Weekly review: market makes history with baby step on one-off inflation boost

WEEKLY MARKET REPORT

It’s only a baby step but once again Australia’s share market managed to make history with its second close above 7300 points.

After starting the day with a dip, the ASX 200 clawed back to register a 0.1% rise to 7312.3 points, squeaking in a weekly rise of 0.2% for the fourth week in a row.

It was slightly unusual combination of mining shares, technology stocks and heavyweight blood products group CSL (ASX: CSL) that pushed through the minor recovery, with the big banks dragging in the opposite direction.

Leading the miners higher was iron ore giant BHP (ASX: BHP), which rose 1.4% to $48.95, while fellow Pilbara iron ore neighbour Fortescue Metals (ASX: FMG) was also up 1.7% to $23.22.

Inflation of 5% due to lots of used car sales

Inflation was the big driver of the market, with the US consumer price growth of 5% in the year to May larger than anticipated but not so high that it spooked investors.

While investors have been spooked by inflation for weeks, the May report was backed up a growing consensus that the blip in inflation was likely to be a one-off, with the sale of used cars being a big contributor as rental car companies bought up vehicles to beef up their fleets as people return to travelling.

The US price data came hot on the heels of soft US jobs figures earlier in the week, which served to ease concerns that central banks would suddenly take away the punchbowl as the economy heated up too much.

Technology stocks stage a comeback

These rosier economic outcomes helped bond yields to ease a little and technology stocks to rebound – factors that turned up in the Australian market as well.

One of those rebounding stocks was Altium (ASX: ALU), which finished up 0.8% on Friday at $35 after a strong week in which it added almost 30% after the company knocked back a $5 billion takeover bid from US technology company Autodesk.

Appen (ASX: APX) finished up 5.6% to $13.85, Afterpay (ASX: APT) jumped 3.7% to $103.52, and NEXTDC (ASX: NXT) was up 2% to $1.85.

Premier sales super strong

In company specific news, retailer Premier Investments (ASX: PMV) released a trading update with the retail group experiencing an impressive 70% lift in global sales for the first 18 weeks of the second half of 2021 compared to a year ago.

The company that runs brands including Smiggle, Portmans, Peter Alexander and Jay Jays also managed to lift sales by 15.8% and has upgraded its 2021 financial year earnings before interest and taxes (EBIT) to the range of $340 million to $360 million.

This sent Premier’s shares up 0.4%.

News that the Victorian Government will extend its Royal Commission into Crown Resort’s (ASX: CWN) Melbourne Casino until 15 October sent shares in the troubled company down 1.5%, with the probe looking closer at corporate culture, gambling harm minimisation and underpayments of casino taxes.

Shares in fund manager AMP (ASX: AMP) were up 1.2% after it firmed up its new leadership team, with State Street’s Shawn Johnson appointed AMP Capital chief executive and Alexis George the new AMP chief executive to replace the retiring Francesco De Ferrari.

Small cap stock action

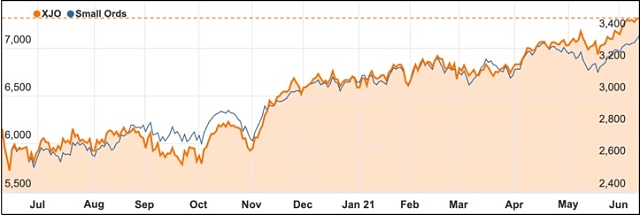

The Small Ords index rose a strong 1.52% this week to close at 3379.2 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

AssetOwl (ASX: AO1)

As its growth strategy gains momentum, AssetOwl has signed the 10th real estate agency to trial its inspector360 SaaS property inspection platform.

All-up, AssetOwl’s contracted customers have 4,000 properties under management.

AssetOwl chief executive officer Geoff Goldsmith said the latest client onboarding was an “exciting achievement” for the company that shows a “clear market need” for its inspector360 technology in the real estate market.

The company’s current onboarding model gives real estate agencies a free trial period when they sign a licence.

AssetOwl then uses the period to migrate the agencies existing property inspection records and train property managers on using inspector360.

The company plans to roll-out its technology across eastern Australia during the second half of this year.

Piedmont Lithium (ASX: PLL)

Aspiring integrated lithium miner and chemical producer Piedmont has demonstrated “exceptional economics” in a scoping study for its proposed lithium-hydroxide project in North Carolina.

Additionally, the project is expected to have a “far lower” environmental footprint than alternative suppliers and generate about US$401 million in annual EBITDA.

While firming up the lithium-chemical arm of its proposed integrated business, Piedmont has also boosted the industrial mineral by-product resource for the namesake mining operation in the same region amid increasing demand.

An updated lithium resource of 39.2Mt at 1.09% lithium for 1.046Mt of contained lithium carbonate equivalent was announced in April.

This week, Piedmont revealed a 40% increase to the by-product resource of 11.5Mt of contained quartz, 17.77Mt of feldspar and 1.63Mt of mica.

Piedmont also completed the acquisition of a 25% interest in Sayona Mining’s Canadian subsidiary this week.

Deep Yellow (ASX: DYL)

Infill drilling has continued to yield positive results for Deep Yellow at the Tumas 3 Central uranium deposit in Namibia.

The company has now completed 359-holes for 7,634m at the deposit, with drilling aiming to update inferred resources to indicated status.

Of the 359 holes, 48% contained uranium mineralisation grading more than 100ppm over a 1m interval.

Notable assays were 10m at 1,945ppm equivalent uranium from 28m; 8m at 2,242ppm from 10m; 9m at 1,897ppm from 7m; 5m at 1,222ppm from 16m; and 8m at 754ppm from 16m.

Drilling is now underway at Tumas 3 West.

Wide Open Agriculture (ASX: WOA)

Wide Open Agriculture’s plant-based, regeneratively farmed and carbon neutral OatUP oat milk is now sold across more than 150 cafes and retail locations in WA and South Australia, with further growth anticipated through expanded distribution.

The company noted distribution of the plant-based milk was expanding weekly, with managing director Dr Ben Cole saying he was “thrilled” with the uptake of the milk.

He said investor appetite for oat milk was at an all-time high and the company was well positioned to take advantage of the promising $4.78 billion oat milk market.

As part of the growth strategy, Wide Open Agriculture has completed packaging prototypes of OatUP for multiple markets beginning with South East Asia with market testing underway in Singapore, Hong Kong and Thailand.

Discussions are also progressing with potential customers and partners in the US and Europe.

Classic Minerals (ASX: CLZ)

Emerging gold producer Classic Minerals has secured approval from WA’s Department of Mines, Industry Regulation and Safety to mine a bulk ore sample from a trial pit at its proposed Kat Gap mine near Southern Cross.

The trial mining will begin shortly and will excavate up to 5,000t of ore grading 4-6g/t gold to generate up to 1,000oz.

This sample will be processed through Classic’s 30t per hour Gekko plant for evaluation and to enable any adjustments to the processing circuit ahead of first production which is scheduled for August.

Sovereign Metals (ASX: SVM)

Sovereign Metals unveiled a maiden resource for its Kasiya deposit in Malawi that places it among the largest rutile deposits globally.

The company says its closest peer with a deposit this size is Iluka Resources’ subsidiary Sierra Rutile with its operations in Sierra Leone.

Sovereign’s Kasiya resource totals 644Mt at 1.01% rutile for 6.5Mt of contained metal, including a higher-grade, near-surface component of 137Mt at 1.41% rutile for 1.9Mt.

Managing director Dr Julian Stephens said the maiden resource was “remarkable” and was “just the beginning” with substantial growth expected over the coming quarters.

The maiden resource covers 49sq km of 114sq km of highly prospective tenure.

AML3D (ASX: AL3)

AML3D has protected its 3D printed metal part wire additive manufacturing technology further after securing an Australian patent.

The company’s managing director Andrew Sales said the patent was further validation of the company’s technology and cements its position as a provider of a major 3D printing process.

AML3D’s technology is noted for “significantly” reducing manufacturing costs and build time, while enabling clients to have customised parts manufactured to meet specific requirements.

The current addressable market for 3D printing is currently estimated at US$10 billion with this expected to soar to US$63 billion by 2026.

Duke Exploration (ASX: DEX)

Earlier this week, Duke Exploration revealed its Quorn prospect within the flagship Bundarra copper project could have a larger mineralised system than the nearby Mt Flora target.

During recent reverse circulation drilling at Quorn, Duke intersected visible copper in stacked zones up to 53m wide.

“We can already see from preliminary drilling that our exploration target at Quorn will be met and potentially exceeded as drilling of the new zones progresses,” Duke managing director Philip Condon said.

“The drilling results and electrical geophysical surveys have increased our confidence that additional new discoveries will continue to be made around the remaining 46km perimeter of the Bundarra Pluton contact,” Mr Condon added.

Coda Minerals (ASX: COD) and Torrens Mining (ASX: TRN)

In what Coda chairman Keith Jones has described as a “tremendously exciting” discovery, the company and joint venture partner Torrens Mining have unearthed intense iron-oxide-copper-gold mineralisation in the first deep hole at Elizabeth Creek.

The hole was drilled into the Emmie Bluff Deeps target within the South Australian project and encountered 200m of intensely haematitic and altered sediments and granites including 50m of moderate to intense copper sulphides.

Mr Jones said this was the first drill-backed evidence the company has obtained to support its IOCG exploration model for the target.

The week ahead

Jobs, jobs and more jobs will be the key this week with the release of the May data on Thursday being the biggest announcement for the week.

Expectations are that there will be a 20,000 lift in Australian jobs and for a marginal fall in the unemployment rate from the previous 5.5%.

Also, the Reserve Bank will be important, with the minutes from the last Board meeting to be released on Tuesday.

RBA Governor Dr Philip Lowe will deliver a speech on Thursday too, which could illustrate what the latest thinking on interest rates is.

Other highlights for Australian releases include the house price index, household spending intentions, consumer sentiment, population estimates and the distribution of household income, consumption and wealth.

Internationally, inflation will remain a central focus for investors with US consumer inflation expectations data, the Producer Price Index (PPI) and retail sales data all providing some hints about where prices are heading.

In China there is a swag of monthly data released including retail sales, production, investment and unemployment, with all expected to be stronger.

The US Federal Reserve Open Market Committee (FOMC) meets over Tuesday and Wednesday and their decision will be handed down on Thursday, with no change to their accommodative stance expected.