for difference (CFDs).

Any interest earned on cash is paid directly to the user, which Marketech claims is “rare in low-cost offerings”.

“This offering is true ‘fee-for-service’. Real, unbiased share ownership should be accessible to all and putting aside our price, the cloud technology has allowed us to provide a feature set that is unheard of on a mobile phone,” Mr Clark said.

The platform is connected to the settlement operations of OpenMarkets, Australia’s largest independent non-bank owned clearing participant, and Macquarie Bank’s Cash Management Account.

Upcoming features

Marketech said its in-house development team have been working on “several exciting new features” including optional live-streaming data and live-market scanning tools “to highlight the stocks that meet a trader’s strategy as they occur in real time”.

“We will continue to rollout new features with our aim to keep Marketech Focus users a step ahead,” Mr Clark said.

The company is offering a free two week trial with a practice account for beginners. With the Marketech app available on Apple’s App Store or Google Play for Android devices.