Weekly review: market hits a record despite COVID ‘national emergency’

WEEKLY MARKET REPORT

Sydney might well be a “national emergency’’ of COVID-19 cases but that hasn’t stopped the Australian share market from once again setting a new record high close on Friday.

Not even the prospect of a potential double dip recession caused by the unprecedented dual lockdowns in Sydney and Melbourne was enough to cause a market breather, although there was less conviction around the “look past’’ idea of predicting an economic boom once vaccination rates get higher and we move to herd immunity.

By the close the ASX 200 was up by 0.1% to 7394.4 points, which represents a 0.6% rise for the week.

Market rises despite weaker banks and miners

For a change of pace the big banks and miners were marginally weaker, leaving blood products and biotechnology giant CSL (ASX: CSL) to lead the charge and inspire other rises in the healthcare sector, which added 1.3%.

For the week CSL was up an impressive 5.4% to $293.48, with a 1.5% rise on Friday adding fuel to the defensive trend.

Even the bruised buy now pay later (BNPL) brigade were lending a hand in the absence of the traditional banks and miners barbell, with Afterpay (ASX: APT) up 0.8% to $106.70, while Zip Co (ASX: Z1P) also rose by 1.4% to $7.09.

Retailers and health stocks ride the lockdown higher

The perceived wisdom that lockdowns are great for basic retail is also holding with giant Wesfarmers (ASX: WES) adding 0.8% to reach a new closing high of $61.93.

In a similar vein, Woolworths (ASX: WOW) and Coles (ASX: COL) were up, with health stocks ResMed (ASX: RMD) and Fisher and Paykel (ASX: FPH) also finishing in front.

While it seems difficult to believe that market traders can continue to look through the worsening COVID news such as a burst travel bubble with New Zealand and tough border closures, there was some positive offshore leads to help the bulls.

Offshore leads overcome COVID worries

US earnings figures remained robust – hopefully pointing to some strength when our companies report – while the European Central Bank issued some dovish guidance which will have reassured those worried about rising interest rates and inflation.

Dragging down the index was energy, which decreased 1.1% and financials which dropped 0.5%, with utilities also down 0.2%.

There were some company specific moves with Evolution Mining (ASX: EVN) up 4.4% after successfully completing a $400 million placement of about 104 million new shares at $3.85, which will help to fund its gold mine acquisitions in Western Australia.

Star Entertainment (ASX: SGR) withdrew its $12 billion merger proposal with Crown Resorts (ASX: CWN), due to the uncertainties arising from the Victorian Royal Commission which is deciding on the suitability of Crown’s Victorian casino licence.

Star shares dipped 0.6% while Crown shares fell 2.2%.

Small cap stock action

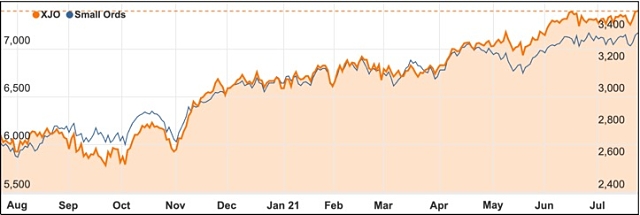

The Small Ords index rose 0.32% to close the week on 3402.6 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

3D Metalforge (ASX: 3MF)

PSA Corporation has awarded 3D Metalforge a 15-month contract worth $387,000 to produce 3D metal parts at the world’s first additive manufacturing hub for port applications in Singapore.

The new facility is at PSA’s Pasir Panjang terminal in the port of Singapore.

3D Metalforge worked with PSA to develop and commission the facility that will enable 3D Metalforge to identify, design and produce port equipment parts at greater speed, while at a lower cost and with less environmental impact than traditional manufacturing.

The deal allows PSA to secure parts on demand, redesign them to improve performance and lifespan, and reduce its overall inventory.

RooLife Group (ASX: RLG)

The June quarter heralded another record revenue period for RooLife Group, which achieved $3.9 million.

This was RooLife’s third consecutive quarter of record revenue, which it attributed to increased product sales to Chinese consumers.

All-up, for the full year ending June 2021, RooLife’s revenue was $9.6 million, which is an increase of 182% on the previous full year’s $3.4 million.

RooLife expects the strong sales performance will continue into next year.

Amplia Therapeutics (ASX: ATX)

Amplia Therapeutics revealed results of a phase 1 clinical trial of its AMP945 drug support further research for the drug’s use in pancreatic cancer and pulmonary fibrosis, with a phase 2 study scheduled to start towards the end of the year.

The phase 1 trial demonstrated the drug was safe and well-tolerated at all doses tested.

A total of 56 healthy adult volunteers participated in the trial and were given either a placebo or AMP945.

“AMP945 has been shown to have a safety and tolerability profile suitable for progressing it into phase two trials in both pancreatic cancer and pulmonary fibrosis,” Amplia chief executive and managing director Dr John Lambert said.

Digital Wine Ventures (ASX: DW8)

WineDepot order volumes are expected to increase by more than 150% after owner Digital Wine Ventures agreed to acquire Parton Wine Group this week.

Digital Wine Ventures describes Parton as one of Australia’s largest specialist wine and beverage logistics providers with warehouses in Sydney, Melbourne and Perth.

The company anticipates the acquisition will boost the total number of cases shipped by 220% to about 87,000 a while, while total monthly order volumes are predicted to rise to almost 30,000.

Additionally, the number of unique suppliers on the platform is expected to grow by 60% to 600.

Nova Minerals (ASX: NVA)

Alaska-focused Nova Minerals has observed significant gold mineralisation at the RPM prospect within its flagship Estelle project in the Tintina province.

The company says the observed mineralisation correlates with historic data with drilling continuing at the prospect and assays pending.

Earlier this week, Nova noted latest assays from the primary Korbel Main deposit could have a positive impact on the pit design and economics.

“Our lead engineers have strongly advised that these drilling results are likely very material and should ideally be included in our scoping study before [its] release,” Nova chief executive officer Christopher Gerteisen explained.

Lifespot Health (ASX: LSH)

Cannabinoid specialists Dr Andrew Saich and Darryl Davies have joined Lifespot Health’s board as non-executive directors.

The new directors will assist the board with executing Lifespot’s strategy of delivering innovative medication systems and therapies to market.

Dr Saich is a UK-trained physician and is currently chief medical officer of US-based Return Health, which is developing psychedelic treatments for dementia sufferers. He also co-founded cannabinoid prescription medicines investment group Diligenc Capital.

Mr Davies has more than 15 years’ experience in psychology, healthcare and harm minimisation. He is co-founder of medical cannabis service provider Cannvalate.

The week ahead

Real live data on inflation is a vital ingredient in working out which way interest rates might head which is why the June quarterly inflation report will be the biggest release in the coming week.

If the rate is too high, above the forecasts of 0.7% headline for the quarter, then there could be some real concerns.

With higher prices expected for clothing and footwear, health, petrol, furnishings and household equipment, even an 0.7% reading would push the annualised rate from 1.1% to 3.8% as the low results from last year drop out, which is a strong rise.

Any unpleasant rises above that would be unwelcome.

Other things to watch out for during the week include the CommSec State of States quarterly economic report, consumer confidence, a speech from Reserve Bank Deputy Governor Guy Debelle, international trade, private sector credit data and producer price indices.

Moving overseas, the US reporting season continues and is likely to show a continued impressive return to strong profitability.

Other US events to watch out for are the Federal Reserve Open Market Committee (FOMC) policy decision, economic growth (GDP) figures, manufacturing, home sales, consumer confidence and unemployment numbers.